Middle East Home Healthcare Market Trends

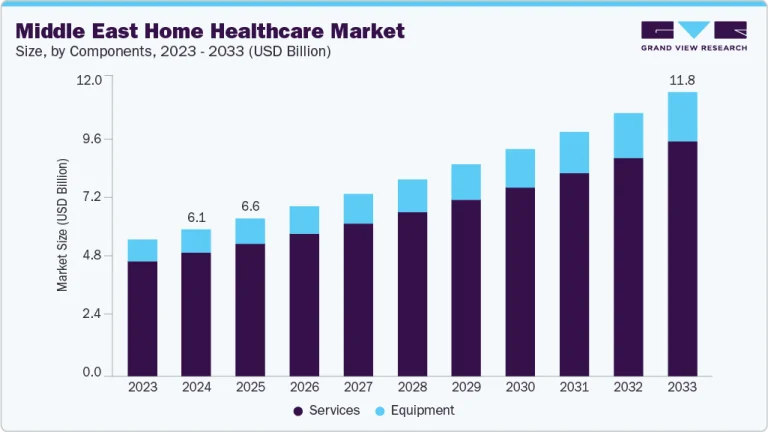

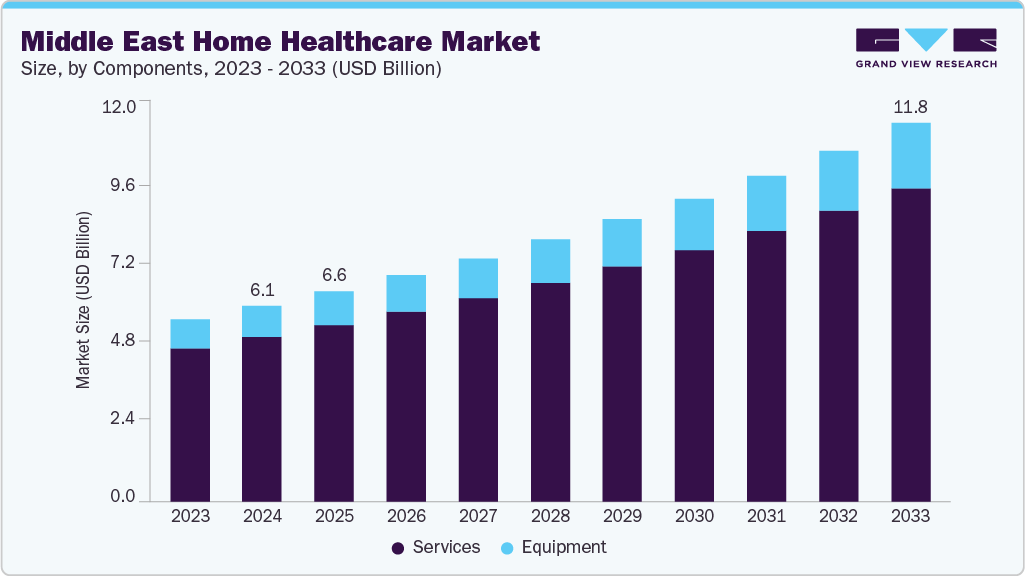

The Middle East home healthcare market size was estimated at USD 6.12 billion in 2024 and is expected to reach USD 11.80 billion by 2033, growing at a CAGR of 7.59% from 2025 to 2033. This can be attributed to the rising prevalence of chronic diseases, government initiatives, technological advancements, and the increasing geriatric population. Moreover, technological advances such as telemedicine and remote patient monitoring are expected to fuel the expansion of this market.

Large and growing populations in countries such as Egypt, Saudi Arabia, Algeria, Iraq, and Iran create a substantial patient base, especially as aging populations and the prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses rise. Nations with high urbanization rates, such as the UAE, Qatar, and Bahrain, are seeing increasing demand for advanced, technology-enabled home healthcare services due to lifestyle-related health issues and a preference for convenience. In addition, wealthier Gulf countries with strong healthcare infrastructure and government spending are accelerating the adoption of remote monitoring, telehealth, and personalized in-home medical services.

