Middle East Smart Healthcare Market Summary

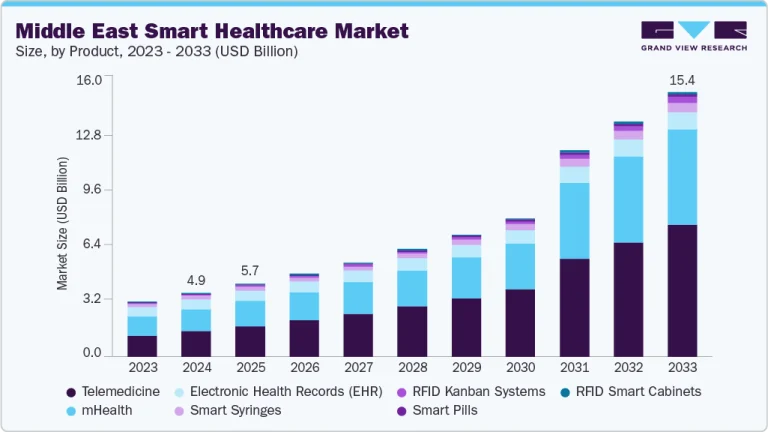

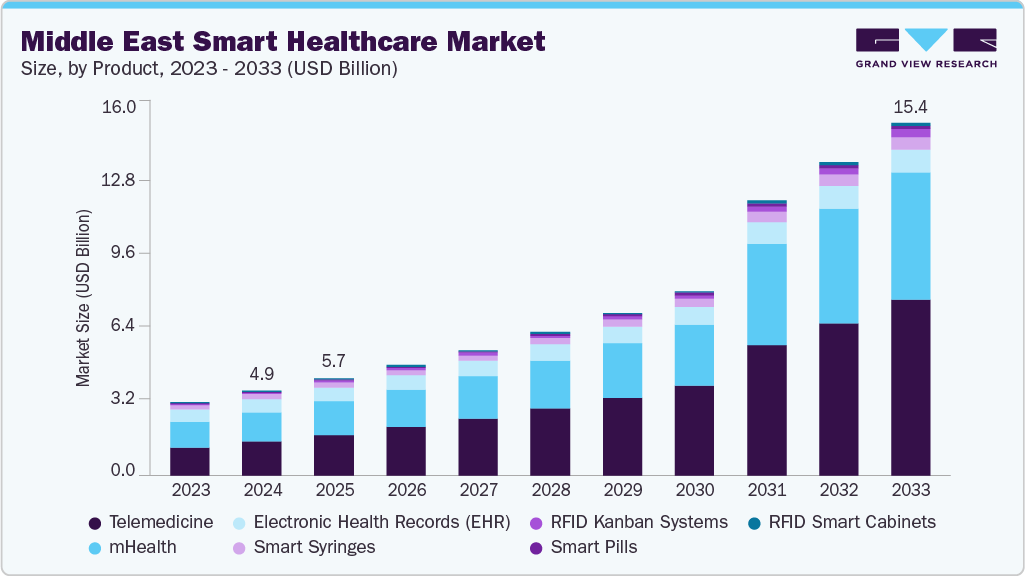

The Middle East smart healthcare market sizewas estimated at USD 4.94 billion in 2024 and is projected to reach USD 15.43 billion by 2033, growing at a CAGR of 13.4% from 2025 to 2033. This growth is attributed to the technological advancements, rising healthcare costs, and the increasing demand for efficient, patient-centric care delivery.

Key Market Trends & Insights

Saudi Arabia dominated the market and accounted for a 19.2% share in 2024.

By product, the telemedicine segment held the largest revenue share of 40.6% in 2024.

