North America AI In Healthcare Market Summary

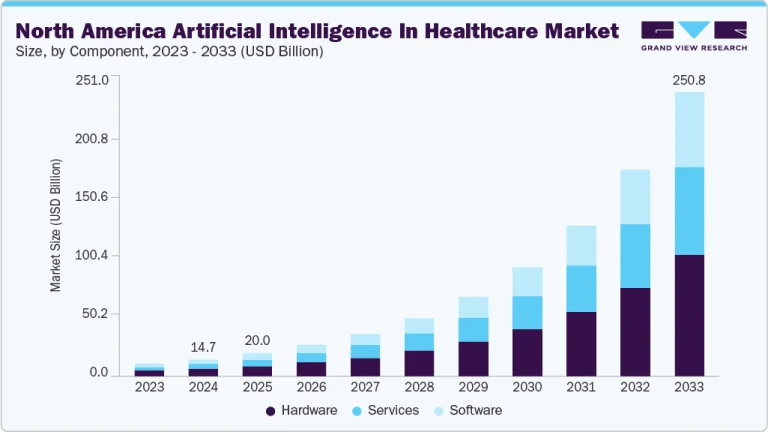

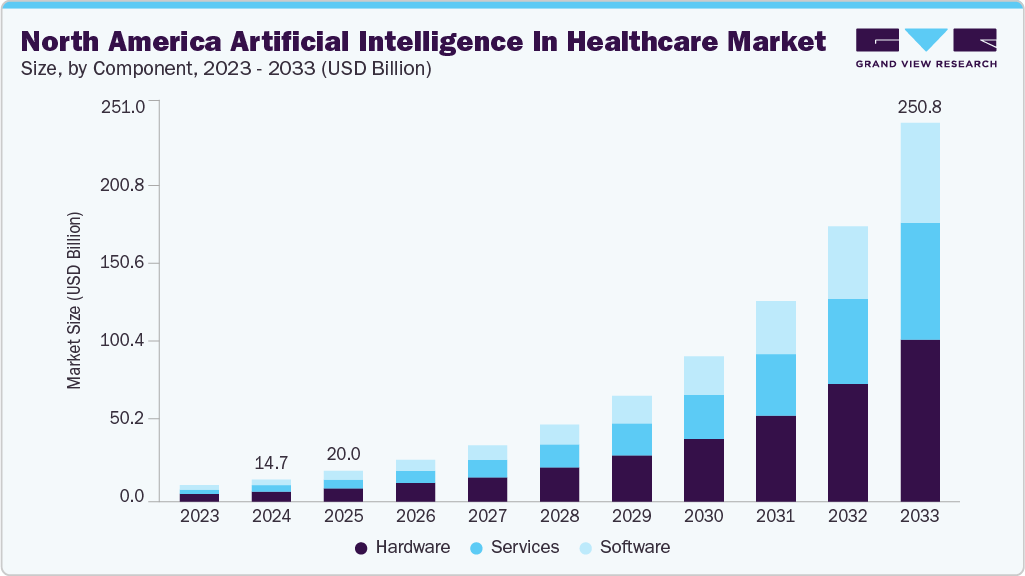

The North America artificial intelligence in healthcare market size was estimated at USD 14.66 billion in 2024 and is projected to reach USD 250.81 billion by 2033, growing at a CAGR of 37.17% from 2025 to 2033. Rapid expansion of digital health infrastructure, growing adoption of telemedicine and remote care, and increasing government investments, coupled with national artificial intelligence (AI) strategies, are factors contributing to market growth.

Key Market Trends & Insights

U.S. dominated the North America market, accounting for a 90.45% share in 2024.

Mexico is anticipated to register growth at the fastest CAGR over the forecast period.

By component, the software segment dominated the market with a revenue share of 44.00% in 2024.

By technology, the context-aware computing is anticipated to register the fastest growth over the forecast period.

By application, the robot-assisted surgery segment held the largest market share in 2024.