Population Distribution of Middle East by Country and Geographical Sub-region:

Country

Geographical Sub-region

Population in Thousand

Bahrain

Arabian Peninsula/GCC

1,702

Kuwait

4,271

Oman

5,107

Qatar

2,881

Saudi Arabia

35,587

UAE

9,890

Iraq

Levant

40,220

Jordan

10,200

Lebanon

8,825

West Bank/Gaza

4,803

Syria

17,500

Iran

West Asia

83,993

Yemen

Arabian Peninsula

29,826

Source: Secondary Research, The London School of Hygiene & Tropical Medicine, Grand View Research

The market is growing rapidly due to advancements in remote patient monitoring technologies. Telehealth platforms and wearable devices enable real-time tracking of patients’ vital signs and medication adherence, allowing for early detection of complications and reducing hospital readmissions. This trend provides patients, especially the elderly and those with chronic conditions, with more convenience and consistent care at home. As healthcare infrastructure improves, the significance of these technological innovations is expected to increase further. For instance, Saudi Arabia’s Ministry of Health started the Saudi Telehealth Network initiative to improve the quality and accessibility of healthcare services by utilizing telemedicine technologies to link hospitals and primary care centers in remote locations with specialist healthcare facilities. Chronic conditions, such as cardiovascular diseases, diabetes, cancer, and respiratory disorders, are on the rise in Middle East and Africa. Home healthcare offers a convenient and cost-effective way to manage these conditions.

Driver / Trend

Description

Impact on Market Growth

Key Beneficiaries

Advancements in Remote Patient Monitoring

Integration of wearable devices, mobile apps, and connected medical tools

Improves real-time health tracking and timely interventions

Elderly patients, chronic disease patients

Telehealth Platforms

Virtual consultations and digital care coordination

Expands access to medical professionals, especially in remote areas

Rural/underserved populations, mobility-limited

Real-Time Vital Signs Tracking

Continuous monitoring of blood pressure, heart rate, glucose, oxygen levels

Enables early detection of health deterioration

Patients with cardiac, diabetic, or respiratory issues

Medication Adherence Monitoring

Smart pill dispensers and reminder systems

Reduces complications from missed doses

Elderly, multi-medicated patients

Reduction in Hospital Readmissions

Preventive and proactive intervention via alerts and monitoring data

Lowers healthcare costs and relieves hospital capacity

Healthcare systems, insurance providers

Enhanced Patient Convenience

Care delivered at home with continuous oversight

Boosts adoption and patient satisfaction

General patient base, caregivers

Source: Grand View Research

According to the World Health Organization (WHO), the Eastern Mediterranean region has the highest diabetes prevalence rates, ranging from 7% in Somalia to 18% in Egypt. Government initiatives and expenditures aimed at improving healthcare access and delivery have also fueled the expansion of home healthcare services in Middle East. For instance, Saudi Arabia is focusing on implementing multiple strategies to adopt the digitalization of healthcare, which would significantly transform care delivery and patient experience and support overall efficiency improvement.

Governments across the Middle East are actively working to expand and modernize home healthcare through strategic investments, digital transformation, and public-private partnerships. In Saudi Arabia, as part of its Vision 2030 and the Health Sector Transformation Program launched in 2022, the Ministry of Health has implemented comprehensive initiatives. These include allocating over USD 65 billion toward healthcare infrastructure by 2030, increasing private sector involvement from approximately 40% to 65%, and enhancing digital health capabilities through platforms such as Sehhaty and Wasfaty.

Moreover, the Seha Virtual Hospital, the largest in the world, connects 224 hospitals and offers 44 specialized services, facilitating extensive virtual and home-based care. In the UAE, governmental support is evident in initiatives such as the “Care” program, launched in May 2023, which specifically targets senior citizens and people with disabilities. This program provided over 10,665 home healthcare services within four months, supported by a dedicated hotline and improved follow-up systems. Broader regional plans, including the UAE’s Centennial 2071 and AI Strategy 2031, along with Saudi Arabia’s digital transformation agenda, are driving advancements such as electronic medical records, interoperability networks (such as., Malaffi in Abu Dhabi, Riayati in Dubai, and the Seha platform in Saudi Arabia), and AI-powered diagnostics. These efforts collectively strengthen the infrastructure for home-based care.

