Conversational AI In Healthcare Market Overview

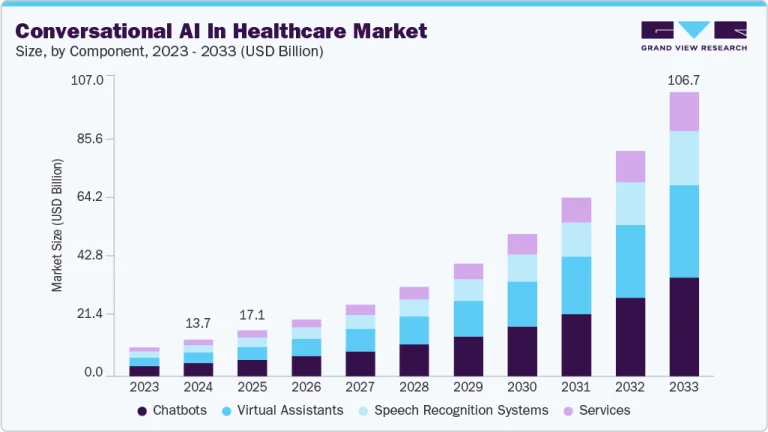

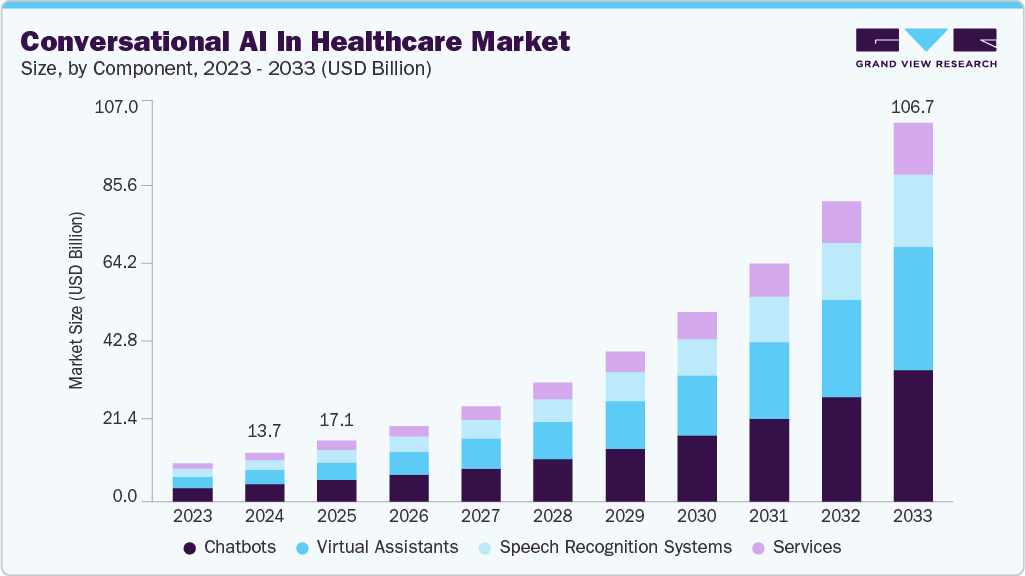

The global conversational AI in healthcare market size was estimated at USD 13.68 billion in 2024 and is projected to reach USD 106.67 billion by 2033, growing at a CAGR of 25.71%% from 2025 to 2033. Rising demand for improved patient engagement, increasing adoption of telehealth and remote care, and advancements in natural language processing (NLP) and AI technologies are significant factors contributing to market growth.

