Middle East AI In Healthcare Market Trends

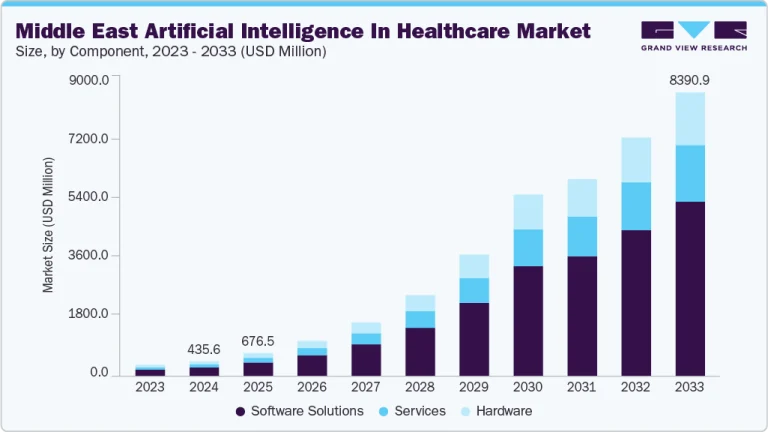

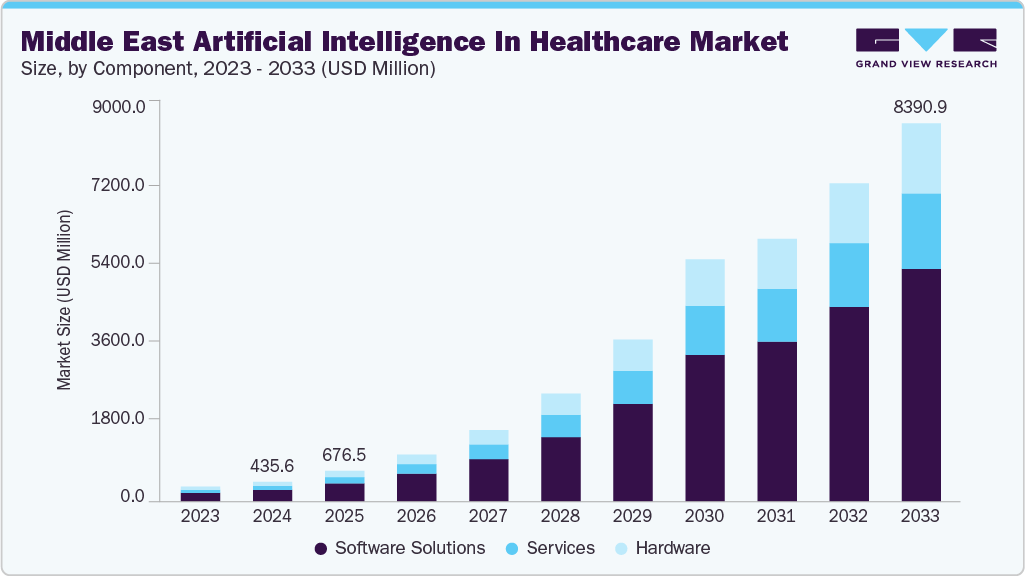

The Middle East artificial intelligence in healthcare market size was valued at USD 435.63 million in 2024 and is projected to reach USD 8390.91 million by 2033, growing at a CAGR of 36.99% from 2025 to 2033. Rapid expansion of digital health infrastructure, growing adoption of telemedicine and remote care, and increasing government investments, coupled with national artificial intelligence (AI) strategies, are factors contributing to market growth.

Healthcare systems across the Middle East are undergoing rapid digitalization, harnessing AI integration. Initiatives such as Abu Dhabi’s Malaffi platform, which connects all regional hospitals and clinics via a secure health information exchange, enhance real-time, seamless data sharing. This infrastructure enables AI algorithms to leverage comprehensive, high-quality patient data, significantly improving diagnostic precision, risk stratification, and personalized treatment planning.

