The healthcare and life sciences sector offers unique opportunities for private equity (PE) investors. It is one of the largest, most extensive, and highly fragmented sectors in certain segments. Investments in healthcare are strategically supported by the increasing demand for healthcare services, advances in medical technology, innovations in bioscience and patient care, and a growing aging population. Conversely, healthcare is highly regulated, deeply affected by policy changes, and inherently complex. PE volume in healthcare services will grow 15% in 2024 compared to 2023, reflecting increased regulatory oversight and operational challenges such as increased labor costs and physician turnover decreased. For PE investors, understanding these dynamics is essential to increasing returns while managing risk.

This article is the first in a series focused on transactional challenges in the healthcare and life sciences sector, including healthcare services, pharmaceuticals, biotechnology and medical devices, health technology, and managed care (payers). Contains major subsections:

Medical service due diligence

Historically, healthcare services is the largest subsector based on the number of PE deals (65% and 63% of healthcare and life sciences deals in 2022 and 2023, respectively). Healthcare services companies include hospitals, outpatient clinics (such as physician practice management (PPM) companies), behavioral health, home health, hospice, medical staffing, pharmacy services, and specialty facilities (such as ambulatory surgery centers and skilled nursing facilities (SNF)). ) etc.). and inpatient rehabilitation facilities. Regardless of the type of service a company provides, some common trading risks always occur. These should be considered when assessing the quality of earnings for U.S. health services entities.

Earnings quality analysis

A major accounting challenge for healthcare service companies is revenue recognition. This is because a large portion of the proceeds are subject to third-party reimbursement, which can be complicated as described below.

