Getty Images

Getty ImagesThe “brazen and targeted” killing of UnitedHealthcare health insurance executive Brian Thompson outside a New York hotel this week shocked America. The reaction to the crime also exposed simmering anger against a trillion-dollar industry.

“Prior permission” doesn't seem to be a word that arouses much passion.

But on a hot July day this year, more than 100 people gathered outside UnitedHealthcare's Minnesota headquarters to protest the insurer's policies and the denial of patient claims.

“Pre-approval” allows companies to consider proposed treatments before agreeing to pay for them.

Eleven people were arrested for blocking roads during the protests.

They came from across the country, including Maine, New York, Texas and West Virginia, to attend the People's Action Institute-sponsored rally, according to police records.

Unai Montes Ileste, director of media strategy for a Chicago-based advocacy group, said those protesting have personal experience with claim denials and other issues with the health care system. .

“They are denied treatment and then have to go through an appeals process that is incredibly difficult to win,” he told the BBC.

In the wake of the clearly targeted murder of Thompson in New York City, many Americans have expressed their feelings about the health care system (a dizzying array of health care providers, including for-profit and nonprofit corporations, large insurance companies, and government programs). The latent anger suddenly surfaced. on wednesday.

Mr. Thompson was CEO of UnitedHealthcare, the insurance division of UnitedHealth Group, a healthcare provider. The company is the largest insurance company in the United States.

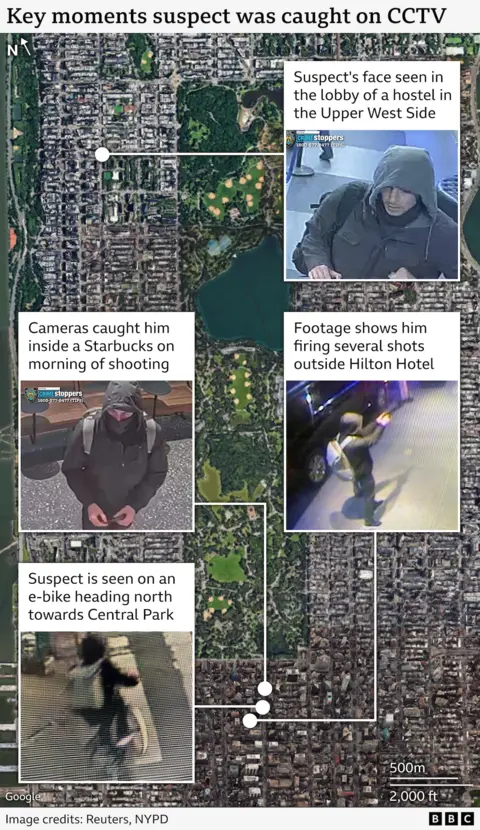

Police are still searching for a suspect in the murder, with no motive known, but authorities have revealed a message written on a shell casing found at the scene.

The words “denial,” “defense,” and “forfeiture” were found on the case, which investigators believe could refer to tactics used by insurance companies to avoid payouts and increase profits. There is.

A scroll through Thompson's LinkedIn history shows that many people were angry that their claims were denied.

One woman responded to a post from an executive bragging about his company's efforts to make medicines more affordable.

“I have stage 4 metastatic lung cancer,” she wrote. “We just left (United Healthcare) because we were refused medication. The reason for the refusal varies every month.”

Thompson's wife told NBC that he had previously received threatening messages.

“There were some threats,” Paulette Thompson said. “Basically, I don't know, but is there a lack of (medical) coverage? I don't know the details.”

“All I know is that he said there were people threatening him.”

Security experts say it is inevitable that complaints about high costs across industries will lead to threats to business leaders.

Philip Klein, who runs the Texas-based Klein Investigative Service, which protected Thompson when he gave speeches in the early 2000s, said he was surprised the executive did not have security on his trip to New York City. He says there is.

“There's a lot of anger in the United States right now,” Klein said.

“Companies need to wake up and realize that executives anywhere can be cornered.”

Klein said she has been flooded with calls since Thompson was killed. America's top companies typically spend millions of dollars on the personal security of their senior executives.

united healthcare

united healthcareMany politicians and industry figures expressed shock and sympathy in the wake of the shooting.