Market Size & Forecast

2024 Market Size: USD 14.66 Billion

2033 Projected Market Size: USD 250.81 Billion

CAGR (2025-2033): 37.17%

Robust healthcare infrastructure and substantial R&D investments by key players catalyze market growth in North America. The presence of industry leaders such as IBM, GE Healthcare, Microsoft, and Siemens Healthineers AG, among others, ensures continued innovation in AI platforms, software, and solutions. For instance, in August 2025, Philips announced plans to invest over USD 150 million in U.S. manufacturing and R&D, expanding its Pennsylvania facility that produces AI-enabled ultrasound systems and its Image Guided Therapy facility in Plymouth, Minnesota.

“Each year, Philips spends $900 million in R&D in the U.S. to drive innovation and deliver cutting-edge technology that empowers healthcare professionals to diagnose, treat and monitor patients more effectively. Increasing our manufacturing and R&D capabilities will create jobs and accelerate our ability to deliver better care for more people with innovative AI-enabled solutions.”

-Jeff DiLullo, Chief Region Leader, Philips North America

Moreover, the rising prevalence of chronic diseases, a growing geriatric population, and increasing healthcare costs push healthcare systems to AI for scalable solutions. AI enables predictive analytics to forecast disease progression, optimize treatment plans, and reduce unnecessary hospitalizations. Value-based care models supported by AI improve care quality and cost-effectiveness, providing measurable benefits to payers, providers, and patients.

Recent Developments in the North America AI in Healthcare Market:

Country

Institute/ Company

Date and Year

Initiative

Canada

Circle Cardiovascular

Imaging Inc.

2025 July

Circle Cardiovascular Imaging (Circle CVI) released advanced AI automation modules for interventional planning, expanding its suite to support EVAR, TEVAR, carotid, and peripheral vascular procedures.

WELLSTAR Technologies

May 2025

WELLSTAR Technologies, a subsidiary of WELL Health Technologies, launched Nexus AI, a Canadian-built artificial intelligence platform for healthcare providers. Nexus AI integrates with popular Canadian Electronic Medical Records (EMRs) to streamline clinical workflows and reduce administrative burden using an AI medical scribe for real-time documentation.

“WELLSTAR has established the largest ecosystem of digital health technology applications in Canada, creating an environment that enables partners to build AI tools that prioritize the provider experience collaboratively.

-Amir Javidan, CEO, WELLSTAR Technologies Corp.

Oracle

May 2025

Oracle Health launched its Clinical AI Agent across Canadian health systems, significantly reducing physician documentation time by 30%. The AI-powered assistant integrates generative AI, voice recognition, and automation, supporting over 40 medical specialties and streamlining workflows.

Sensi.AI

February 2025

Sensi.AI partnered with Right at Home Canada to launch its AI-powered Care Copilot, providing 24/7 care intelligence using advanced audio technology.

U.S.

Tebra

Jun-25

Tebra launched AI Note Assist, a HIPAA-compliant ambient documentation tool that reduces clinical note-taking time by up to 50% for independent practices.

Cleveland Clinic, Oracle Health, and G42

May-25

Cleveland Clinic, Oracle Health, and G42 collaborated to develop a health AI platform to improve care delivery and quality. The platform is likely to form an AI-driven healthcare hub, combining Oracle’s cloud infrastructure and AI data platform with Cleveland Clinic’s expertise and G42’s AI capabilities

Mar-25

Google launched TxGemma, a suite of open AI models for drug discovery that analyze proteins, chemicals, and text to predict therapeutic properties.

“The development of therapeutic drugs from concept to approved use is a long and expensive process, so we’re working with the wider research community to find new ways to make this development more efficient.”

-Karen DeSalvo, chief health officer at Google

NVIDIA and GE HealthCare

Mar-25

NVIDIA and GE HealthCare collaborated to enhance autonomous diagnostic imaging through Physical AI. This partnership focuses on developing autonomous X-ray and ultrasound technologies, utilizing the NVIDIA Isaac for Healthcare platform for simulation.

“We look forward to taking advantage of physical AI for autonomous imaging systems with NVIDIA technology to improve patient access and address the challenges of growing workloads and staffing shortages in healthcare.”

– Roland Rott, president and CEO of Imaging at GE HealthCare

VoiceCare AI

February 2025

VoiceCare AI launched a pilot program with the Mayo Clinic to automate back-office operations using agentic AI technology. This initiative aims to optimize administrative workflows, minimize errors, and improve efficiency, allowing healthcare providers to dedicate more time to patient care.