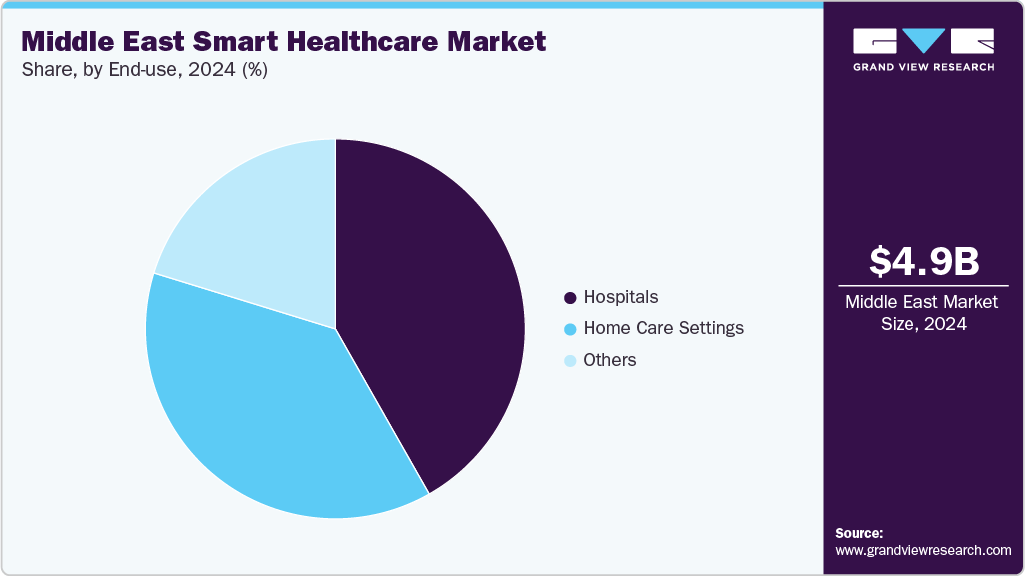

By end-use, the hospitals segment held the largest revenue share in 2024.

Market Size & Forecast

2024 Market Size: USD 4.94 Billion

2033 Projected Market Size: USD 15.43 Billion

CAGR (2025-2033): 13.4%

The industry is witnessing strong adoption of RFID-based solutions, such as Kanban systems and smart cabinets, which help hospitals optimize inventory control, reduce wastage, and improve supply chain efficiency. For instance, in August 2022, Sharjah Public Library began implementing an advanced RFID library system developed by 3M, with Arabian Advanced Systems (AAS) managing installation, staff training, and support, aiming to enhance collection management efficiency and automate processes such as circulation and inventory control in one of the largest RFID library deployments in the Middle East.

Rapid adoption of virtual healthcare ecosystems that leverage advanced technologies significantly drives the market growth. In December 2024, UAE’s Mulk International and India’s Ajeenkya DY Patil Group launched the region’s first large-scale global virtual hospital with a USD 27.2 million (AED 100 million) investment. Featuring over 20,000 doctors, 24/7 telehealth consultations, discounted medicines, smart ambulances, mobile clinics, and AI-driven ICU pods, this initiative highlights how large-scale digital health investments are reshaping patient care models. Such projects not only address gaps in healthcare accessibility but also accelerate the integration of AI, IoT, and telemedicine into mainstream healthcare, fueling the growth of the Middle East smart healthcare market.

Furthermore, countries such as the UAE are actively embracing advanced technologies to transform their healthcare sector through the development of Smart Hospitals. Despite this progress, the country still depends heavily on imported high-end medical equipment. To address this gap, the UAE has established strategic partnerships with leading U.S. medical device companies such as GE Healthcare, Philips Healthcare, Abbott, 3M, and Medtronic. These collaborations align with the government’s broader vision of achieving self-sufficiency in pharmaceuticals and medical devices.

The nation’s pro-business policies and forward-looking initiatives continue to attract global pharmaceutical leaders to expand their presence in the region. A notable example of this innovation-driven approach is the Dubai 3D Printing Strategy, which aims to revolutionize healthcare manufacturing. In line with this vision, the Dubai Health Authority recently partnered with Sinterex, a medical 3D printing startup, to establish dedicated 3D printing laboratories. These labs are being set up at Rashid, Latifa, Dubai, and Hatta Hospitals, enabling point-of-care production of customized medical devices and enhancing treatment capabilities.