Michael Tuffin, chairman of insurance trade group Ahip, said: “We are heartbroken and horrified by the loss of our friend Brian Thompson.”

“He was a devoted father, a good friend to many, and a refreshingly outspoken colleague and leader.”

UnitedHealth Group said in a statement that it has received many messages of support from “patients, consumers, healthcare professionals, associations, government officials and other caring people.”

But online, many people, including UnitedHealthcare customers and users of other insurance services, had a different reaction.

Those reactions ranged from harsh jokes (one common joke was “thoughts and pre-authorization,” a play on “thoughts and prayers”) to insurance claims rejected by United Healthcare and other companies. It covers a wide range of topics, including explanations about the number of .

In the extreme, industry critics harshly told Thompson there was no room for sympathy. Some celebrated his death.

Online outrage appeared to bridge a political divide.

Hostility was expressed from avowed socialists to right-wing activists suspicious of the so-called “deep state” and corporate power. We also heard from members of the public sharing stories of insurance companies denying claims for treatment.

Montes Ilueste of People's Action said he was shocked by news of the killing.

He said his group was campaigning in a “nonviolent and democratic” manner, but added that he understood the vitriol online.

“Our health care system is fragmented and broken, and that's why people who are experiencing that broken health system in so many ways are expressing very strong feelings right now,” he said. said.

Tuffin, president of the health insurance industry group, condemned any threats against his colleagues, calling them “dedicated professionals striving to provide the most affordable insurance and health care possible.” He said that.

Getty Images

Getty ImagesThese posts highlighted the deep dissatisfaction many Americans feel with their health insurance companies and the health care system in general.

“This system is incredibly complex,” says Sarah Collins, a senior research fellow at the Commonwealth Fund, a health care research foundation.

“Just understanding and navigating how to get compensation can be difficult for people,” she said. “And everything may seem fine until you get sick and need a plan.”

A recent study by the Commonwealth Fund found that 45% of insured working-age adults have been charged for something they thought should have been free or covered by their insurance, and that 45% of insured working-age adults have been charged for something they thought should have been free or covered by their insurance, and that 45% of insured working-age adults reported being charged for something they thought should have been free or covered by insurance, and that 45% of insured working-age adults reported being charged for something they thought should have been free or covered by their insurance, and that 45% of insured working-age adults reported being charged for something they thought should have been free or covered by their insurance, and that 45% of insured working-age adults reported being charged for something they thought should have been free or covered by insurance, and that 45% of insured working-age adults reported being charged for something they thought should have been free or covered by their insurance. Less than half of those who reported suspicions filed an objection. Additionally, 17% of respondents said their insurance company refused to cover treatment recommended by their doctor.

The U.S. health care system is not only complex, but also expensive, with large costs often falling directly on individuals.

Prices are negotiated between health care providers and insurance companies, Collins said, so the amounts charged to patients and insurance companies often bear little resemblance to the actual cost of providing health care services.

“A high percentage of people say they can't pay for their health care across all types of insurance, even[government-funded]Medicaid and Medicare,” she said.

“People accumulate medical debt because they can't pay their bills. This is unique to the United States. We are truly facing a medical debt crisis.”

Nearly two-thirds of Americans say insurance companies should bear a “huge” responsibility for high medical costs, according to a survey by researchers at the Health Policy Foundation KFF. Most enrolled adults (81%) still rate their health insurance as “excellent” or “good.”

Kristin Eibner, a senior economist at the Rand Corporation, a nonprofit think tank, said that in recent years, insurance companies are increasingly denying treatment coverage or using prior authorization to deny coverage. .

She said the premium was about $25,000 (£19,600) per family.

“On top of that, people are facing out-of-pocket costs that can easily reach thousands of dollars,” she says.

UnitedHealthcare and other insurance companies face lawsuits, media scrutiny and government investigations over their practices.

Last year, UnitedHealthcare settled a lawsuit brought by a chronically ill college student that was featured on the news site ProPublica. According to ProPublica, he was denied medication prescribed by his doctor and incurred $800,000 in medical bills.

The company is currently fighting a class action lawsuit that claims it uses artificial intelligence to end treatment early.

The BBC has contacted UnitedHealth Group for comment.

With reporting by Tom Bateman