In addition, countries such as the UAE and Qatar are investing heavily in smart hospitals, where AI solutions are being embedded into patient care models. The UAE’s National Strategy for Artificial Intelligence 2031 and Saudi Vision 2030 prioritize AI integration in healthcare to increase access, efficiency, and quality of care. Investment in AI research centers, talent development like the Mohamed bin Zayed University of Artificial Intelligence, and collaborations with leading U.S. healthcare institutions foster innovation.

Similarly, in April 2025, Abu Dhabi announced it would launch a pioneering AI and healthcare Innovation Hub through a strategic partnership between Abu Dhabi Health Data Services (ADHDS), SRI International (a Silicon Valley-based R&D leader), and VantageBridge Partners (Abu Dhabi private equity). Thus, the expansion of robust digital health ecosystems enables AI adoption at scale, supporting more efficient healthcare delivery.

Moreover, the rapid adoption of telehealth platforms drives market growth further. For instance, SEHA Virtual Hospital is a flagship example of AI-enabled, hub-and-spoke virtual care that augments specialist throughput. In February 2025, Aster DM Healthcare launched myAster, its flagship digital health platform, in Saudi Arabia at LEAP 2025, expanding from its success in the UAE. The AI-powered app integrates telemedicine, online pharmacies, appointment management, chronic disease monitoring, and health record access.

Furthermore, the regional focus on developing biotechnology hubs and precision medicine accelerates demand for AI-powered research, drug discovery, and personalized therapeutics, driving sustained market expansion. For instance, in April 2025, the Institute for Healthier Living Abu Dhabi (IHLAD) and Singleron Biotechnologies launched AD-Omics, a joint venture to advance precision medicine in the Middle East using AI-driven single-cell multi-omics technologies. Thus, the demand for precision medicine and data-driven tailored treatments underscores the accelerated adoption of AI-driven medical devices in this region.

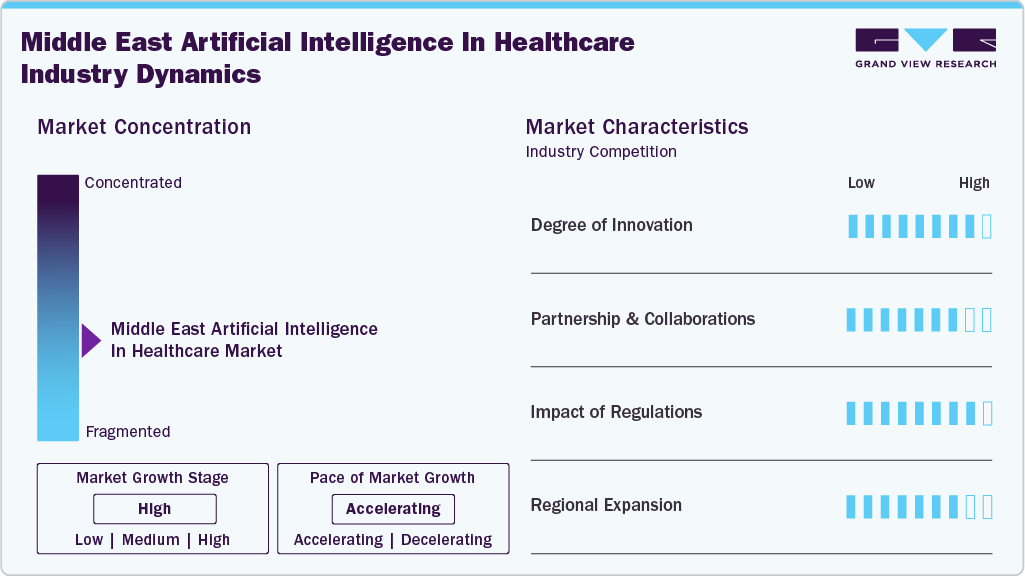

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The X-axis represents the level of market concentration, ranging from low to high. The Y-axis represents various market characteristics, including industry competition, degree of innovation, level of partnership and collaborations, regulatory impact, and regional expansion. For instance, the Middle East AI in healthcare market is slightly fragmented, with many players entering the market and launching new innovative products.

