This article is based on content published on our original partner platform, Seerist. Seerist is an enhanced analytics solution for threat and risk intelligence experts.

China launched a drastic national campaign against healthcare corruption in mid-2023, showing a massive escalation of anti-corruption enforcement in the sector. The campaign gained new momentum from 2024-25, with increased regulatory efforts from various authorities increasingly and evolving expectations for compliance in the healthcare business.

Among the most important regulatory changes in early 2025, on January 10, the State Administration for Market Regulation (SAMR) announced “Compliance Guidelines for Healthcare Companies to Prevent the Risk of Commercial Bribery.” What are the evolving executive trends in China's healthcare industry in 2025? And what are the impacts of these business changes?

Continuous but evolving scrutiny

SAMR guidelines are that there is a healthcare sector that remains a priority target for anti-corruption enforcement. The nationwide healthcare anti-corruption campaign launched in July 2023 was originally scheduled to last for a year. However, it will continue until 2024, and perhaps central regulators show recognition that corruption-related violations are prevalent. At least 350 healthcare professionals were the subject of a new survey in 2024, according to state media. In January 2025, the Central Sectoral Examination Committee (CCDI) reaffirmed medicine as one of eight “major anti-corruption areas” of the year.

Although medical misconduct remains a major focus, these extensive research has made concrete business implications. Several major multinational health companies have cited delays in procurement bids and product delivery through latest financial reporting campaigns, due to precautions taken by local health agencies during investigations of relevant staff. Furthermore, investigators' attention is steadily focused on business personnel involved in the bribery scheme. Public records show that at least five senior executives from the domestic healthcare company listed in late 2024 have been detained for corruption-related investigations, reflecting an increase in regulatory measures against bribery be-givers.

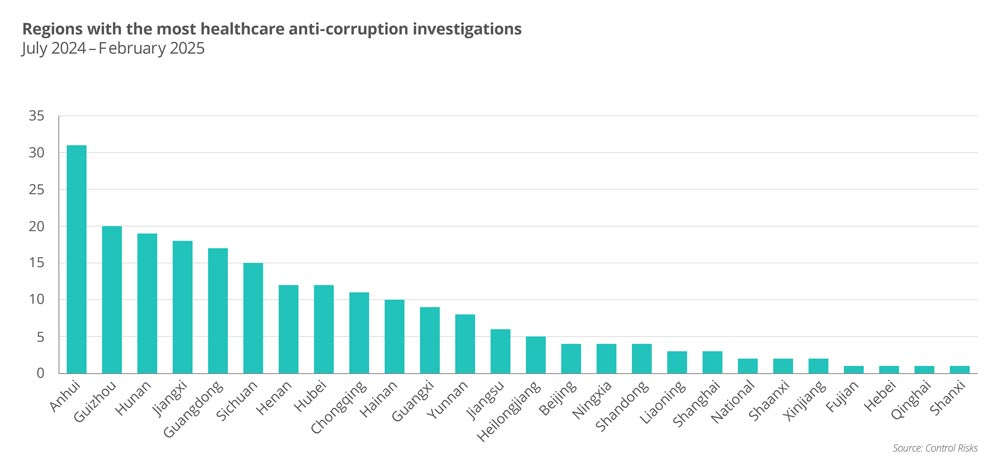

Management Risk identified 221 published cases of new anti-corruption investigations of local officials across the country between July 2024 and February 2025, revealing several changing enforcement priorities and expanded scrutiny. For example, early 2025 shows a new trend to further explore healthcare professionals at the national level. In late February 2025, the former deputy director of the National Medical Products Agency (NMPA) was taken into custody for a CCDI investigation, making him the most senior medical professional to date affected by the anti-corruption campaign. Media reports in January also showed that the National Joint Procurement Bureau for High Value Health Consumers is being subject to corruption-related investigations.

As seen since the campaign began in mid-2023, public hospital directors and department heads in charge of healthcare procurement remain the most frequent goals of the survey. However, unlike the period from 2023 to early 2024, regulators have been increasingly scrutinizing local health officials involved in volume-based procurement (VPB) programs, product testing and approval, and public health insurance management.

Additionally, senior executives from healthcare sector state-owned enterprises (SOEs) are increasingly involved with leaders from healthcare-centric higher education institutions. These developments suggest an expanded scope of enforcement, requiring companies to monitor not only interactions with hospitals but also engagement with other state-related stakeholders throughout the product lifecycle, including approval and distribution.