The Middle East is rapidly positioning itself as a center for digital health innovation, with governments and private sector players investing heavily in AI, telemedicine, and smart infrastructure. Growing demand for advanced care delivery models and the region’s efforts to become a global leader in healthcare innovation are driving large-scale collaborations and technology deployments. AI integration is emerging as a transformative force in the Middle East’s smart healthcare market, fostering advancements in diagnostics, precision medicine, and next-generation care delivery.

In July 2025, the US-UAE healthcare partnership entered a new phase with the launch of the 1GW Stargate UAE AI supercomputing cluster, aimed at accelerating genomics research, drug discovery, and AI-driven healthcare solutions. Complementing progress in telemedicine and smart hospital technologies, this collaboration shows how the region is

leveraging global partnerships, supercomputing power, and AI innovation to enhance healthcare infrastructure and deliver life-changing medical advancements beyond national borders.

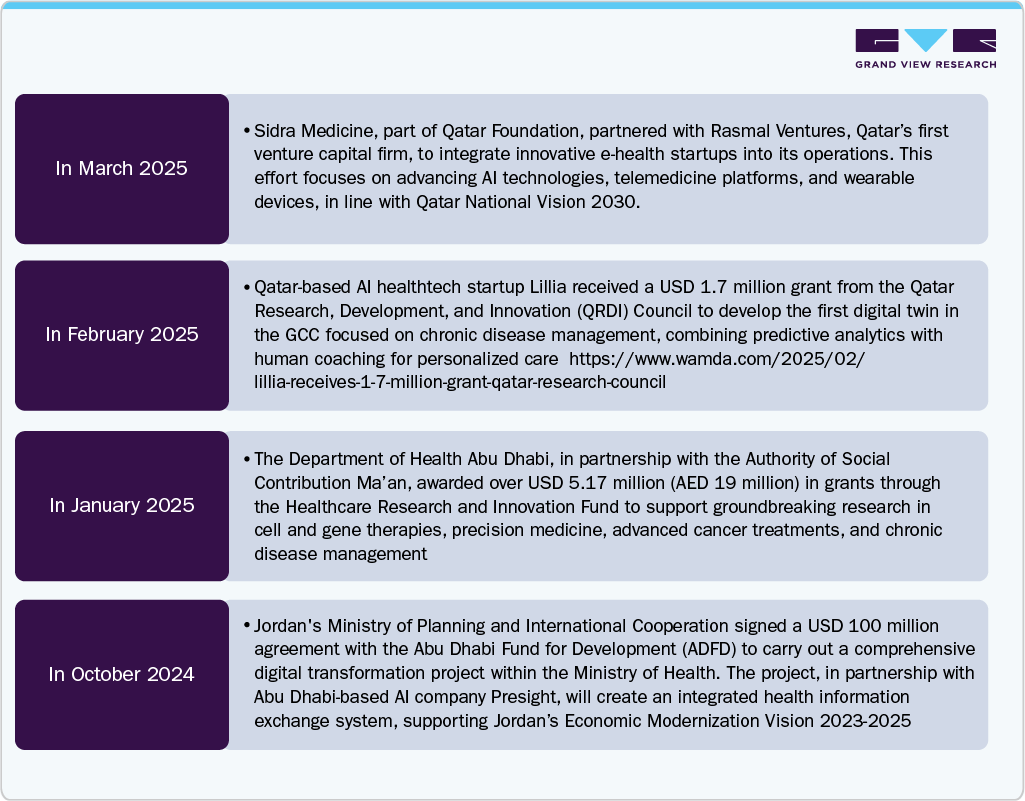

Growth Opportunities in Middle East Smart Healthcare Market

The market offers significant growth opportunities for technology providers, investors, and healthcare innovators, fueled by increasing government commitments, large investments, and AI-driven initiatives. Key developments include

These initiatives show a strong trend toward AI integration, digital health systems, and precision medicine across the Middle East. For market players, these investments present opportunities to expand through partnerships, localizing advanced technologies, and deploying scalable solutions in telemedicine, digital twins, genomics, and smart hospital infrastructure. The clear support from both government and private sectors creates a positive environment for international and regional healthcare technology providers to boost growth in this market.