Furthermore, increasing strategic initiatives such as new product launches, partnerships, collaborations, and mergers and acquisitions, leading to scalable AI solutions in imaging, chronic disease management, and clinical decision support, are expected to propel the market further. These partnerships ensure continuous innovation through shared expertise, resources, and validation frameworks. For instance, in June 2025, Cohere, a Canadian AI firm, in partnership with the U.S.-based Ensemble Health Partners, launched its AI healthcare agents to automate administrative tasks like appealing insurance claim denials, improving revenue cycle management (RCM), and patient experience. In addition, the proliferation of AI startups and digital health platforms fosters ecosystem growth and diverse innovation. Thus, such a collaborative ecosystem remains a strong driver of AI deployment across diverse healthcare applications in the region.

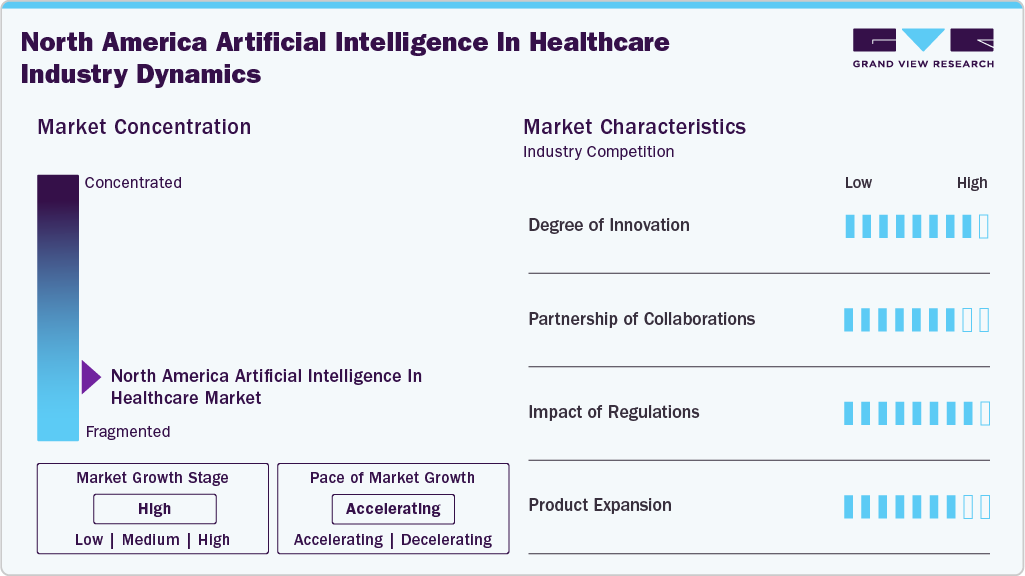

Market Concentration & Characteristics

The chart below illustrates the relationship among industry concentration, industry characteristics, and industry participants. It depicts the level of market concentration, ranging from low to high, while shedding light on industry competition, degree of innovation, level of partnership and collaborations, regulatory impact, and regional expansion. For instance, the AI in healthcare market in North America is fragmented, with many players entering the market and launching new innovative products.

The industry experiences a high degree of innovation driven by technological advancements. The increasing adoption of artificial intelligence in telehealth, medical imaging, and remote patient monitoring supports new innovations in the market. For instance, according to the July 2025 news, GE HealthCare has led the FDA’s list of AI-enabled medical device authorizations for the fourth consecutive year, achieving 100 approvals in the U.S.

The regional market is witnessing a significant level of partnership and collaborations undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing industry. For instance, in April 2025, Seattle Children’s Hospital partnered with Google Cloud to create Pathway Assistant, an AI-powered agent designed to improve clinical decision-making by providing quick access to complex, evidence-based clinical standard work (CSW) pathways for over 70 diagnoses.

The regulatory framework for the North America market is governed by the U.S. Food and Drug Administration (FDA) and Health Canada, which classify AI-based healthcare tools as medical devices or Software as a Medical Device (SaMD). The FDA has established the Digital Health Innovation Action Plan and the AI/ML-Based SaMD Action Plan to address the challenges of adaptive algorithms. In Canada, Health Canada regulates AI-enabled healthcare solutions under the Medical Devices Regulations (SOR/98-282), ensuring compliance with safety, quality, and efficacy standards.