Middle East AI in healthcare industry experiences a high degree of innovation driven by technological advancements. The increasing adoption of artificial intelligence in telehealth and remote patient monitoring supports new innovations in the market.

The industry is experiencing a significant level ofpartnerships and collaborations undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in March 2025, Lunit, a South Korean medical AI company, expanded its partnership with Saudi Arabia’s largest medical group, Dr. Sulaiman Al Habib Medical Group (HMG), securing a second contract to deploy its AI-powered chest X-ray analysis solution, Lunit INSIGHT CXR.

“We are proud to further strengthen our collaboration with Dr. Sulaiman Al Habib Medical Group. This second contract underscores the value of our AI solutions and reflects our shared commitment to advancing healthcare through innovation.”

– Brandon Suh, CEO of Lunit

The regulatory framework of the Middle East AI in healthcare industry is evolving, with countries such as the UAE and Saudi Arabia introducing national AI strategies that include healthcare as a priority sector, emphasizing ethical use and clinical validation. The Saudi Food and Drug Authority (SFDA) regulates AI-based medical devices in Saudi Arabia, while the UAE’s Ministry of Health and Prevention (MOHAP) oversees compliance and approvals. The Gulf Cooperation Council (GCC) nations have established frameworks encompassing AI research, market approvals, and post-implementation monitoring, integrating healthcare law and ethics.

The industry is witnessing high geographical expansion. Companies within the AI in healthcare industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. For instance, in April 2025, Hippocratic AI partnered with UAE-based Burjeel Holdings to deploy generative AI healthcare agents across hospitals and clinics in the UAE and Oman. These AI agents handle non-diagnostic patient-facing tasks like appointment scheduling, education, risk assessments, and follow-ups, supporting personalized and empathetic care.

“We’re proud to partner with Burjeel Holdings, one of the most respected healthcare systems in the region. This partnership supports our shared mission of achieving healthcare abundance. Our empathic genAI agents are designed to create a more compassionate and effective patient experience. Together, we will tailor our solutions to meet the specific needs of the communities we serve.”

– Munjal Shah, Co-Founder and CEO of Hippocratic AI

Component Insights

Based on component, the software solution segment dominated the market with the largest revenue share of over 58.31% in 2024, and it is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the rapidly growing adoption rate of AI-based software solutions amongst healthcare providers, payers, and patients. For instance, in May 2025, the UAE-based startup X-Technology launched an AI-powered virtual reality (VR) platform to support emotional and cognitive health, targeting patients with cancer, Alzheimer’s, trauma, and chronic stress.

However, the services segment is anticipated to grow significantly from 2025 to 2033. This growth rate is attributed to rising demand for implementation, integration, and maintenance of AI solutions in clinical settings. With the growing adoption of telemedicine, predictive analytics, and personalized medicine, recurring services such as data management and cloud support are becoming critical. This evolution from product-oriented models to service-focused engagements reflects a significant and positive trend in the digitalization of healthcare.

Application Insights

Based on application, the robot-assisted surgery segment dominated the market in 2024 with the largest revenue share of 13.50%, driven by rapid adoption of advanced surgical technologies across leading hospitals and specialty centers. Countries such as the UAE and Saudi Arabia are investing heavily in robotic surgical systems as part of their healthcare modernization strategies. For instance, in June 2025, Yas Clinic – Khalifa City in Abu Dhabi launched an advanced AI-powered robotic spine surgery program, integrating intelligent AI-driven medical navigation for enhanced surgical precision.