Furthermore, cultural values and growing awareness primarily drives the home healthcare market in the region. Strong family-oriented traditions encourage at-home care for elderly or ill relatives, seen as a moral obligation. Families prefer home-based care for their comfort, privacy, and connection to loved ones. In addition, governments and private providers are promoting awareness of available services, technologies, and insurance options, further increasing the demand for professional home healthcare services in the region.

Country

Cultural Preference for In-Home Care

Public Awareness Initiatives

% Population Preferring Home Care (Est.)

Saudi Arabia

Very high – family caregiving deeply embedded

Ministry of Health awareness campaigns on home rehab and chronic care

70%

UAE

High – expatriates and locals value privacy, comfort

Dubai Health Authority “Care” program promotion

65%

Qatar

High – strong family networks

Public Health campaigns on elderly care at home

60%

Kuwait

High – preference for close family support

Limited but growing public workshops and media campaigns

58%

Oman

Moderate – rural areas more accustomed to home care

Regional awareness drives on palliative and chronic care

55%

Source: Grand View Research

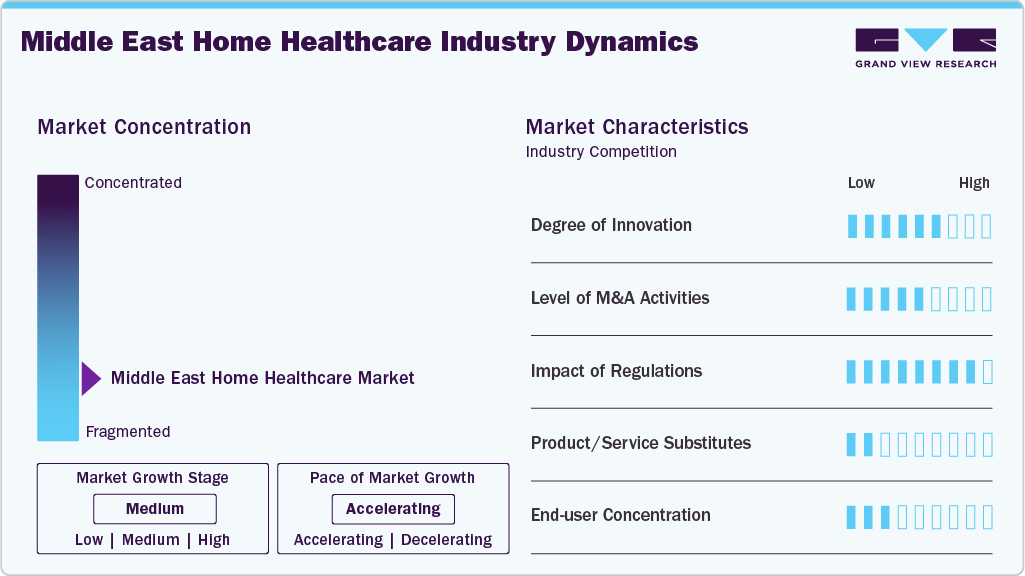

Market Concentration & Characteristics

The market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, the level of mergers & acquisitions activities is medium, and the impact of regulations on the market is high. Moreover, there are few service substitutes available in the market, and end user concentration is medium.

Innovations include the rapid adoption of AI, robotics, and IoT. Across the GCC, AI and robotics are transforming clinical care: the UAE is accelerating adoption of AI under its national strategy, while King Faisal Specialist Hospital has used robotic systems for transplant surgery and AI-driven genomics services. In addition, Bahrain first deployed robots during the pandemic for tasks such as disinfection and temperature screening, showcasing early-stage innovation in routine care. Moreover, innovation is being institutionalized across the region. The Saudi Ministry of Health’s Innovation Center, along with programs such as “Seha-thon,” cultivate startups and pilot novel technologies such as virtual reality in public health.

M&A activities in the industry is high, driven by growing demand and consolidation among companies. For instance, in May 2022, Huma, a UK-based digital health technology provider, has partnered with Tamer, one of the Middle East’s foremost healthcare distributors, to introduce a “hospital at home” platform across the Kingdom of Saudi Arabia under a five-year agreement. The initiative aims to empower remote care-starting with patients battling diabetes and cardiovascular disease, two of the region’s most pressing health challenges (with CVD accounting for 37% of deaths and diabetes affecting at least 13% of the population, plus an additional estimated 5% undiagnosed).