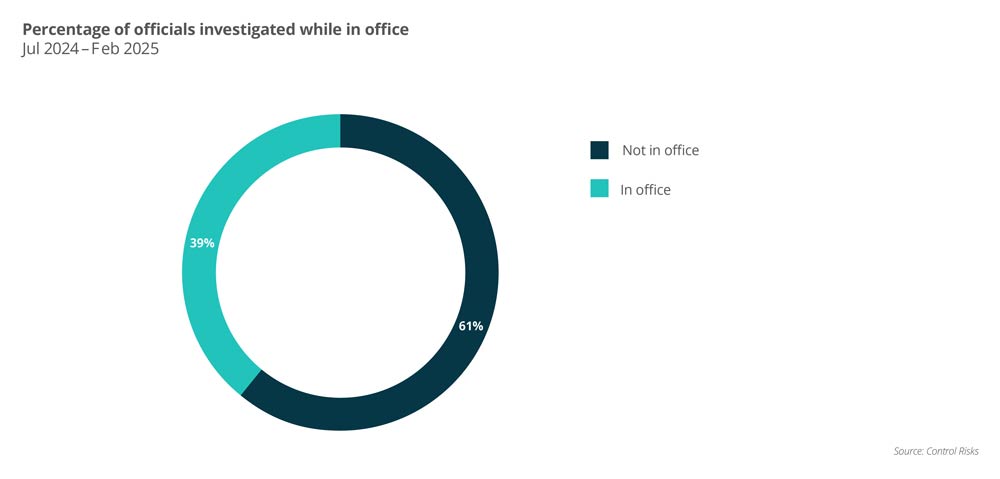

Another trend is the retrospective nature of enforcement. Approximately 60% of the 172 surveys over the past eight months involved healthcare professionals who have retired or moved to another position. In comparison, as shown in public records, the survey at the start of the campaign is primarily targeted at incumbent local healthcare professionals. Many of these cases can return to violations in the 2010s, highlighting that businesses will conduct a thorough review of legacy compliance practices to prevent potential exposure to regulatory scrutiny.

Furthermore, there continued to be clear regional disparities in anti-corruption enforcement. Anhui has done the most research in the last eight months, with Guizhou, Hunan and Jiangxi following as states. These regions were also hotspots in 2023, suggesting a sustained focus by regulators. Many of these studies are driven by the “chain effect,” where probes to one high-ranking official lead to scrutiny of subordinates and sometimes close business contact. Companies operating in these regions should strengthen local compliance measures and monitor future execution rollouts related to previous or ongoing investigations.

New Anti-Bribery Guidelines

SAMR guidelines are consistent with existing anti-bribery regulations frameworks, as well as regulations issued by other authorities. In addition to reflecting the growing expectations of healthcare companies for compliance, the guidelines also aim to provide practical, standardized instructions to address areas of ambiguity, such as donations to medical representatives to physicians and academic research.

The guidelines for the first time identifying nine “high-risk” scenarios in the business and academic activities of healthcare companies in China. Each scenario has a specific “DO and DOS” and prohibited activities. Apart from the already increased scrutiny of health representatives' involvement with physicians, the guidelines underscore the need for companies to enhance compliance management of third-party vendors at stages such as production distribution and clinical research.

In particular, SAMR outlined through guidelines how companies with violations can reduce penalties by working with investigators, including providing evidence of violations and fraudulent conduct that they actively report. This coincides with Beijing's baseline message from 2023 onwards. In other words, the enforcement campaign aims to improve industry-wide compliance rather than punishing all businesses for previous violations.

Companies are encouraged to review and adjust recommended measurements and compliance protocols for all relevant scenarios from the guidelines. SAMR and its local branches may use guidelines as a benchmark for future research to assess whether certain anti-bribery violations are individual fraud or inadequate compliance management by organizational-level companies.

“High-risk” scenarios identified in SAMR guidelines

Scenarios with bribery risk exposure

Examples of risk activities flagged by SAMR

Academic visits and promotion activities at hospitals

Assign sales targets to medical representatives and encourage them to interfere with physician prescribing decisions.

Hosting healthcare workers in business activities

Conceal hosting costs under other cost categories (such as training or research)

Pay a doctor in professional consulting services

Lack of transparency in service scope, frequency, or payment criteria

Outsourcing of production, research and development, and distribution to third parties

Paying outsourced service providers excessively or respectively without sufficient justification.

Offer discounts or commissions during sales

Provide unrecorded or excessive discounts, rebates, or fees to distributors or third parties

Donation funds or medical products

Use donations or sponsorships to influence your procurement decisions, bypass competitive bids, or obtain priority treatments

Place free medical devices in hospitals

Provide free medical devices to hospitals in exchange for exclusive procurement agreements

Partners with hospitals for clinical research

Payments or incentives provided to accelerate research timelines and manipulate results

Source: National control for market regulation

Beyond anti-briety

Beyond anti-briety, regulatory pressures are rising in other areas of healthcare compliance, including bidding-related compliance, public health insurance, and product quality. These areas require more aggressive internal control and regulatory oversight to mitigate risk exposure. It is also important for businesses to enhance compliance tracking and raise awareness among third-party vendors and other external partners.

Bid-related violations: Enforcement actions for violations related to conspiracy to bid during procurement bids at public hospitals and forged documents have increased significantly since 2024. While existing cases have primarily impacted distribution companies rather than producers, healthcare businesses need to increase compliance oversight of third-party distributors to avoid adverse regulations and reputational outcomes. Public Health Insurance Misuse: The National Health Security Agency (NHSA) in 2024 focused on expanding testing to public health insurance fraud by healthcare providers. However, the controversy over the China-based employees of a large multinational drug company in late 2024 highlights that even companies eligible for the National Refund Drug List or other public health insurance programs are under supervision. Tumor treatments may be assigned for future testing. Later in 2024, we reportedly witnessed investigations of several national genetic testing service providers, reportedly promoting illegal health insurance reimbursements for certain cancer treatments by forgerying patients' genetic testing reports. Product Quality and Safety: Authorities will steadily strengthen inspections regarding quality-related compliance requirements and inspections over the next year. On January 15, the National Medical Products Agency (NMPA) issued a new draft of the Medical Device Manufacturing Quality Control Standards for public comment. There are also rules regarding “Whistleblower Rewards Reporting the Quality and Safety of Drugs and Medical Devices,” which were released until its finalisation in October 2024. On January 21, 2025, the NHSA, together with the NMPA and other central regulators, launched a special working group in Shanghai to investigate complaints from doctors regarding quality issues with certain medical products supplied by the VBP programme.