Key Market Trends & Insights

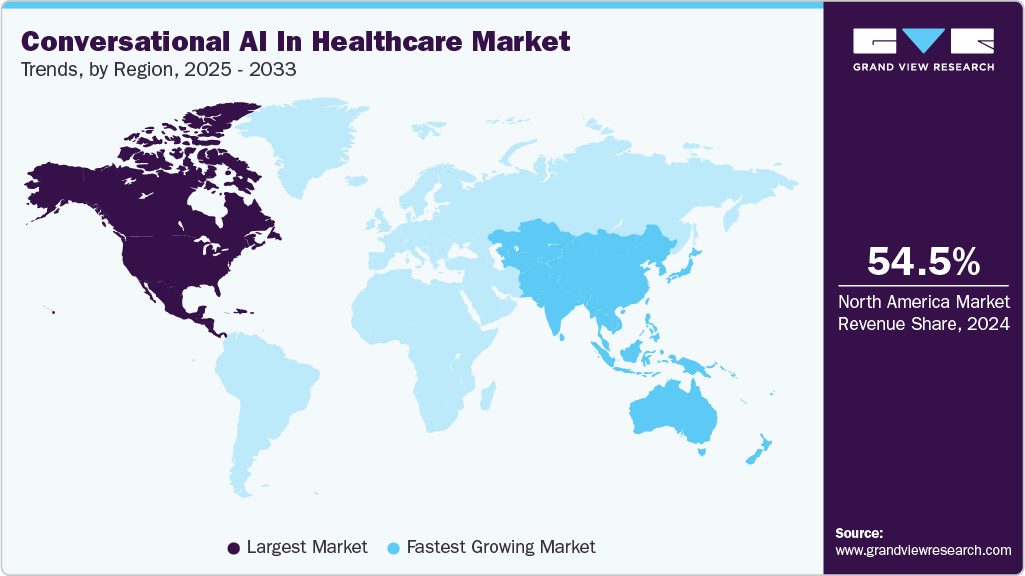

The North America AI in healthcare market accounted for the largest revenue share of 54.51% in 2024.

The U.S. conversational AI in healthcare industry held the largest revenue share in 2024.

The speech recognition & generation segment accounted for the largest revenue share of 30.84% in 2024.

The patient engagement & support segment accounted for the largest revenue share of over 29.51% in 2024.

Market Size & Forecast

2024 Market Size: USD 13.68 Billion

2033 Projected Market Size: USD 106.67 Billion

CAGR (2025-2033): 25.71%%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

In addition, cost efficiency & operational optimization, and automation of administrative healthcare workflows are some other factors fueling market growth further. The rapid adoption of telemedicine amplifies the need for conversational AI to support virtual patient interactions and care coordination. AI-powered chatbots enable symptom triage, follow-ups, and health education during remote consultations. Conversational AI enhances telehealth platforms by providing real-time assistance to patients and clinicians. Remote patient monitoring devices combined with AI-driven communication tools improve chronic disease management and adherence. The convenience and scalability of AI systems boost telehealth penetration globally.

Healthcare providers leverage conversational AI to maintain continuity of care and reduce hospital readmissions outside physical settings. Increasing demand for home-based and decentralized healthcare drives AI-enabled virtual care solutions. For instance, in April 2025, Belong. Life partnered with Equiva to integrate its conversational AI health mentors, Dave (cancer care expert) and Fred (general health and lifestyle coach), into Equiva’s in-hospital and home-based platforms. These AI companions provide real-time support by answering health questions, preparing patients for doctor visits, translating medical documents, guiding hospital discharge, and offering tailored emotional and behavioral coaching.

Furthermore, increasing adoption of voice-enabled AI assistants propels market growth. Voice-enabled AI assistants have transformed healthcare workflows by offering hands-free, real-time support for clinicians and patients. These AI tools streamline administrative tasks such as clinical note transcription, scheduling, and EHR retrieval. Voice assistants reduce provider workload, allowing more focus on patient care while minimizing errors and enhancing communication. For instance, in May 2025, SoundHound AI partnered with Allina Health to launch “Alli,” an AI agent designed to streamline patient engagement and access to care. Powered by SoundHound’s Amelia conversational AI platform, Alli integrates with electronic medical records to identify callers instantly, manage appointments, and support medication refills and provider searches.

