As we head into the final months of 2024, economic conditions appear to be improving. Inflation has slowed to near the Fed's target rate, central banks have begun lowering interest rates, and the last jobs report showed a surge in hiring. In response, Wall Street experts are outlining their top picks for investments in the coming years, providing investors with valuable insight.

KeyBanc analyst Matthew Gilmore focuses on healthcare services stocks, a sector with multiple potential tailwinds. Baby boomers are aging rapidly and using more health care services, while government policies such as Obamacare ensure broader coverage and payments. Gilmore sees these and other factors as decisive here.

“We believe that fiscal pressures and demographic trends will require significant efficiency improvements in the U.S. health care system over the next five to 10 years,” Gilmore said. “Healthcare services will likely be the epicenter of innovation, disruption and opportunity…Our proprietary hospital card data shows continued strong usage in September and in the third quarter. We expect hospitals and acute care providers to outperform and increase revenue in the third quarter. We support efficient providers competing against inefficient nonprofits.”

With this backdrop, Gilmore takes a deep dive into the details of Humana (NYSE:HUM) and Privia Health Group (NASDAQ:PRVA), companies that are approaching the sector from very different directions. He rates both and highlights one as the top healthcare stock to buy right now. Let's take a look at the details.

humana

We start with Humana, the fifth largest health insurance company in the $1.4 trillion U.S. health insurance market. Humana has a 7.3% market share in the industry and a market capitalization of $31 billion. The company's total fourth-quarter revenue of $112 billion for the second half of 2023 and first half of 2024 ranks eighth among all U.S. insurance companies, regardless of specific market. Humana is a significant provider of individual and family medical, dental and vision plans in the U.S. private health insurance sector, as well as a variety of Medicaid-based plans based on customer eligibility. Additionally, Humana is known for offering eligible patients a variety of Medicare Advantage plans that cover medical, routine dental, and vision and hearing benefits.

Coverage of Medicare Advantage has brought headlines to Humana recently, but not the kind the company was hoping for. The Centers for Medicare and Medicaid Services (CMS), the federal regulatory oversight agency for Medicare and Medicaid insurance companies, recently downgraded most of Humana's Medicare products. This has a significant impact on the company's future earnings, as insurers with programs with higher star ratings can receive bonus payments from Medicare. At Humana, the percentage of Medicare Advantage members enrolled in 4-star plans in 2025 is significantly lower than this year.

story continues

This isn't the only potential failure Humana has recently reported. In January, the company reported that an increasing proportion of its insured members were elderly patients seeking care, a demographic shift that could hurt revenue.

That being said, Humana still reported revenue growth in the second quarter of this year, as reported last quarter. Revenue was $29.54 billion, $1.1 billion higher than expected and an increase of more than 10% from the same period last year. The company's non-GAAP earnings were $6.96 per share, beating estimates by $1.09. For the third quarter, the company plans to announce its financial results at the end of this month. Analysts expect quarterly revenue to be $28.65 billion. This represents an 8.4% increase over the same period last year.

The stock presents a mixed picture for KeyBanc analyst Matthew Gilmore, who outlines reasons for both optimism and pessimism: HUM is underperforming across the MA books due to v28 changes, higher usage in 2023-2024, and lower benchmark updates. Efforts to improve margins through plan termination should yield some benefits next year. However, due to the TBC threshold and star weakness in 2025, significant margin recovery may not occur until 2027 or later. We estimate that a normalized MA margin (~3.5%) against a reasonable long-term earnings multiple (~15x) could generate over $600 in equity at some point. Masu. ”

Looking ahead, however, Gilmore is cautious, saying: “We see a long-term bullish case for HUM, but we will figure out the timing of a recovery in MA margins before a potentially more constructive development. I am thinking of doing so.''

To quantify his stance here, the analyst gave HUM stock a sector-weight (neutral) rating and declined to set a fixed price target.

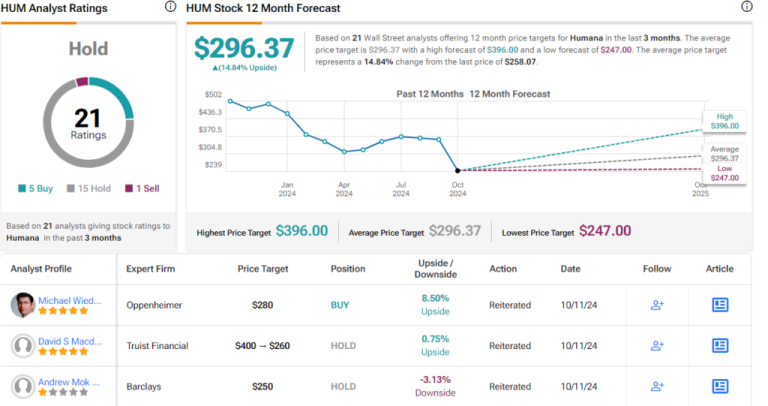

Overall, Street View is consistent with KeyBanc. The consensus on HUM stock is a Hold based on 21 reviews, including 5 Buys, 15 Holds, and 1 Sell. Current stock price is $258.07, IThe average price target of $296.37 implies an upside of 15% over the next 12 months. (See Humana stock price forecast)

Privia Health Group

The second stock on our list, Privia Health Group, is a national physician organization that equips physicians and other health care providers with the tools and talent they need to provide the best care for their patients. We are a technology-savvy organization that delivers. The company's goal is to help physicians optimize their practices and improve the patient experience, ensuring they receive the best care in both office and virtual environments.

Privia works directly with healthcare providers, who realize the benefits of independent practice and group membership. This is an innovative way to combine small physician groups with efficiencies of scale. From a patient perspective, the benefit is more personalized care. The company currently works with more than 4,500 healthcare providers in more than 1,100 locations, collectively treating more than 5 million patients.

On the financial front, Privia beat expectations in its last earnings report released in August and covering the second quarter of 2024. The company had revenue of $422.3 million, up 2.2% from the year-ago period and beating Street estimates by $10.84 million.. Privia's bottom line came in at 19 cents per share on a non-GAAP basis, beating forecasters by a penny.

Consensus for Privia's full-year 2024 revenue is $1.67 billion. The company is expected to report more than $413 million in third-quarter revenue next month, and needs to generate more than $430 million in the fourth quarter to meet that full-year forecast. It's worth noting that Privia has seen year-over-year growth in quarterly revenue over the past few quarters, with over $440 million in Q4 2023.

KeyBanc's Gillmor believes Privia has a solid outlook, writing about the company: PRVA's platform improves fee-for-service (FFS) rates, reduces practice costs, and creates progressive economics for value-based care (VBC). You'll also discover the benefits of PRVA's integrated EMR (electronic medical record). Particularly related to driving behavior change and operational visibility of physicians to improve VBC performance. PRVA creates significant value for payers (quality measurement, documentation of RAF (risk adjustment factor), maintenance of continuity of care). PCP (Primary Care Physician) Network), and we believe the company could be a reasonable acquisition candidate under the right circumstances. ”

In line with these comments, Gilmore rates PRVA stock an Overweight (Buy) with a price target of $23, implying a one-year upside potential of 31%.

The stock has a consensus rating of “Strong Buy” from analysts on The Street. This is based on 12 recent recommendations with a biased 11-to-1 split favoring buys over holds. The stock is trading at $17.55, and the average price target of $24.80 suggests it has room for 41% upside by this time next year. (See Privia stock price forecast)

To find good ideas for trading stocks at attractive valuations, visit TipRanks' Best Stocks to Buy, the tool that unites all of TipRanks' equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.