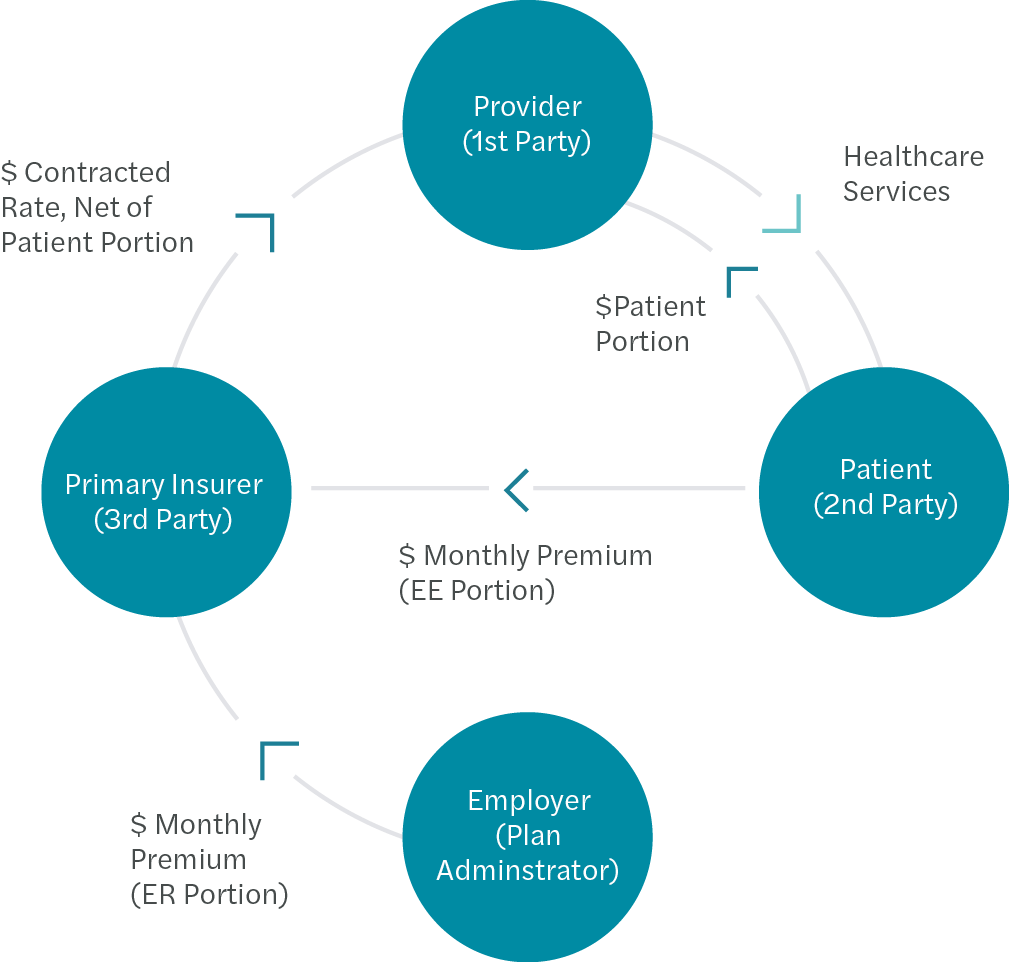

Third party redemption

Third party redemption

The purpose of accrual-based revenue recognition is to record revenue as services are performed. Third-party reimbursement can be tied to individual procedures (service fees), number of visits, days of service (per diem), number of members/participants (per member per month), or other predetermined metrics . The amount recorded in a monthly period should reflect the cumulative amount that the company expects to be paid over a period of time, excluding overpayments (all payers combined). Because estimates are involved, the risk that a company's reported earnings will be materially misstated is relatively high. Due diligence therefore requires significant time and budget to assess the quality of a company's earnings.

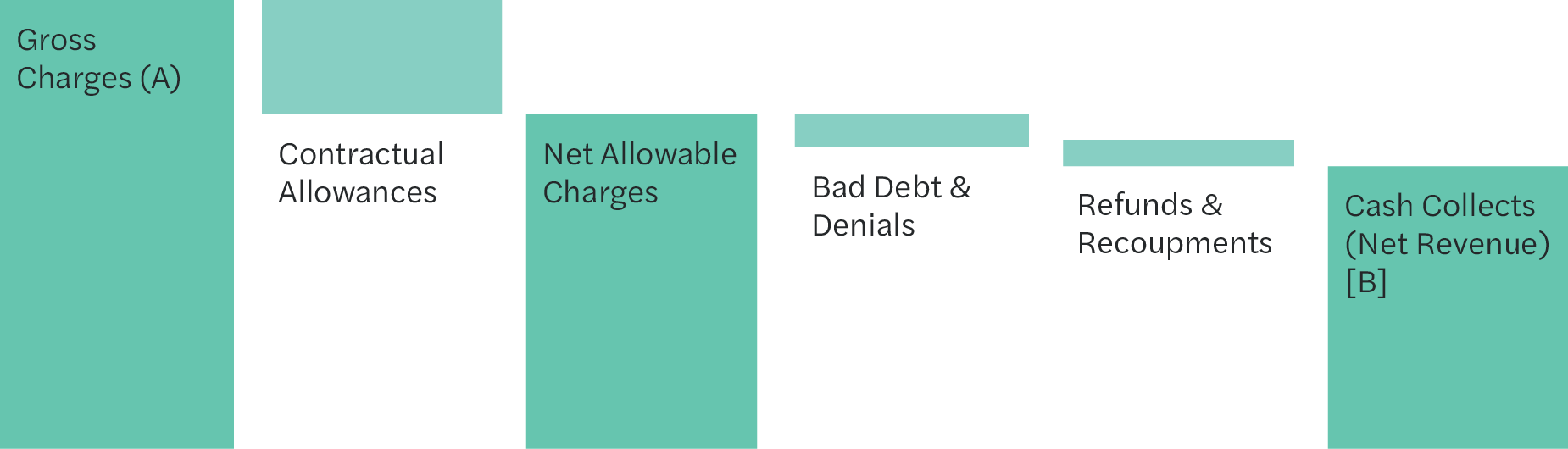

This analysis aggregates billing and collections data at a high-level transaction level and builds a cash “waterfall” of cascading collections by service month and payment month. These waterfalls are used to develop an independent view of accrual earnings that are compared to a company's similarly recorded earnings. This difference can affect your bottom line and has a noticeable impact on the calculation of enterprise value.

The diagram below summarizes the relationship between total charges (A) and actual collections (B) used in the cash waterfall to estimate net revenue.

Gross revenue vs. net revenue

Gross revenue vs. net revenue

Analyzing revenue quality can be time-consuming and requires special skills to collate and analyze large datasets. Experienced medical diligence professionals should perform data integrity checks before proceeding to identify outliers (such as payer or instrument) that could skew the blended collection rate if not separated, and You can use metrics to analyze past collection patterns and velocity trends to estimate expected collection amounts. May occur in the future for “immature” dates of service.

Impact on redemption rates

While the quality of return analysis is important, return analysis only identifies certain types of redemption risk. Certain risks do not appear in the cash waterfall. These include services that may be denied and/or recovered (refunded) in the future, or recent or upcoming reimbursement rate changes that have not yet been reflected in the historical period of the cash waterfall. must be dealt with through.