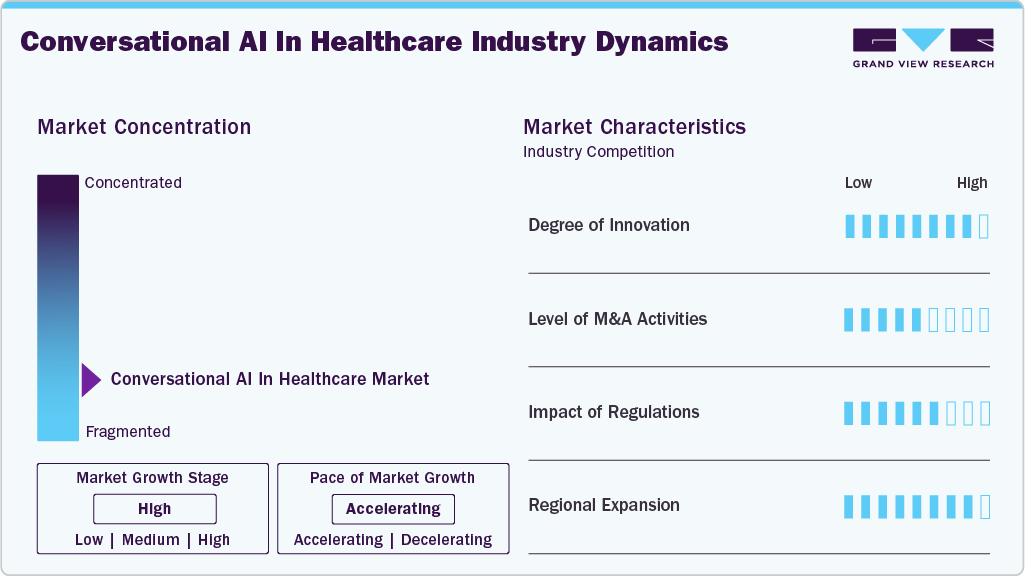

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The conversational AI in healthcare market is fragmented, with the presence of several emerging players entering the market. The degree of innovation is high. The level of merger & acquisition activities and the impact of regulations on the industry is moderate. The regional expansion of industry is high.

The conversational AI in healthcare industry experiences a high degree of innovation driven by technological advancements. The increasing adoption of artificial intelligence in smart health monitoring devices supports new innovations in the market.

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in January 2025, SuperDial acquired MajorBoost, a company specializing in conversational AI that automates calls to health insurers, to boost its voice AI solutions for healthcare providers in the U.S. This acquisition enhances SuperDial’s existing technology, helping healthcare organizations improve their operational efficiency significantly.

Regulations, such as the HIPAA in the U.S. and the GDPR in Europe, establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access.

The conversational AI in healthcare market is witnessing high geographical expansion. Companies within the conversational AI in healthcare industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. With the growing adoption of digital healthcare solutions, the market is expected to grow significantly in the coming years, especially in developing and underdeveloped countries. For instance, in August 2025, India’s first AI Bestie, What’s The Matter, Friend? (WTMF), announced the launch of a beta phase to redefine emotional support using conversational AI. WTMF offers personalized mental wellness assistance through empathetic, real-time conversations, addressing stigma and accessibility challenges in mental health care.

Component Insights

The chatbots segment held the largest market share of 35.66% in 2024. Chatbots enable patients to access medical information, schedule appointments, and receive real-time reminders without human intervention. Healthcare providers leverage these tools to reduce administrative burdens while improving accessibility and responsiveness. With natural language processing capabilities, chatbots can deliver personalized interactions, improving patient satisfaction.

In addition, chatbots are becoming integral to chronic disease management and preventive care by offering medication reminders, symptom tracking, and health education. For instance, in February 2025, the University Hospitals of Geneva (HUG) launched “confIAnce,” Switzerland’s first AI-powered medical chatbot, designed to provide reliable and verified general medical information to the public and healthcare professionals. It covers around 30 common chronic conditions, offering instant answers in multiple languages, alleviating burdens on primary care services.

Moreover, the virtual assistants segment is expected to grow at the fastest CAGR during the forecast period. Virtual assistants are able to handle more complex tasks than chatbots, such as guiding patients through care pathways, providing personalized health recommendations, and supporting clinicians with real-time information. Their integration with electronic health records and clinical decision support systems allows for more accurate, context-aware interactions. This capability reduces physician workload while improving patient engagement and adherence to treatment plans. Growing reliance on digital health ecosystems strengthens the demand for AI-enabled virtual assistants.