Regulations significantly impact the market, with agencies such as the Saudi Commission for Health Specialties in Saudi Arabia, the National Health Regulatory Authority (NHRA) in Bahrain, and the Dubai Health Authority in the UAE-actively regulate licensing, professional standards, facility accreditation, and medical insurance requirements, thereby ensuring consistent and safe delivery of healthcare services. In addition, regulatory reliance models have been increasingly adopted in which countries expedite approvals by leveraging assessments from established authorities such as the FDA or EMA thus improving efficiency without forgoing oversight.

The Middle East home healthcare market faces moderate substitutes due to cultural preferences and available healthcare infrastructure. While home healthcare offers convenient services such as medical care and rehabilitation, traditional options such as hospitals and clinics are also present, especially in urban areas. Family caregiving often reduces the need for paid providers for basic care, but specialized services such as skilled nursing and physiotherapy require trained professionals. There’s a growing trend towards home healthcare for cost efficiency and recovery, though institutional care remains essential for acute situations.

The market sees a high concentration of demand among key patient segments, including the elderly and individuals with chronic illnesses. These groups significantly influence service utilization, making the market reliant on their healthcare needs. A rise in lifestyle-related conditions and increased life expectancy further drives this demand for skilled nursing and personal care services. Service providers are adapting by offering specialized home care equipment and telehealth solutions to enhance patient satisfaction and retention.

Component Insights

The services segment dominated the market and accounted for a share of 84.12% in 2024. It is further segmented into skilled nursing services and unskilled nursing services. Skilled nursing services include a broad range of services licensed healthcare professionals provide. Unskilled nursing services are provided by caregivers or home health aides, who are not certified medical professionals but are skilled in offering patients non-medical support. Home-based care is becoming increasingly prevalent as a more affordable option to hospitalization or institutional care. Skilled nursing services have gained traction due to their convenience and ability to promote patient independence. For instance, in January 2024, NeoHealth, a home healthcare startup, was launched in the UAE. It offers continuity of care, flexible services, and a team of nurses accredited by the Dubai Health Authority.

The equipment segment is expected to register the fastest CAGR during the forecast period. It is segmented into therapeutic, diagnostic, and mobility assistance. Diagnostic equipment accounted for the largest share and is expected to grow at a lucrative rate over the forecast period. Technological advancements in sensors, medical devices, and software result in the development of precise and portable diagnostic equipment. This is anticipated to fuel the segment. For instance, in July 2022, Huawei Technologies Co., Ltd. launched its wrist-type ECG and blood pressure monitoring device, the Watch D, in the UAE. It includes a range of workout modes and health monitoring features, such as blood pressure detection using a tiny pump.

