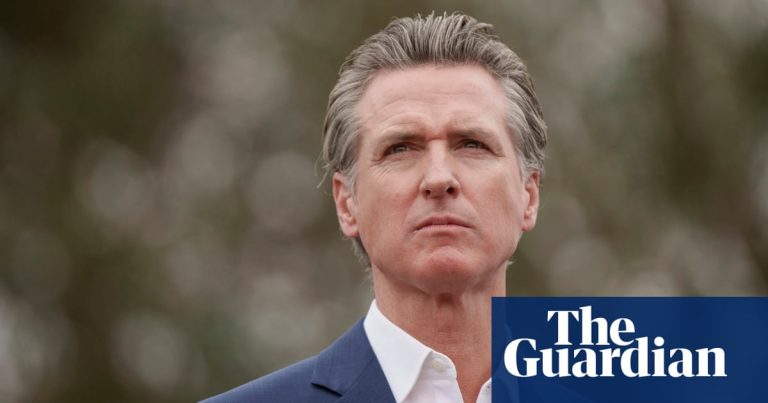

Hopes to curb private equity investment in the health care sector ended in California over the weekend after a nationally watched bill was vetoed by Democratic Gov. Gavin Newsom.

The bill was the nation's highest-profile legislative effort to regulate such investments in the health care sector, giving state attorneys general discretion to veto mergers.

The hospital's demise comes amid U.S. Senate hearings into mismanagement at Steward Health, a chain of more than 30 private equity-backed hospitals in Massachusetts. The hospital's CEO and investors siphoned “hundreds of millions” of dollars from a local hospital, even though it sickened one of its worst patients. Domestic nursing care records.

“We are truly disappointed to see this bill vetoed,” said Health Access California, a consumer advocacy coalition that is lobbying in favor of the bill. said legislative advocate Katie Van Duinze. “Many other states and people were watching this.”

The bill received approval this summer from Lina Khan, chairwoman of the Federal Trade Commission, which is responsible for antitrust enforcement. More than a dozen other U.S. states, including red states like Indiana, have enacted merger review laws or are considering similar legislation this year.

Private equity investors have gained a huge foothold in the U.S. healthcare sector over the past decade, buying up $1 trillion worth of physician practices, hospitals, specialty clinics, and even hospice centers. California alone has $20 billion invested in private equity.

The bill, officially known as AB 3129, would require private equity and hedge fund-backed buyers of certain health care businesses to seek approval from the state attorney general at least 90 days before the transaction is scheduled to close. It required the Attorney General to do so, and gave the Attorney General the option of refusing. such a merger. The bill would also prohibit investor-owners from interfering with the professional medical judgment of health care providers, from dentists to psychiatrists, strengthening so-called medical law corporate practices.

This kind of power could change the playing field for regulators, who have little power to challenge mergers until an organization becomes large or shows anticompetitive behavior.

In response to a request for comment, the private equity lobbying group the American Investment Council directed the Guardian to a statement saying it “commends” Newsom's veto.

“Our coalition has worked hard to ensure that California's leaders recognize and support the critical role of private equity in improving California health care,” the statement said. “The Governor’s reasonable decisions will help ensure that our patients and communities continue to receive quality care.”

“We appreciate the authors' continued efforts and partnership to strengthen oversight of California's health care system,” Newsom said in a letter explaining his veto. But he argued that a recently created state agency should instead oversee health care integration. “For these reasons, I cannot sign this bill.”

Newsom is a key ally of Vice President Kamala Harris, who has a track record of critically examining the integration of these health care sectors. As California's attorney general, Harris intervened to block megamergers and oversaw settlements with major companies such as Quest Diagnostics Laboratories and medical supplies giant McKesson.

Private equity investing has come under special scrutiny this year after a series of investigations by the Boston Globe exposed patient humiliation at Steward Healthcare. At Steward, reporters, and now lawmakers, explained how investors extracted hundreds of millions of dollars from hospitals, even though many were short on staff and basic supplies. Documented.

In recent testimony before the U.S. Senate Health, Education, Labor, and Pensions Committee, one nurse said that hospitals are so stingy with “bereavement boxes,” containers specifically designed to hold infant bodies. He spoke in detail about the lack of.

“Stewards didn't pay the vendors and there was no memento box,” said Ellen MacInnis, Steward's former nurse, pausing to collect her emotions. “And the nurses were forced to put the infant's remains in a cardboard box for shipping.”

At the same time, academic research is beginning to reveal the possible disadvantages that such ownership structures pose to patients. Dr. Jirui Song, a professor of health policy at Harvard University and a general practitioner at the University of Massachusetts, says that patient care is “an inherently human endeavor, ideally one that involves a bond of trust between patient and clinician.” It is an essential art practiced in the world.” hospital.

Song was the lead author of a 2023 Jama study that looked at hospitals owned by private equity. The study looked at preventable injuries and illnesses among more than 662,000 people admitted to 51 private equity-backed hospitals. The researchers compared these lengths of stay with the length of stay of 4.1 million people at 259 control hospitals. All data comes from Medicare, the federal public health insurance program for people age 65 and older and people with disabilities.

Researchers found that accidents such as falls and infections of central lines (tubes inserted near the heart to deliver medicines, fluids, and nutrients) increased by more than 25%. This happened despite the fact that private equity-backed hospitals tend to serve more socio-economically advantaged patients.

“Complications should go down, but they're still going up,” Song says. Increasing fees and charges, another well-documented strategy used by companies to extract profits, is ultimately paid for by “society at large.” This is because health care is primarily funded by taxes and wages waived by employees who receive private insurance.

“While this bill was opposed on all counts, primarily by private equity interests, others who did not want their investment opportunities blocked were also on board,” said Rachel Lynn Gish, communications director for California Health Access. '' For example, state hospital associations opposed AB 3129 even after lawmakers exempted hospitals from oversight, Van Duinze said.

“Our argument has always been that we don't preclude private equity from acquiring hospitals and clinics,” Gish said. “All we want to do is make sure that we don't see reduced access and increased prices. If we continue to provide good, high-quality health care, we shouldn't face any problems. ”