For the first type of risk, billing and coding (regulatory) compliance due diligence is designed to identify potential deficiencies in a company's clinical coding practices that could lead to potential exposure. Masu. Regulatory chart review involves selecting a predetermined number of claims and reviewing the underlying clinical documentation for each. Selection is often weighted to include claims for Medicare and/or Medicaid insured patients, who tend to be at the highest risk. Independent billing and coding experts perform these diligence steps, and their findings can help determine whether the PE applicant completes the transaction.

The second type of risk, changes in reimbursement rates, can occur for a variety of reasons. PE investors need to consider the impact of these interest rate fluctuations on a company's fundamental earnings power. In some cases, these interest rate changes are set to occur outside of historical periods and cannot be addressed using traditional diligence procedures. Contract changes for government and in-network commercial payers are common on an annual basis, and the increases and decreases can be significant. Other irregular events can also create redemption uncertainty, as the external factors in the exhibit below demonstrate.

Impact on reimbursement for medical services

internal factors

Charge Master Changes Automated Contracting or Manual EMR System Conversion Billing Department Replacement Medical Staff Credentials Timely Submission of Claims Rejection Management Timely Posting of Cash Payments RCMB Insourcing and Outsourcing Bad Debt Provision Policy Cybersecurity protocol

external factors

Annual changes in contract salary increases CPT code consolidation/separation Determination of medical necessity Patient percentage increases Clinical documentation changes Credentialing requirements In-network or out-of-network transitions Payment delays Meeting deductibles Prior authorization requirements Demographic/employer changes

Diligence teams can adjust their work plans to identify and quantify potential rate changes. However, hiring a diligent professional with experience in the corporate sector is a way to help PE dealmakers ensure that elusive rate changes are identified and addressed early in the process.

Clinical personnel costs

Healthcare provider salaries and wages, along with payroll taxes and fringe benefits, represent the largest expense category on most healthcare companies' income statements. PE backers rely on a diligent team to examine and analyze these expenses, and if necessary, include adjustments to past earnings to normalize anomalies.

In many medical settings, such as PPM, physician salaries represent the largest clinical personnel cost. PE investors are likely to offer physicians post-transaction new incentive-based compensation arrangements, pegging compensation to the revenue the physician generates. Diligent teams often quantify the impact of this new compensation structure on prior periods in the form of pro forma adjustments to earnings. Similarly, retirement and hiring of physicians and/or opening of new practices may need to be considered.

Finally, the division of labor between employee physicians, physician assistants, nurses, and contractors can have a significant impact on a company's profitability. In addition to wage differences, the returns realized for the same services performed by mid-level practitioners and physicians can also vary widely. If shortages persist, profits may be squeezed as more expensive nursing agencies fill in with cheaper hired nurses. Investors may want to consider what their future staffing strategy will be and, if necessary, quantify the impact of differences between historical models and the optimal model under new ownership. Sho.

Other medical specific matters

In addition to the return considerations and risks discussed above, other elements of healthcare services transactions may seem foreign to less experienced healthcare investors. For example, medical malpractice insurance is a significant expense for healthcare providers and comes in all shapes and sizes. Unlike companies in other sectors, many healthcare services companies must submit annual “cost reports” and comply with other complex regulatory reporting requirements. We may also be subject to periodic audits by government agencies going back more than three years.

In any subsector of healthcare, PE investors are likely to encounter regulatory mechanisms aimed at encouraging certain behaviors or preventing abuse. These structures can fundamentally impact unit economics and have a significant impact on PE investors' investment thesis, such as hospice caps, the Stark Law on self-referrals, and home health wage parity limits. There is a gender. For this reason, inexperienced investors should spend a significant amount of time researching new healthcare fields before moving forward.

Additionally, retaining an attorney with in-depth knowledge of healthcare is essential when drafting and executing a purchase agreement and can help reduce the risk of the entire transaction. Additionally, you can help pinpoint effective deal structures, navigate state laws governing corporate medical practices, ensure Medicare provider numbers can be transferred to purchasers, and help limit transfers. We can also assist in drafting protective language for purchase agreements. Unnecessary debt.

How Forvis Mothers can help

Investing in healthcare services presents significant opportunities and distinct challenges for PE investors. Successful healthcare investments require a deep understanding of the regulatory landscape, a calculated due diligence plan, and a focus on operational improvement. By taking a strategic approach and leveraging the insights of knowledgeable experts, PE sponsors can increase returns while potentially mitigating the risks inherent in the healthcare sector. With our thorough healthcare capabilities and PE collaboration, Forbis Mathers' Healthcare and Life Sciences team is able to provide a variety of financial, regulatory compliance, tax and information technology due diligence services. If you have any questions or need assistance, please contact the experts at Forvis Mazars.