The fraud detection segment is expected to grow at the fastest CAGR from 2025 to 2033. This growth is attributed to the rising need to curb financial inefficiencies in healthcare systems. Fraudulent claims, billing errors, and misuse of insurance benefits place a significant burden on both payers and providers in the region. AI-powered fraud detection systems leverage predictive analytics and pattern recognition to identify real-time anomalies, reducing revenue leakage and ensuring compliance. The demand for robust fraud detection solutions intensifies as healthcare insurance penetration expands across Middle Eastern markets.

End Use Insights

Based on end use, pharmaceutical and biotechnology companies dominated the market with the largest revenue share of 30.22% in 2024. AI-enabled platforms allow companies to analyze vast datasets, identify novel drug targets, and accelerate molecule screening, significantly reducing development timelines. Pharmaceutical companies are deploying AI-driven analytics to enhance clinical trial efficiency, improve patient recruitment, and monitor real-world evidence more effectively. Biotechnology firms are adopting AI to advance genomics research and develop innovative therapies for chronic and rare diseases. For instance, in April 2025 M42, Abu Dhabi’s AI-powered healthtech company, collaborated with Juvenescence to develop AI-enabled therapeutics to extend healthy lifespan and treat life-threatening and age-related diseases in the UAE.

The patient segment is expected to grow at the fastest CAGR in the coming years, supported by the rising adoption of AI-powered self-care and health monitoring tools. The increasing use of mobile health applications, wearable devices, and AI-enabled virtual assistants is empowering patients to take a more active role in managing their health. These technologies provide real-time insights, symptom tracking, and personalized health recommendations, improving patient engagement.

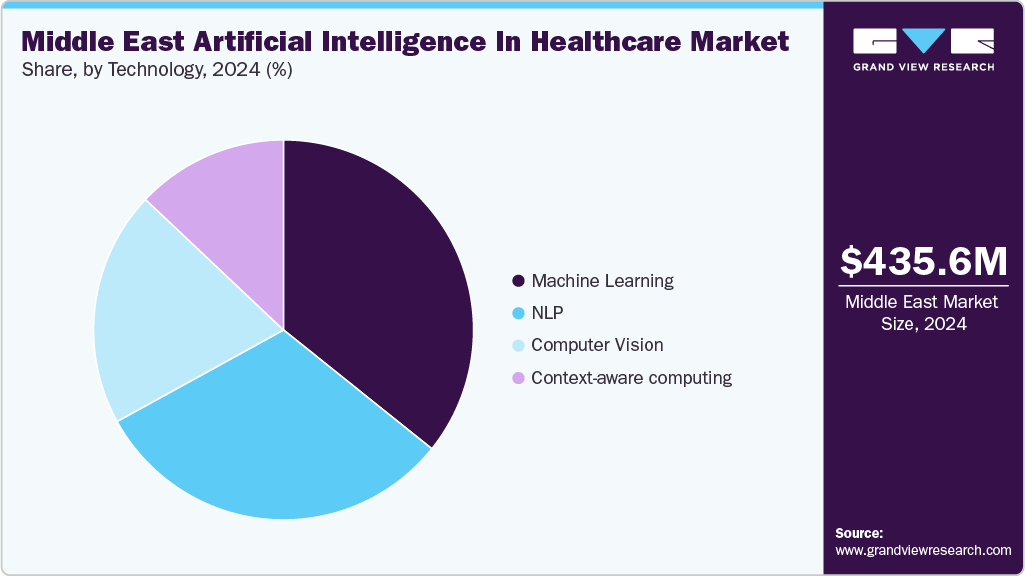

Technology Insights

Based on technology, the machine learning segment held the largest market share of 35.75% in 2024, owing to its wide applicability across diagnostics, predictive analytics, and personalized treatment planning. Machine learning algorithms are extensively deployed in medical imaging, pathology, and cardiology to enhance accuracy and reduce diagnostic variability. Hospitals and research centers across the UAE, Saudi Arabia, and Qatar are leveraging ML-driven tools for early disease detection, particularly in oncology and cardiovascular care. The scalability of ML solutions makes them suitable for integration into expanding digital health infrastructures.

