Mark Bertolini, former CEO of Aetna and current CEO of Oscar Health, said Americans' frustrations with the health system are valid. Employer-sponsored health insurance, which insured more than 160 million Americans, is losing some of its effectiveness as companies have less influence over insurers to lower premiums. There is. Instead, employees must choose their plan from the marketplace, and Oscar targets individuals who don't have employer insurance.

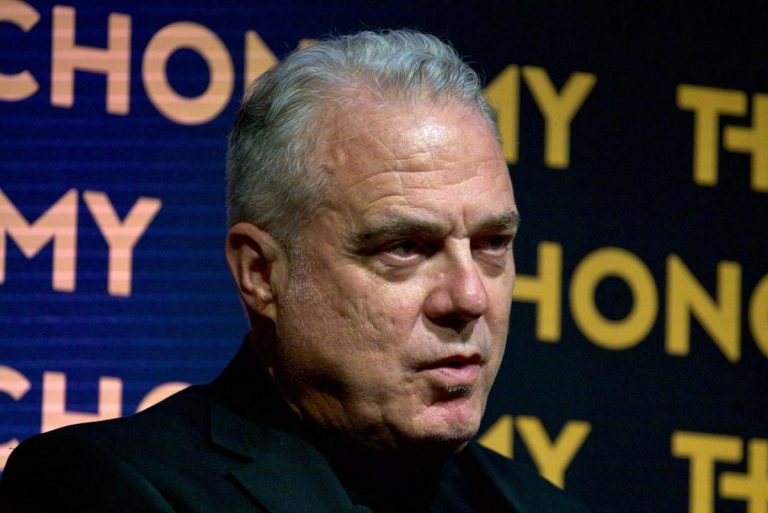

The murder of UnitedHealthcare CEO Blaine Thompson has sparked a new wave of dissatisfaction with the U.S. health care system. Critics say the health system has not improved health outcomes and is notorious for being prohibitively expensive. Mark Bertolini, former Aetna chairman and CEO and current CEO of Oscar Health, believes he has found a solution to the industry's pitfalls. That is the abolition of employer-paid health insurance.

“Perhaps the most important thing is that health care is now very individualized. We want it to be tailored to us,” Bertolini said Thursday on CNBC's “Squawk Box.” “And when my employer buys my health insurance, they buy average premiums.”

Bertolini has been leading Oscar Health since April 2023, after VC Joshua Kushner co-founded the company in 2012. Mr. Kushner has served as vice chairman of the board since its inception. The insurance company is a private health care provider under the Affordable Care Act (ACA) and continues to expand its marketplace availability for people who do not have employer-sponsored insurance. Oscar partnered with Cigna in 2020 to offer group insurance to small businesses and gain access to its provider network, but has struggled to sustain that business unit and to compete with larger companies. We are redoubling our efforts to expand coverage for our employees. Large companies whose employers seek compensation.

According to the health policy nonprofit KFF, by 2023, more than 60% of Americans under age 65, or about 164.7 million people, will have insurance through their employer, making it the largest choice for non-elderly Americans. is the largest source of insurance. The system allowed a wide range of Americans to receive subsidized health insurance and allowed employers to save money through tax breaks by offering group health insurance.

However, the plans can also result in uneven coverage and large variations in the amounts employees are required to contribute to the plan; The average price has increased by more than 50% from $4,940 to $7,590 in 2022. to the U.S. Census. The current health care system is becoming unsustainable as medical costs in the United States have soared to account for nearly 20% of the country's gross domestic product.

the story continues

Bertolini argues that a merger would bring closer relationships between insurers and doctors. Employers will no longer have the same bargaining power with insurance companies to lower premiums, and small businesses will only have less of that bargaining power.

“Corporations have no influence,” he said.

As an alternative, healthcare CEOs suggested that employers continue contributing to employee insurance but allow employees to choose individual plans that fit their needs instead of enrolling them in group plans. . For example, a relatively young and healthy employee should pay less for insurance than an older colleague with a large family.

“Instead of a defined benefit plan, we're giving employees some support so they can understand their health care utilization and plan accordingly,” Bertolini said.

Bertolini effectively explains Oscar's $3.4 billion business model. The market-based insurer reported a loss of $54 million in the last quarter, just after the election. Despite President Donald Trump's proposal to repeal the ACA, the company said in a statement accompanying its earnings call that it is “appealing to Republican demands for consumer choice and a free-market approach and aiming for long-term growth.” We are prepared,” he said.

Oscar did not respond to Fortune's request for comment.

The desire to reinvent the insurance industry comes amid a flurry of criticism of the U.S. health care system following Thompson's death. The criticism led to a flurry of death threats against other healthcare executives, and information about senior executives and executives was removed from the insurance company's website to protect employees. 'Safety

But “the anger is justified,” Bertolini said, especially since claim denial rates are rising, according to Experian Health's 2024 claims report.

“You can't talk to anyone in this city and hear about claim denials, pre-authorizations, or getting the right medication,” Bertolini added.

These grievances have been building for 80 years and are the result of a system built after World War II to accommodate a growing economy and population, he said. In his view, it no longer suits today's population.

In the early 1940s, with so much of the U.S. population serving in the military, there was a severe labor shortage, and employers began raising wages to get the remaining eligible population to join the workforce. President Franklin Roosevelt, fearing a wave of inflation due to the employment promotion, created the Bureau of Economic Stabilization and authorized wage controls through the Stabilization Act of 1942. The measure forced employers to instead use increased health insurance benefits as an incentive. To accommodate the growing number of Americans receiving health care through employee-provided insurance, Congress passed the Hill-Burton Act in 1946 to build and expand U.S. hospitals.

“Ever since the population boom began, the growth in both demand and supply has not slowed down,” Bertolini said. The problem now is that in 1940, health spending was 4.5% of GDP; today it is nearly 20%.

He added: “If you look at these changes over time, we're now beyond our ability to maintain the way we are.”

This article originally appeared on Fortune.com