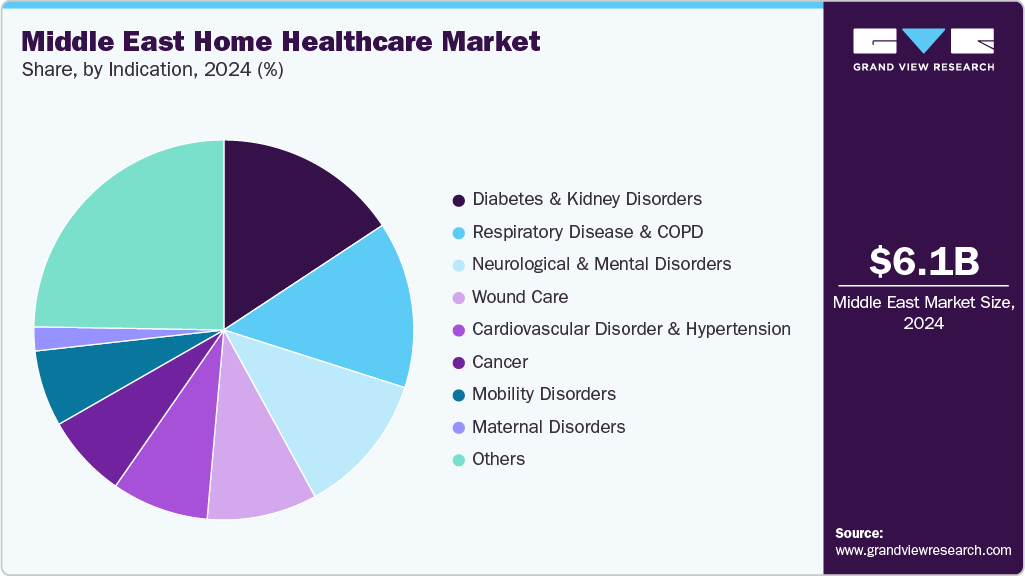

Indication Insights

The diabetes & kidney disorders segment accounted for largest share of 15.72% in 2024. In the Middle East, diabetes and kidney-related conditions are major health concerns. These areas are witnessing an alarming rise in the prevalence of diabetes, which is leading to rising incidences of disorders related to the kidneys. The impact of these conditions on patients is substantial, necessitating home healthcare. For instance, in September 2020, GluCare Integrated Diabetes Center was launched in Dubai. It offers remote continuous data monitoring for diabetic patients.

The mobility disorder segment is expected to register the fastest CAGR from 2025 to 2033. Mobility disorders make it difficult for an individual to do routine activities, necessitating specialized care and assistance. The growing incidence of musculoskeletal ailments, including osteoarthritis, rheumatoid arthritis, and others, has created a demand for home healthcare services that address mobility impairments across the Middle East. These services include a variety of non-medical and medical interventions aimed at enhancing the quality of life for those who struggle with mobility.

Country Insights

Saudi Arabia Home Healthcare Market Trends

Saudi Arabia dominated the regional market in 2024 and accounted for the largest share of the overall revenue owing to a growing aging population, rising incidence of chronic diseases, and government measures to enhance healthcare services. According to the International Trade Administration, Gulf Cooperation Council (GCC) countries spend 60% of their total on Saudi Arabia’s healthcare. The Saudi Arabian government has allocated about USD 65 billion toward developing the nation’s healthcare system as part of Vision 2030.

Oman Home Healthcare Market Trends

Oman is anticipated to witness significant growth. Several key factors, including demographic shifts, technological advancements, and government initiatives, are driving the market growth. For instance, in October 2023, at the ninth meeting of the Gulf Cooperation Council’s Committee of Ministers of Health and the 86th General Conference of the GCC and Yemen, the Sultanate of Oman proposed integrating specialized health services and opening telemedicine clinics for rare diseases in the member states.

UAE Home Healthcare Market Trends

The growing prevalence of various chronic diseases, as well as favorable government initiatives and the market players’ activities, are the main factors propelling the market growth. For instance, in July 2022, Pyramid Health Services, a Hayat Health division governed by the Ghobash Group, entered the Dubai market. The organization provides a range of adult, pediatric, and geriatric patients with skilled and superior medical care.

Key Middle East Home Healthcare Company Insights

The market is fragmented due to presence of large number of multinational as well as local market players. Moreover, the consolidation activities such as home healthcare marketing strategies undertaken by multinational companies are estimated to increase competition in home health care industry. Players in the home healthcare market undertake the strategy to strengthen their product portfolios and offer diverse technologically advanced & innovative products to their customers. Some of the suppliers operating in the market include B. Braun Melsungen AG, Abbott, Sunrise Medical, Omron Healthcare, Inc., GE Healthcare, and others. For instance, B. Braun Melsungen AG offers healthcare solutions for emergency care, surgical products, extra corporeal blood treatments, anesthesia, and intensive care units. It provides services and products to hospitals & private clinics.

Key Middle East Home Healthcare Companies:

Koninklijke Philips N.V.

Omron Healthcare, Inc.

B. Braun SE

Medtronic

Cardinal Health

Sunrise Medical

GE Healthcare

Mediclinic Middle East

Air Liquide

F. Hoffmann-La Roche Ltd.

Linde Plc

Amana Healthcare

Manzil Healthcare Services

Al Tadawi Medical Centre

NMC Healthcare

Abeer Medical

Davita Inc.