The context-aware computing segment is projected to grow at the fastest CAGR during the forecast period due to its ability to provide highly personalized and adaptive healthcare solutions. This feature is particularly beneficial for managing chronic conditions, where continuous monitoring and tailored interventions are crucial. Hospitals and smart health initiatives in countries such as the UAE and Saudi Arabia are increasingly adopting these technologies to enhance predictive care models. As regional healthcare systems focus more on precision and preventive medicine, the demand for context-aware computing is rising.

Country Insights

Saudi Arabia Artificial Intelligence In Healthcare Market Trends

The Saudi Arabia artificial intelligence in healthcare industry held the largest revenue share of 27.12% in 2024. This growth is attributed to the nation’s strategic vision to modernize healthcare under the Saudi Vision 2030 initiative. This comprehensive reform plan prioritizes digitization, AI integration, and private sector involvement to enhance healthcare delivery, accessibility, and efficiency. Strategic investments in smart hospitals, digital health infrastructure, and AI-enabled platforms are expanding nationwide adoption. For instance, in May 2025, A Chinese startup, Synyi AI, launched the world’s first AI-powered doctor clinic in Saudi Arabia’s Al-Ahsa region. The AI doctor, “Dr Hua,” interacts with patients via tablet to diagnose respiratory diseases and provide treatment plans that human doctors review and approve for safety.

“What AI has done in the past is to assist doctors, but now we are taking the final step of the journey to let AI diagnose and treat the patients directly,”

-SynyI AI CEO Zhang Shaodian

UAE Artificial Intelligence In Healthcare Market Trends

The AI in healthcare industry in the UAE is expected to grow at the fastest CAGR over the forecast period. This is attributed to strong government support for digital transformation and innovation. The UAE’s National Strategy for Artificial Intelligence 2031 identifies healthcare as a priority sector, channeling significant funding into AI infrastructure, research programs, and talent development. Furthermore, strategic initiatives undertaken by leading companies help boost awareness of the use of AI solutions in the healthcare industry, leading to market growth. For instance, in January 2024, Koninklijke Philips N.V. displayed multiple innovations at Arab Health 2024, including the AI-powered MR Smartspeed, a fast, high-quality imaging solution.

Key Middle East Artificial Intelligence In Healthcare Company Insights

Market players are utilizing innovative product development strategies, partnerships, and mergers and acquisitions to expand their presence in response to the increasing demand for early and accurate disease detection, cost containment, addressing the shortage of healthcare providers, and providing value-based care.

Key Middle East Artificial Intelligence In Healthcare Companies:

Microsoft

IBM

Google

NVIDIA Corporation

Intel Corporation

GE Healthcare

Medtronic

Oracle

IQVIA

Siemens Healthineers AG

Recent Developments

In May 2025, Oracle Health, the Cleveland Clinic, and Abu Dhabi-based G42 announced a strategic partnership to develop an AI-based healthcare delivery platform. This platform aims to deliver more effective, scalable, and affordable healthcare by integrating Oracle Cloud Infrastructure, the Cleveland Clinic’s clinical expertise, and G42’s sovereign AI infrastructure and clinical AI models.

In April 2025, Unilabs Middle East introduced the region’s first AI-powered digital cytology technology in the UAE with the Hologic Genius Digital Diagnostics System. This combines deep learning AI and volumetric imaging for highly precise cervical cancer detection by identifying pre-cancerous and cancerous cells.

In January 2025, Augnito, a medical voice AI technology provider, partnered with Almoosa Health, a Saudi healthcare provider, to integrate Augnito’s Omni AI Scribe across Almoosa Specialist Hospital. The AI tool captures multi-lingual medical dialogues (including all Arabic dialects) and seamlessly integrates with Almoosa’s Electronic Medical Records (EMR) and Hospital Information System (HIS).

