Jd

Jones' Day

more

On January 14, 2025, China's Market Regulation (“SAMR”), the leading Chinese regulator to oversee market supervision, issued compliance guidelines for healthcare companies to prevent the risk of commercial bribery.

US

Food, Drugs, Healthcare, Life Sciences

To print this article, all you need to do is sign up or log in to Mondaq.com.

On January 14, 2025, the State Administration for Regulation of China Markets (“SAMR”) is China's leading regulatory body for overseeing market oversight, and healthcare companies have introduced compliance guidelines to prevent the risk of commercial bribery. Published (“Guidelines”).

These guidelines apply widely to pharmaceutical and medical device companies and other third parties involved in the research, development, production and distribution of medical products within China. These guidelines address bribery risks associated with interactions with healthcare organizations (“HCOs”) and healthcare professionals (“HCPS”) whether practiced in private or public abilities. It's there. These guidelines represent the most definitive and authoritative guidance to date regarding the perspectives of Chinese regulators on practices in the healthcare and life sciences (“HCLS”) industry.

Under Chinese rules and regulations, HCO is defined to include hospitals, clinics, township health centres, community health services centres, clinics and outpatient departments. Meanwhile, HCPs should include licensed physicians, assisted licensed physicians, registered nurses, pharmacists, laboratory technicians, imaging technicians, village doctors, and other professionals engaged in medical and medical work. It is widely defined.

Risk-based classification of daily work

The guidelines address nine business activities that HCLS companies are routinely involved and are identified as areas at risk of bribery. That is, (i) academic promotion activities, such as meetings with HCPS to provide academic information and technical consultations. (ii) Hospitality, for example, HCP meals and entertainment during business interactions. (iii) Consulting service fees to HCPS. (iv) Outsourcing medical research, manufacturing and other business activities to third parties. (v) Financial incentives offered at the point of sale, such as discounts, rebates, and committees. (vi) Donations, sponsorships, and grants. (vii) Free supply of medical devices to HCOS. (viii) Clinical research. (ix) Sales by retail pharmacies.

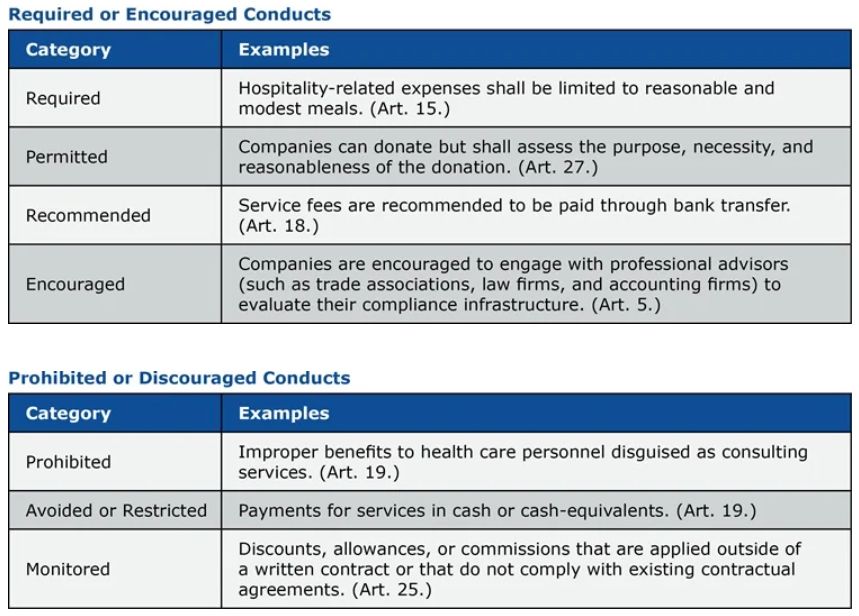

The guidelines provide detailed guidance on managing these risks as follows:

Strengthening scrutiny for cooperation with government investigations

The guidelines are consistent with standard best practices commonly shown and industry guidelines that apply to other parts of the world. Previous laws and regulations emphasized the importance of cooperation with such investigations, but these provisions may be considered to interfere with the investigation and the circumstances and requests for investigation. They did not clearly distinguish between situations where circumstances that did not violate the situation could be considered based on good reasons. In this regard, the guidelines provide more specific scenarios that constitute obstruction, such as unsupported claims of business secrets and lack of internal approval. SAMR retains considerable discretion in determining what constitutes delays and blockages.

The new guidelines are not legally bound by China, but they are in close agreement with established China's anti-briety laws. The new guidelines are considered important reference points for enforcement agencies as they provide detailed examples and frameworks that clarify these existing provisions and are expected to have a significant impact on enforcement practices. .

The content of this article is intended to provide a general guide to the subject matter. You should seek expert advice on your particular situation.