The industry is witnessing high geographical expansion. Companies within the AI in healthcare industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. For instance, in March 2025, Siemens Healthineers signed a USD 560 million imaging and AI deal with the Canadian government, specifically with the Alberta Cancer Foundation. Siemens is likely to invest USD 124 million of its funds to establish two centers of excellence focusing on AI, machine learning, and oncology training. The initiative aims to reduce wait times, enhance diagnostic precision, increase capacity, and support cancer care workforce development.

Component Insights

Based on component, the software solution segment dominated the market with the largest revenue share of 44.00% in 2024. This growth is attributed to the rapidly growing adoption rate of AI-based software solutions amongst healthcare providers, payers, and patients. For instance, in July 2025, Circle Cardiovascular Imaging (Circle CVI) unveiled cvi42|Plaque, an advanced AI technology for real-time automated quantification and characterization of coronary artery plaques from CCTA scans.

The services sector is expected to experience the fastest CAGR during the forecast period, driven by the growing demand for AI integration, deployment, training, and maintenance within North American healthcare institutions. As hospitals and clinics implement increasingly sophisticated AI systems, they depend more on expert service providers to facilitate seamless implementation and continuous technical support. Furthermore, the shift towards value-based care and digital transformation necessitates ongoing upgrades and customization, increasing the need for consulting and managed services.

Application Insights

In terms of application, the robot-assisted surgery segment held the largest market share of 13.43% in 2024, driven by rapid adoption of advanced surgical technologies across leading hospitals and specialty centers. The region has a well-established healthcare infrastructure and a strong focus on technological advancements, leading to a higher adoption of robotic-assisted surgeries. For instance, in July 2025, Researchers at Johns Hopkins University developed an AI-powered, voice-controlled robot, called Surgical Robot Transformer-Hierarchy (SRT-H), capable of performing fully autonomous gallbladder removal surgeries.

The fraud detection segment is expected to grow at a notable CAGR during the forecast period. This growth is attributed to the rising need to curb financial inefficiencies in healthcare systems. Fraudulent claims, billing errors, and misuse of insurance benefits place a significant burden on both payers and providers in the region. AI-powered fraud detection systems leverage predictive analytics and pattern recognition to identify real-time anomalies, reducing revenue leakage and ensuring compliance. The demand for robust fraud detection solutions intensifies as healthcare insurance penetration expands across North American markets.

Technology Insights

On the basis of technology, the machine learning segment captured the largest market share of 35.57% in 2024, owing to its wide applicability across diagnostics, predictive analytics, and personalized treatment planning. The increasing availability of large healthcare datasets and advancements in computing power and cloud infrastructure have accelerated the deployment of ML models in healthcare. The growing investments in precision medicine and clinical research further support the adoption of machine learning.

The context-aware computing segment is projected to grow at the fastest CAGR during the forecast period due to its ability to provide highly personalized and adaptive healthcare solutions. Context-aware computing delivers personalized and adaptive healthcare solutions by analyzing real-time contextual data such as patient location, behavior, medical history, and environment.The increasing focus on patient-centric care, remote monitoring, and smart healthcare infrastructure is driving demand for context-aware technologies.

