The 43rd JP Morgan Healthcare Conference (JPM), held in San Francisco from January 13 to 16, was a global industry leader, empirical growth company, innovative technical developers, and investment communities member.

The following are three important topics that emerged from conversations on the first floor.

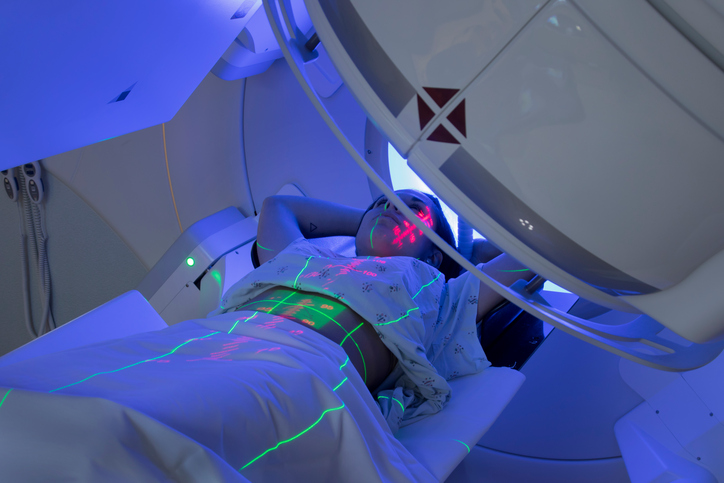

Increased radiation therapy

Radiation therapy was the main focus of the participants. Radiation therapy, also known as radiation therapy, uses target radiation to kill cancer cells and reduce tumors. According to MarketsandMarkets's report in December 2024, the radiation therapy market has strengthened its efforts to increase the use of particle ray therapy in cancer treatment, an increase in the number of cancer patients, and increase the awareness of radiation therapy. It is focused on and is growing rapidly. Market research company. The report is expected to grow from $ 7.21 billion in 2024 to $ 9.62 billion by 2024, and the CAGR (annual complex growth rate) during the growth period is 4.9 %. I conclude that.

Many investors and strategic partners have already recognized the clinical and commercial importance of radiation therapy in the field of tumor science, but positive research results, new FDA approval, and as follows. The recognition has been further increased due to the increase in commercial traction due to the clinical and commercial success of radioactive drugs. Increased lutathera, pluvicto, and merger and acquisition (M & A) activities. Lutetium Lu 177 Dotatate has been proven to be promising as part of the initial treatment of some neurotredic tumors (net), and is the first radioactive drug approved for the treatment of these rare tumors. 。 Pluvicto (Lutetium Lu 177 Bipibochido Tetra Sethane) is a radioactive drug that has been demonstrated in a prominent effect on metastatic prostate cancer patients. In these two adaptation, there is a wave of radioactive drug companies trying to compete with Lutsela and Pullvik. Regarding M & A activities, Taylor Weming, a global law firm specializing in technology and life science, has recently established radioactive drugs for tumor indications as a treatment that has recently established “actual traction in the market.” did. Examples include Rayzebio, which was acquired by Bristol Meyers Squive in 2024, and Point Biopharma acquired by Eli Lilly & Co. in late 2023. The activation of M & A activities is also promoting investment, and the funds obtained from successful withdrawal are being reinvested in new companies.

Sudden increase in Chinese biotechnology

Another theme of the meeting was the motivation of a US pharmaceutical company for transactions with China. More than one -third of the treatment molecules purchased by US pharmaceutical companies in 2024 were procured from China, but four years ago, it was zero. This amazing statistics is from STIFEL's 2025 biological drug outlook report announced earlier this month. These transactions were greater than average, with three or more or more partnerships or completely new companies, mainly in China's assets developed. According to EVALUATE PHARMA's 2025 preview report, Chinese companies are involved in at least one -fifth of the entire clinical pipeline development program. Venture companies have also followed this and have launched US startups, mainly Chinese compounds. Historically, China's transactions have emphasized tumor, but prospects of pharmaceutical companies are spreading to obesity, immunology, and heart -hearing diseases.

China's biotechnology boom stimulated by the inflow of scientists trained in the United States and Europe is an effort to make biotechnology research and development suitable for biotechnology. It threatens the global advantage of, causing concerns about dependence on pharmaceuticals. New drug research and development in China. The example cited in the Biopharma Dive is Ivonescimab, a drug approved by the US -based AKESO and a -based SUMMIT THERAPEUTICS. Recent recent results of lung cancer research in China showed that Iboneeshimab had a better effect than Kitaruda. Merck's Kitaruda is the company's major immunotherapy and is now the most profitable product in the pharmaceutical industry. Roche's business development officer Boris Zitra, which sells Kitaruda rivals, said that the discovery was “a major focus on what was happening in China.”

Whether this trend continues, it is not a guess, but in the past, it is a warning that the US pharmaceutical industry is facing severe competition for innovation.

AI and drug discovery

The role of AI in drug discovery has not yet been demonstrated, but the great potential advantages of saving time, resources and funding attracted a lot of interest in conference participants. For example, a JAMA Network Open survey in 2024, which is usually $ 1727 million in a process that usually takes 10 to 15 years from 2000 to 2018. I understood that it was. Even small improvements of these numbers will benefit from drug discovery and patient health. Participants, in particular, shared the expectations that AI will help reduce the failure rate of new drugs. Despite the large investment mentioned above, about 90% of the clinical development of clinical developments still fail. If JAMA Network Open research includes the cost of failure, the cost of pharmaceuticals will increase to $ 518.8 million, including the failure of pharmaceutical development and capital costs. In other words, it increased to about $ 1.1 billion when converted to the current amount. 。

The huge amount of data accumulated by pharmaceutical companies for decades is ripe mining by AI companies. Many AI companies are affiliated with major pharmaceutical companies in the discovery and design of new low molecules. For example, NVIDIA, a high -tech company, the most valuable company in the world, uses AI to reduce management burden, promote drug discovery, strengthen genome research, and speed up clinical trials and health. A new partnership has been announced at a conference to change the care and life science industry. The announced partnership includes partnerships with IQVIA, a global provider that provides clinical research services, commercial insights, and healthcare intelligence in the life science and healthcare industry. Illumina is a global leader of DNA sequence decision and information technology. ARC Institute is a research organization that works at an intersection between biology and machine learning.

Photo: Getty Image, 501972854

Rafi Levi specializes in corporate finance and strategies, has been working in the Investment Bank category in Goldman Sachs in New York and Tel Aviv for 13 years, and has been the CFO of Alpha Town since 2019. Recently, I have been an executive director in charge of Israel's healthcare banking. He has acquired an economics of economics at the University of Pennsylvania Warton and has acquired an electrical engineering bachelor's degree and a master's degree at the Faculty of Engineering and Applicated Sciences.

This post is posted through the MedCity Influencers program. Anyone can publish a business and innovation perspective on healthcare in Medction News through Medcity influencers. Click here for the method.