Technology Insights

The speech recognition & generation segment accounted for the largest revenue share of 30.84% in 2024 as providers focus on improving clinical documentation and patient communication. Speech recognition tools convert spoken language into structured clinical notes, reducing the administrative burden on healthcare professionals. The demand for accurate, real-time transcription and communication tools is driving adoption across hospitals, clinics, and telehealth platforms. In addition, advancements in natural language processing and AI models are enabling more accurate speech-to-text and text-to-speech solutions tailored for healthcare settings. Integration with electronic health records and diagnostic systems ensures seamless data flow, enhancing decision-making and care coordination. For instance, in October 2024, Oracle Health launched its Clinical AI Agent, a generative AI-powered, voice-activated assistant integrated with its Electronic Health Record (EHR) system, to reduce physicians’ documentation time.

The large language models (LLMs) and generative AI segment is anticipated to grow at the fastest CAGR from 2025 to 2033 due to its ability to process unstructured medical data and deliver context-aware insights. LLMs can synthesize clinical notes, research articles, and patient histories into actionable information, supporting evidence-based decision-making. Generative AI enhances patient interactions by delivering personalized explanations, treatment options, and educational content in natural language. The demand for advanced, adaptive AI models is propelling adoption in diagnostics, clinical support, and patient engagement.

Application Insights

The patient engagement & support segment accounted for the largest revenue share of over 29.51% in 2024. Conversational AI tools facilitate appointment scheduling, medication reminders, and follow-up care, ensuring patients remain actively involved in their treatment plans. In addition, conversational AI enables scalable patient education and chronic disease management through tailored guidance and symptom monitoring. By offering real-time support, conversational AI enhances accessibility for patients outside clinical settings. The focus on value-based care models further accelerates the adoption of patient-centric AI platforms.

The mental health support & therapy bots’ segment is projected to witness growth at the fastest CAGR from 2025 to 2033. Therapy bots are being integrated into broader mental health care strategies. They complement traditional therapy by offering continuous support between clinical sessions. Advancements in natural language processing enable these bots to deliver empathetic, context-aware responses, enhancing user trust and engagement. For instance, in July 2025, Slingshot AI launched Ash, an AI-powered therapy chatbot designed specifically for mental health, using clinical data and psychologist-designed prompts. The chatbot supports evidence-based therapies, including CBT, DBT, and ACT, offering 24/7 accessible, cost-effective mental health support, with safeguards to redirect users in crisis to human professionals.

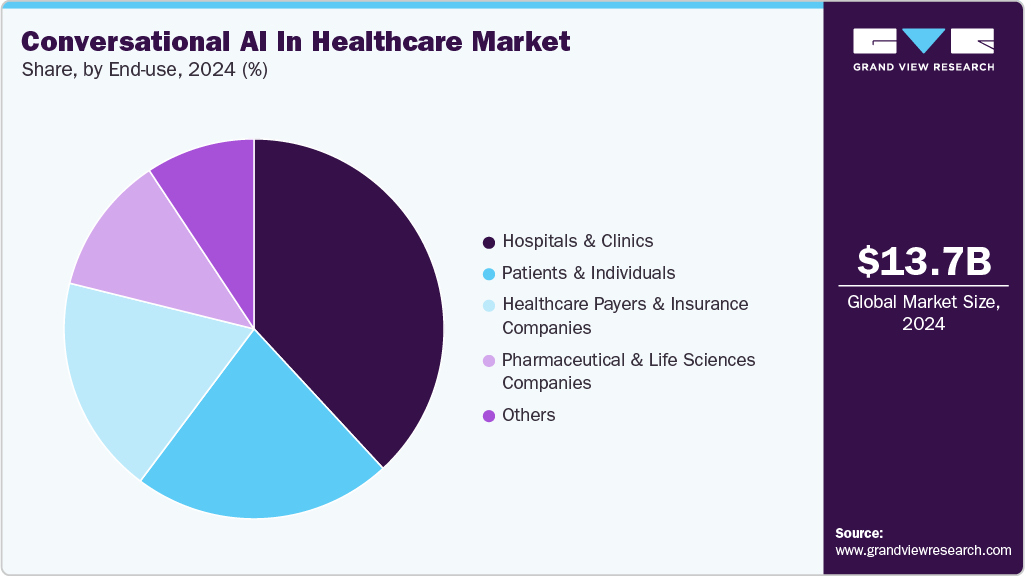

End Use Insights

The hospitals & clinics segment led the conversational AI in healthcare industry with the largest revenue share of 38.12% in 2024, due to the growing need to optimize clinical workflows and improve patient communication. Hospitals and clinics deploy conversational AI tools to manage appointment scheduling, triage patient inquiries, and streamline administrative tasks, reducing staff workload. In addition, hospitals and clinics are leveraging conversational AI to support telemedicine and remote care services, ensuring continuous communication with patients outside of physical visits.