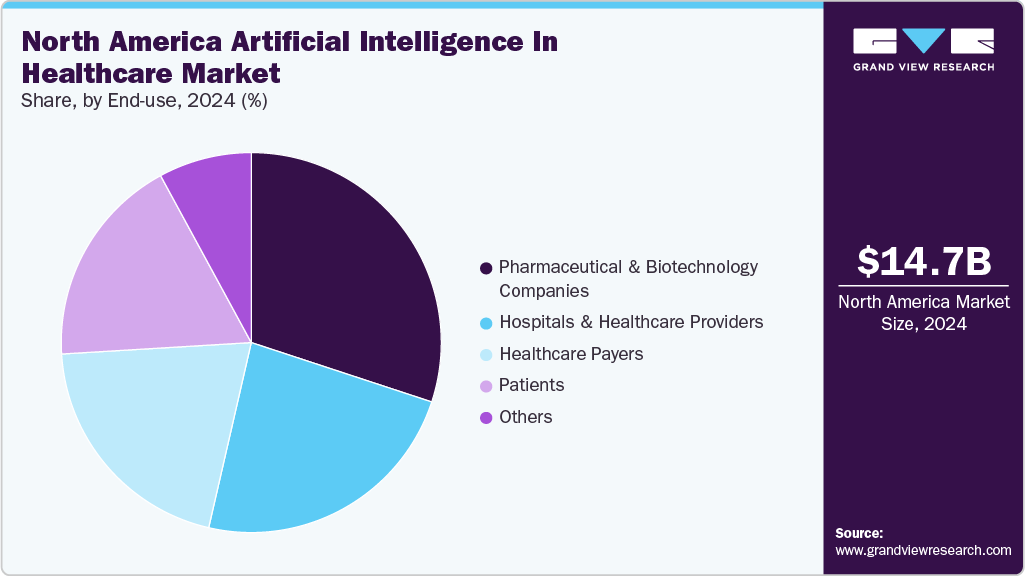

End-use Insights

Based on end use, pharmaceutical and biotechnology companies spearheaded the market with the largest revenue share of 30.06% in 2024. This growth is attributed to the increasing use of AI in drug discovery, clinical trial optimization, and personalized medicine development. For instance, in May 2025, Renovaro Inc. launched Augusta, an AI-powered Precision Neurology Platform to enhance patient stratification, biomarker discovery, and drug validation. Utilizing multiomics and advanced data analytics, Augusta addresses challenges in diagnosing neurological disorders, significantly accelerating drug discovery processes.

The patient segment is expected to grow at an impressive CAGR in the coming years, supported by the rising adoption of AI-powered self-care and health monitoring tools. The increasing use of mobile health applications, wearable devices, and AI-enabled virtual assistants is empowering patients to take a more active role in managing their health. These technologies provide real-time insights, symptom tracking, and personalized health recommendations, improving patient engagement.

Country Insights

U.S. Artificial Intelligence In Healthcare Market Trends

The U.S. artificial intelligence (AI) in healthcare industry logged the largest revenue share in 2024. Robust digital health infrastructure and investments in AI technology, the growing prevalence of chronic diseases, and the increasing demand for personalized and remote healthcare solutions are factors driving market growth. In addition, increasing prevalence of chronic diseases, supportive government initiatives, a shortage of healthcare professionals, and the growing need for operational efficiency are some other factors propelling market growth further. Moreover, the increasing adoption of telehealth solutions for remote patient monitoring drives market growth further. For instance, in December 2024, VSee Health, an AI-powered telehealth platform provider, partnered with Tele911 to create the first virtual emergency department.

Canada Artificial Intelligence In Healthcare Market Trends

The Canada artificial intelligence (AI) in healthcare industry is driven by strong government support and national initiatives promoting digital health innovation. Another significant driver is the integration of AI in wearable health technologies that facilitate continuous remote monitoring and predictive health analytics. Furthermore, growing investments by government initiatives and healthcare organizations in AI-driven workflow automation and predictive analytics contribute to improved healthcare efficiency and operational effectiveness.

Key North America Artificial Intelligence In Healthcare Company Insights

Market players are utilizing innovative product development strategies, partnerships, and mergers and acquisitions to expand their presence in response to the increasing demand for early and accurate disease detection, cost containment, addressing the shortage of healthcare providers, and providing value-based care.

Key North America Artificial Intelligence In Healthcare Companies:

Microsoft

IBM

Google

NVIDIA Corporation

Intel Corporation

GE Healthcare

Medtronic

Oracle

IQVIA

Siemens Healthineers AG

Koninklijke Philips N.V.

Tempus AI

Recent Developments

In August 2025, Philips launched Transcend Plus for its EPIQ CVx and Affiniti CVx cardiovascular ultrasound systems. These systems feature FDA-cleared AI enhancements and significant improvements in image quality.

“Transcend Plus is more than an advancement-it’s a clear statement of Philips’ leadership in cardiovascular ultrasound. Building on the momentum of our original Transcend launch, Transcend Plus brings the full power of AI integration to the forefront, giving clinicians the confidence, speed, and precision they need to lead in cardiac care-today and into the future.”

– David Handler, Business Leader, Cardiology Ultrasound at Philips.