“This collaboration with Almoosa Health Group represents a quantum leap in healthcare efficiency. By combining our AI expertise with Almoosa’s clinical excellence, we’re setting a new standard for medical documentation-one that prioritizes both practitioner productivity and patient outcomes.”

-Rustom Lawyer, Co-Founder and CEO of Augnito

In September 2024, Nanostics partnered with OncoHelix to launch the AI-powered ClarityDX Prostate blood test in the Middle East, providing advanced prostate cancer risk assessment through an Abu Dhabi-based lab operated by Burjeel Holdings.

In August 2023, FluidAI Medical launched its AI-powered postsurgical monitor, the Stream Platform, in Saudi Arabia. This non-invasive system uses advanced sensors and AI-driven algorithms to detect postoperative leaks and severe complications early in digestive tract surgeries.

In October 2022, Lunit partnered with Abu Dhabi Health Services Company (SEHA), the largest healthcare network in the UAE, to conduct a proof of concept (POC) trial of its AI-based radiology solutions, including Lunit INSIGHT CXR for chest X-ray analysis and Lunit INSIGHT MMG for mammography.

Middle East Artificial Intelligence In Healthcare Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 676.52 million

The revenue forecast in 2033

USD 8,390.91 million

Growth rate

CAGR of 36.99% from 2025 to 2033

Historical data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, technology, end use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Microsoft; IBM; NVIDIA Corporation; Intel Corporation; GE Healthcare; Google; Medtronic; Oracle; IQVIA; Siemens Healthineers AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Artificial Intelligence In Healthcare Market Report Segmentation

This report forecasts revenue growth at the regional and country-level and provides an analysis of industry trends in each of the sub segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the Middle East Artificial Intelligence (AI) in healthcare market report based on component, application, technology, end use, and country:

Component Outlook (Revenue, USD Million, 2021 – 2033)

Hardware

Processor

MPU (memory protection unit)

FPGA (Field-programmable gate array)

GPU (Graphics processing unit)

ASIC (Application-specific integrated circuit)

Memory

Network

Adapter

Interconnect

Switch

Software Solutions

Services

Application Outlook (Revenue, USD Million, 2021 – 2033)

Robot Assisted Surgery

Virtual Assistants

Administrative Workflow Assistants

Connected Medical devices

Medical Imaging & Diagnostics

Clinical Trials

Fraud Detection

Cybersecurity

Dosage Error Reduction

Precision medicine

Drug discovery & development

Lifestyle management & remote patient monitoring

Wearables

Others (Patient engagement, etc.)

Technology Outlook (Revenue, USD Million, 2021 – 2033)

End Use Outlook (Revenue, USD Million, 2021 – 2033)

Healthcare providers (hospitals, outpatient facilities, and others)

Healthcare payers

Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

Patients

Others

Country Outlook (Revenue, USD Million, 2021 – 2033)

Middle East

Saudi Arabia

UAE

Kuwait

Qatar

Oman

Frequently Asked Questions About This Report

b. The Middle East artificial intelligence in healthcare market size was estimated at USD 435.63 million in 2024 and is expected to reach USD 676.52 million in 2025.

b. The Middle East artificial intelligence in healthcare market is expected to grow at a compound annual growth rate of 36.99% from 2025 to 2033 to reach USD 8390.91 million by 2033.

b. The software segment held the largest market share of 58.31% in 2024.

b. Some key players operating in the Middle East artificial intelligence in healthcare market include Microsoft; IBM; NVIDIA Corporation; Intel Corporation; GE Healthcare; Google; Medtronic; Oracle; IQVIA; and Siemens Healthineers AG.

b. Key factors that are driving the Middle East AI in healthcare market are rapid expansion of digital health infrastructure, growing adoption of telemedicine and remote care, and increasing government investments, coupled with national AI strategies.