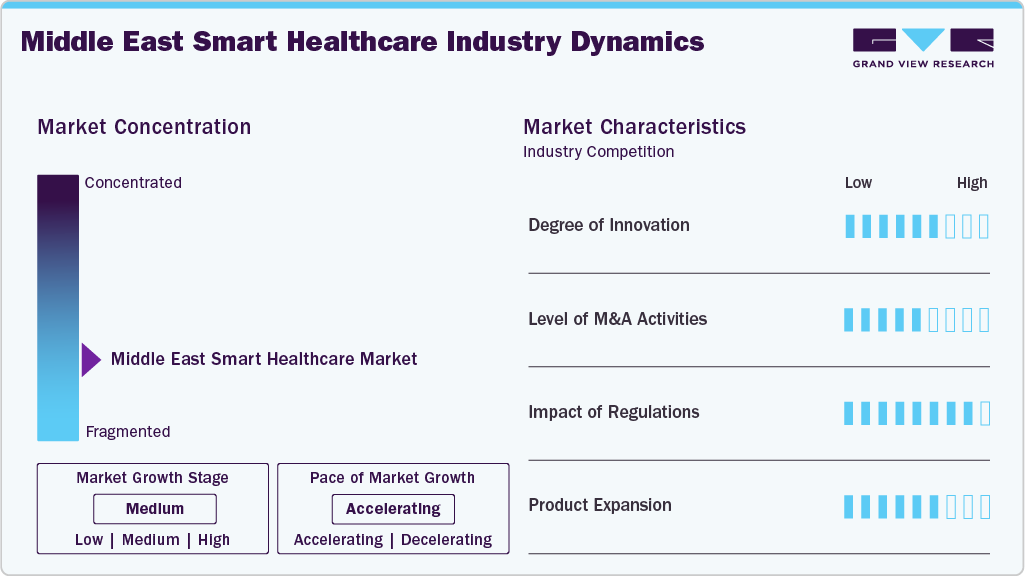

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the Middle East smart healthcare market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation is moderate to high, supported by digital health transformation programs, strong government backing, and rising demand for connected, technology-enabled care. Providers are increasingly adopting RFID systems, EHR, telemedicine, mHealth solutions, and AI-integrated platforms to streamline operations and improve outcomes. In February 2025, Aster DM Healthcare launched its digital health platform, myAster, in Saudi Arabia at the LEAP 2025 event, featuring AI and generative AI voice integration in collaboration with Google Cloud to provide Arabic voice response and personalized healthcare services.

The level of partnerships and collaboration activities is moderate, driven by the region’s focus on creating connected, interoperable, and scalable healthcare ecosystems. For instance, in October 2023, Cura Healthcare announced a strategic partnership with the Saudi German Hospital Group to integrate the group’s medical services into Cura’s dynamic care marketplace, enhancing patient access to comprehensive healthcare, including virtual consultations, remote monitoring, and health information exchange across all Saudi German Hospital Group locations in Saudi Arabia

The impact of regulations on the market is high, as governments enforce stringent frameworks to ensure patient safety, system interoperability, and data security in digital health ecosystems. Regulatory authorities such as the UAE’s Ministry of Health and Prevention (MOHAP) and Saudi Food and Drug Authority (SFDA) are increasingly aligning with global standards, including ISO 13485, IEC 60601, and GDPR, to oversee the quality, cybersecurity, and reliability of smart healthcare technologies.