In May 2025, Philips partnered with NVIDIA to enhance MRI technology using AI. This collaboration aims to develop a foundational model that improves image quality, accelerates scan times, and streamlines diagnostic workflows.

“Our AI-powered MRI solutions are already enabling healthcare providers to deliver better care to more people. By partnering with NVIDIA to build an MR Foundational Model, we’re pioneering a new frontier for medical imaging, one that has the potential to transform the role of MR in the diagnosis and treatment of a wide range of diseases. The benefits for patients and healthcare providers could be enormous.”

– Dr. Ioannis Panagiotelis, Business Leader of MRI at Philips

In May 2025, Moorfields Eye Hospital, in collaboration with UCL Institute of Ophthalmology and Topcon Healthcare, launched Cascader Limited, a new medical technology company. This venture aims to enhance eye disease detection and management through AI, utilizing advanced retinal imaging to understand systemic health conditions, benefiting patients and the NHS.

In May 2024, In-House Health raised USD 4 million in seed funding to develop an AI-driven scheduling platform that improves staffing efficiency for nursing teams. This innovative solution addresses the nurse shortage by optimizing shift management and reducing scheduling time and costs.

“Saving manager time on scheduling is a huge win and relieves burnout among nursing leaders, but the real prize is improved staffing outcomes. When hospitals fail to properly predict the future, it costs money in overtime pay and agency use. We can reduce both through precision staffing.”

– Ari Brenner ex- co-founder and COO of Stellar Health

In February 2024, Aidoc and the American College of Cardiology (ACC) collaborated to enhance cardiovascular care by using Aidoc’s AI technology to detect coronary artery calcification (CAC), a key risk factor for heart disease.

In August 2023, Viz.ai signed an agreement with the University of California, San Francisco to commercialize its three AI algorithms for automated cardiovascular disease detection.

North America Artificial Intelligence In Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.01 billion

Revenue forecast in 2033

USD 250.81 billion

Growth rate

CAGR of 37.17% from 2025 to 2033

Historical data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, technology, end-use

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Microsoft; IBM; NVIDIA Corporation; Intel Corporation; GE Healthcare; Google; Medtronic; Oracle; IQVIA; Siemens Healthineers AG; Koninklijke Philips N.V.; Tempus AI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Artificial Intelligence In Healthcare Market Report Segmentation

This report forecasts revenue growth at the regional and country-levels and provides an analysis of industry trends in each of the sub segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the North America Artificial Intelligence (AI) in healthcare market report based on component, application, technology, end-use, and country:

Component Outlook (Revenue, USD Million, 2021 – 2033)

Hardware

Processor

MPU (memory protection unit)

FPGA (Field-programmable gate array)

GPU (Graphics processing unit)

ASIC (Application-specific integrated circuit)

Memory

Network

Adapter

Interconnect

Switch

Software Solutions

Services

Application Outlook (Revenue, USD Million, 2021 – 2033)

Robot Assisted Surgery

Virtual Assistants

Administrative Workflow Assistants

Connected Medical devices

Medical Imaging & Diagnostics

Clinical Trials

Fraud Detection

Cybersecurity

Dosage Error Reduction

Precision medicine

Drug discovery & development

Lifestyle management & remote patient monitoring

Wearables

Others (Patient engagement)

Technology Outlook (Revenue, USD Million, 2021 – 2033)

End Use Outlook (Revenue, USD Million, 2021 – 2033)

Country Outlook (Revenue, USD Million, 2021 – 2033)

Frequently Asked Questions About This Report

b. The North America AI in healthcare market size was estimated at USD 14.66 billion in 2024 and is expected to reach USD 20.01 billion in 2025.

b. The North America AI in healthcare market is expected to grow at a compound annual growth rate of 37.17% from 2025 to 2033 to reach USD 250.81 billion by 2033.

b. The software segment held the largest market share of 44.00% in 2024.

b. Some key players operating in the North America AI in healthcare market include Microsoft; IBM; NVIDIA Corporation; Intel Corporation; GE Healthcare; Google; Medtronic; Oracle; IQVIA; Simens Healthineers AG; Koninklijke Philips N.V.; Tempus AI.

b. Key factors that are driving the North America AI in healthcare market are rapid expansion of digital health infrastructure, growing adoption of telemedicine and remote care, and increasing government investments, coupled with national AI strategies.