By Vikas Saini and Brenna Miller

The US has fewer healthcare dollars than its peer countries, and is well known to cost more and less for a while. Where does all the money go? A recent study from Jama Internal Medicine shows how much of the healthcare industry's profits are directed towards corporate shareholders.

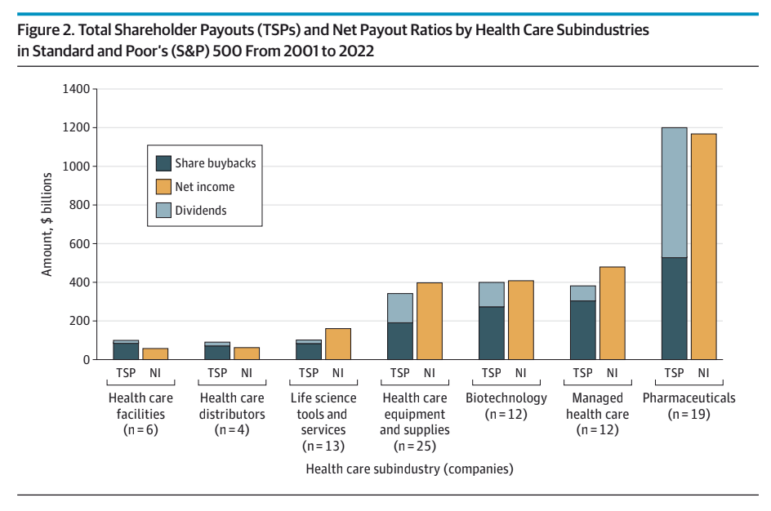

Healthcare companies have given shareholders trillions

Researchers looked at all health companies listed on the S&P 500 Healthcare Index from 2001 to 2022, spending $2.6 trillion on stocks in dividends and buybacks, representing 95% of all profits made in the sector. Over the same period, the number of healthcare companies on the index almost doubled, with total shareholder payments tripling from $54 billion to $1700.2 billion. Stock buybacks (where a company purchases its own shares to increase the value of the remaining shares) will benefit executives, particularly those who are compensated through stock options.

The pharmaceutical industry collectively returned $1.2 trillion to shareholders, collectively returning managed healthcare, biotechnology and medical devices and supplies, accounting for much greater total payments. This is in line with previous research showing that many large pharmaceutical companies spend more on buybacks and dividends than research and development.

“The functioning market is fantasy.”

Some may also see shareholder payments, of course, or at worst “normal business.” After all, the theory of capitalism is that private companies justly reward shareholders with dividends when they enter a market with the products they need and increase their efficiency in achieving their economic success. However, this perspective assumes that the healthcare system works in the same way as other markets. In fact, market obstacles are well documented, ranging from the abuse of patent systems to mass integration and the lack of downward pressure on prices.

As he told USA Today, “The whole idea that there is a functioning market is fantasy. Given that fact, the flow of money is not rational at all. That's why you get what you get with regard to every price.” In fact, there's a compelling argument that healthcare essentially can't function like a regular market.

What do Americans get for these payments?

This study shows important results for profit-based healthcare systems. Shareholder prioritization for patients. The health industry complex returns billions to shareholders each year, but 25% of Americans struggle to encounter prescription drugs and 100 million Americans in some form of medical debt.

As he told USA Today, “This is a valuable question for society. Are there any points that it is completely rational, or are there any points that are completely lewd? Obviously, it's not indecent for shareholders. They love it.” But for most Americans, including many, if not most Trump voters, it's indecent.

The authors of this study concluded that “an increase in capital distribution to shareholders of publicly traded companies may be associated with higher prices and may not be reinvested in improved access, delivery, or research and development.”

Ultimately, billions of dollars have been poured into shareholder pockets over the past 20 years, showing the outcome of AMOK's implementation of a profit-driven healthcare system. While investors were benefiting, millions of Americans struggled with the financial burden of getting care. Data in this paper show that in order to make all Americans healthy at prices, limiting the market's constant willingness to suck up profits for shareholders at the expense of patients.