Recent Developments

In October 2024, Manzil Healthcare Services partnered with Spectator Healthcare Technology, a Dutch innovator in integrated telehealth solutions, to bring a transformative suite of digital tools to the region. Under this partnership, Manzil will deploy Spectator’s advanced Telehealth Platform, complemented by the white-label BiDiApp for mobile users and Tele-Assistance Rooms for remote or rural communities.

In October 2024, ES Healthcare Centre introduced its AI-enabled home healthcare services in Dubai, marking a strategic expansion into the UAE market. In partnership with iACCEL GBI, a leading accelerator under the patronage of Dubai SME, the company is leveraging local market expertise to integrate its offerings seamlessly into Dubai’s evolving healthcare ecosystem

In April 2024, Clinitouch partnered with Riyadh-based HoopoeView Ltd to introduce its remote patient monitoring technology in the region. Announced at Arab Health in Dubai, this collaboration aligns with Saudi Arabia’s ambitious Healthcare Sector Transformation Programme and Vision 2030 agenda, aiming to modernize and integrate care delivery outside hospital settings.

In September 2023, Aims Healthcare LLC announced the inauguration of its new branch in Sharjah, United Arab Emirates. The Sharjah branch aims to offer a wide range of home healthcare and diagnostic services to patients in Sharjah and surrounding areas.

Middle East Home Healthcare Market Report Scope

Report Attribute

Details

Market size in 2025

USD 6.57 billion

Revenue forecast in 2033

USD 11.80 billion

Growth rate

CAGR of 7.59% from 2025 to 2033

Actual data

2021 – 2024

Forecast data

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional scope

Middle East

Segments covered

Component, indication, country

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Koninklijke Philips N.V.; Omron Healthcare, Inc.; Air Liquide; Amana Healthcare; B. Braun SE; Medtronic; Manzil Healthcare Services; Al Tadawi Medical Centre; NMC Healthcare; Abeer Medical; Davita Inc.; Cardinal Health; Sunrise Medical; GE Healthcare; F. Hoffmann-La Roche Ltd.; Linde Plc.; Mediclinic Middle East

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Home Healthcare Market Report Segmentation

This report forecasts revenue growth, regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East home healthcare market report based on component, indication, and country.

Component Outlook (Revenue, USD Billion, 2021 – 2033)

Equipment

Therapeutic

Diagnostic

Diabetic Care Unit

BP Monitors

Multi Para Diagnostic Monitors

Home Pregnancy And Fertility Kits

Apnea And Sleep Monitors

Holter Monitors

Heart Rate Meters (Including pacemakers)

Other

Mobility Assist

Wheel Chair

Home Medical Furniture

Walking Assist Devices

Services

Indication Outlook (Revenue, USD Billion, 2021 – 2033)

Cardiovascular Disorder & Hypertension

Diabetes & Kidney Disorders

Neurological & Mental Disorders

Respiratory Disease & COPD

Maternal Disorders

Mobility Disorders

Cancer

Wound Care

Others

Country Outlook (Revenue, USD Billion, 2021 – 2033)

Saudi Arabia

UAE

Kuwait

Qatar

Oman

Frequently Asked Questions About This Report

b. The Middle East home healthcare market size was valued at USD 6.12 billion in 2024 and is expected to reach USD 6.57 billion by 2025.

b. The Middle East home healthcare market is expected to reach USD 11.80 billion by 2033, growing at a CAGR of 7.59% from 2025 to 2033.

b. The services segment dominated the market and accounted for a share of 84.12% in 2024. Home-based care is becoming increasingly prevalent as a more affordable option to hospitalization or institutional care. Skilled nursing services have gained traction due to their convenience and ability to promote patient independence.

b. Key players in the market include Koninklijke Philips N.V.; Omron Healthcare, Inc.; Air Liquide; Amana Healthcare; B. Braun SE; Medtronic; Manzil Healthcare Services; Al Tadawi Medical Centre; NMC Healthcare; Abeer Medical; Davita Inc.; Cardinal Health; Sunrise Medical; GE Healthcare; F. Hoffmann-La Roche Ltd.; Linde Plc.; Mediclinic Middle East.

b. Key factors driving the market include the rising prevalence of chronic diseases, government initiatives, technological advancements, and the increasing geriatric population. Moreover, technological advances such as telemedicine and remote patient monitoring are expected to fuel the expansion of this market.