The level of regional expansion in the market is moderate, driven by accelerating healthcare digitization programs and significant government investments across the Gulf Cooperation Council (GCC) countries to strengthen connected care infrastructure and digital health adoption. For instance, in July 2023, SML Group launched its Middle East business operations with a new office in Dubai to provide advanced retail RFID and labeling solutions, targeting the rapidly growing apparel and retail market in the region. The expansion aims to help retailers adopt UHF RFID technology for better inventory management, accuracy, and omnichannel sales, with existing deployments in over 100 stores across the Middle East.

“This is a hugely exciting time for SML as we solidify our presence in the Middle East with a new Dubai location. We’re confident that this new venture will contribute significantly to SML’s growth and success in the region.”

-Ignatius K.C. Lau, CEO of SML Group

Product Insights

The telemedicine segment held the largest revenue share of 40.6% in 2024. This growth is attributed to the increasing demand for remote healthcare services, especially post-pandemic. Key drivers include the need for convenient, accessible healthcare, growing adoption of digital health solutions, and advancements in communication technologies. Telemedicine enables virtual consultations, monitoring, and follow-ups, improving healthcare access for patients in remote areas. For instance, in February 2025, Sidra Medicine, a member of Qatar Foundation, signed a Memorandum of Understanding (MOU) with Rasmal Ventures, Qatar’s first venture capital firm, to drive digital health innovation in Qatar. The partnership focuses on integrating e-health startups, advancing AI technologies, telemedicine, and wearable devices, and fostering a health-tech entrepreneurship ecosystem.

The RFID Kanban Systems segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by the need for real-time inventory tracking, reduction in stock-outs and overstocking, and improved medication expiration management. The increasing demand for lean inventory practices and enhanced operational efficiency continues to drive the adoption of RFID Kanban systems in healthcare settings.

End-use Insights

The hospitals segment held the largest revenue share of the smart healthcare industry in 2024, due to the increasing demand for advanced technologies to improve patient care, operational efficiency, and cost reduction. The healthcare industry is experiencing a digital transformation with advancements, enhancing patient care, hospital management, and security.

The home care settings segment is expected to grow at the fastest CAGR in the market, driven by an aging population, increased chronic disease prevalence, and a preference for in-home care. Technologies such as remote patient monitoring and telehealth services enable continuous care and early intervention, reducing hospital readmissions. Innovations enhance patient outcomes and alleviate healthcare system burdens, making home care a central focus in modern healthcare delivery. In September 2024, Johns Hopkins Aramco Healthcare (JHAH) partnered with TruDoc Healthcare to launch innovative “Hospital at Home” services in Saudi Arabia, providing integrated digital consultations, remote patient monitoring, and hospital-level care at patients’ homes.

Country Insights

The smart healthcare market in the UAE is experiencing significant growth, driven by robust government digital health initiatives, increased adoption of electronic health records, telemedicine, and AI-powered platforms, and a focus on enhancing healthcare interoperability and patient access. On October 22, 2024, the World Health Organization (WHO) and the Kingdom of Saudi Arabia announced a digital health partnership to expand the Hajj health care initiative, supporting nearly 3 million pilgrims annually by securely summarizing vital health information for personalized and high-quality care. The program, which builds on a 2024 pilot involving more than 250,000 pilgrims, utilizes WHO’s Global Digital Health Certification Network to improve interoperability, data security, and healthcare delivery across the region, highlighting the UAE’s leadership in advancing smart healthcare adoption.

Saudi Arabia Smart Healthcare Market

The Saudi Arabia smart healthcare market is witnessing strong momentum as the Kingdom accelerates digital transformation in line with Vision 2030. Recent initiatives emphasize integrated care delivery, advanced health monitoring, and data-driven decision-making to strengthen system capacity and patient outcomes. In August 2025, Saudi Arabia established a national Medical Referral Centre under the Ministry of Health to oversee and coordinate 15 key medical tasks, including patient referrals, air medical evacuations, medical leave reviews, and hospital capacity monitoring. This initiative reflects the country’s focus on building a connected and efficient healthcare ecosystem that leverages smart technologies to optimize resources and deliver high-quality, legally compliant care domestically and internationally.

Key Middle East Smart Healthcare Company Insights

Key players operating in the Middle East smart healthcare market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Middle East Smart Healthcar Companies:

Oracle

GE Healthcare

Siemens Healthineers

Medtronic

McKesson Corporation

Samsung

Apple Inc.

Cisco

IBM

AT&T Inc.

Veradigm LLC (Allscripts)

Pepperl+Fuchs Pvt. Ltd.

Logi-Tag

Recent Developments

In September 2024, Tokyo-based Medident signed a strategic Memorandum of Understanding (MoU) with Riyadh-based IT company Web Arabia to integrate Japanese healthcare standards into Saudi Arabia’s healthcare sector. The partnership focuses on advanced medical technologies, digital training for healthcare professionals, telemedicine, electronic health records, and health monitoring technologies.

In June 2023, Qatar Biobank (QBB) integrated with Oracle Cerner’s electronic health record system (EHR) used by Hamad Medical Corporation (HMC), enhancing data sharing and streamlining workflows to accelerate medical research and improve healthcare delivery in Qatar. This integration supports Qatar’s Vision 2030 by facilitating seamless patient referrals, reducing errors, and providing researchers with easier access to comprehensive patient data for advanced studies.

“We are thrilled to have integrated with Oracle Cerner’s EHR at HMC, as this will greatly improve our ability to deliver high-quality healthcare services and conduct medical research in Qatar. The new system not only facilitates patient referrals between Qatar Biobank, HMC, and Primary Health Care Corporation, but also enhances the delivery of healthcare services across Qatar.”

-Dr. Nahla Afifi Director of Qatar Biobank

Middle East Smart HealthcareMarket Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.65 billion

Revenue forecast in 2033

USD 15.43 billion

Growth rate

CAGR of 13.4% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Oracle; GE Healthcare; Siemens Healthineers; Medtronic; McKesson Corporation; Samsung; Apple Inc.; Cisco; IBM; AT&T Inc.; Veradigm LLC (Allscripts); Pepperl+Fuchs Pvt. Ltd.; Logi-Tag.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Smart Healthcare Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East smart healthcare market report based on product, end-use, and country

Product Outlook (Revenue, USD Million, 2021 – 2033)

End-use Outlook (Revenue, USD Million, 2021 – 2033)

Hospitals

Home Care Settings

Others

Country Outlook (Revenue, USD Million, 2021 – 2033)

Saudi Arabia

UAE

Kuwait

Qatar

Oman

Frequently Asked Questions About This Report

b. The Middle East smart healthcare market size was estimated at USD 4.94 billion in 2024 and is projected to reach USD 5.65 billion by 2025.

b. The Middle East smart healthcare market is expected to grow at a compound annual growth rate of 13.4% from 2025 to 2033 to reach USD 15.43 billion by 2033

b. Saudi Arabia dominated the market and accounted for a 19.2% share in 2024. The Saudi Arabia smart healthcare market is witnessing strong momentum as the Kingdom accelerates digital transformation in line with Vision 2030. Recent initiatives emphasize integrated care delivery, advanced health monitoring, and data-driven decision-making to strengthen system capacity and patient outcomes.

b. The key players in Middle East smart healthcare market are Oracle, GE Healthcare, Siemens Healthineers, Medtronic, McKesson Corporation, Samsung, Apple Inc., Cisco, IBM, AT&T Inc., Veradigm LLC (Allscripts), Pepperl+Fuchs Pvt. Ltd., and Logi-Tag.

b. The factors driving the Middle East smart healthcare market are technological advancements, rising healthcare costs, and the increasing demand for efficient, patient-centric care delivery. Electronic Health Records (EHRs) are another key growth driver, with both web-based and client-server models gaining traction as governments push for unified health information systems.