Virtual assistants and chatbots assist clinicians with documentation, clinical decision support, and patient follow-ups, improving care coordination. For instance, in August 2025, Pieces Technologies launched “Pieces in your Pocket,” an advanced phone-based AI personal assistant for inpatient physicians that creates complete patient progress notes from 30-45 second voice interactions, cutting documentation time by 50%. It utilizes a deep understanding of the patient, prior notes, and physician style to generate accurate EMR notes.

The AI-driven chatbots and virtual assistants respond immediately to health-related questions, symptom checks, and lifestyle guidance. These tools empower patients to make informed decisions and actively manage their health. Their availability across smartphones and digital platforms enhances accessibility, especially in underserved regions. The growing preference for self-service healthcare solutions strengthens the adoption of conversational AI among individuals.

Regional Insights

The North America AI in healthcare market accounted for the largest revenue share of 54.51% in 2024. This is attributed to advancements in healthcare IT infrastructure, widespread adoption of AI/ML technologies, lucrative funding options, and the presence of several key players. Moreover, favorable government initiatives, a strong insurance sector, and the adoption of AI in this field propel market growth further.

U.S. Conversational AI in Healthcare Market Trends

The U.S. conversational AI in healthcare industry held the largest revenue share in 2024, due to the advancements in medical technology, robust healthcare infrastructure, and an increasing use of AI in clinical diagnostics, patient monitoring, patient engagement, and the insurance sector, among others. For instance, in May 2025, Limbic introduced the Limbic Intake Agent, an innovative voice AI tool designed to assist behavioral health organizations with patient intake processes. It offers on-demand conversational support and guided activities tailored to the prescribed treatment plan and the patient’s current condition.

Europe Conversational AI in Healthcare Market Trends

The Europe conversational AI in healthcare industry is expected to witness significant growth during the forecast period. This is attributed to the widespread adoption of AI technologies in healthcare and increasing investments by government and private organizations. Moreover, the European market experiences a significant degree of strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships and collaborations by industry players. For instance, in August 2025, the U.S.-based Healthcare Outcomes Performance Company (HOPCo) acquired Dutch startup Caro Health. Caro Health’s AI-driven patient engagement and operational tools were integrated into HOPCo’s expanding digital health platform, strengthening HOPCo’s presence in Europe and advancing AI-powered healthcare innovation globally.

“We have been hugely impressed with Caro’s thoughtful approach to integrating Conversational AI into complex clinical workflows. The Caro team has clearly demonstrated that, when partnering with physicians to combine best-in-class technology with deep clinical expertise, Conversational and Generative AI can enhance both patient experience and operational workflow. This enables both physicians and administrators to focus on delivering patient care.”

– said Dr Tom Harte, President of HOPCo Digital

The UK Conversational AI in healthcare market is expected to grow over the forecast period, owing to the robust healthcare infrastructure and increasing investments in AI technologies to enhance patient care, optimize operations, and tackle various healthcare challenges. For instance, in January 2025, the government introduced the AI Opportunities Action Plan, which includes the creation of AI Growth Zones and an investment of USD 9 billion in the coming five years.

The conversational AI in healthcare market in Germany held the largest revenue share in 2024, attributed to the increasing investments in healthcare technology and robust healthcare infrastructure. In addition, favorable government initiatives and insurance coverage, coupled with the expansion of telemedicine services, create a lucrative environment for the adoption of conversational AI to improve healthcare communication.

Asia Pacific Conversational AI in Healthcare Market Trends

The Asia Pacific conversational AI in healthcare industry is expected to grow at the fastest CAGR during the forecast period. Rapid healthcare digital transformation and the rising prevalence of chronic diseases drive market growth. Rising smartphone penetration enables broad adoption of AI-powered virtual health assistants and chatbots for triage and health coaching. For instance, in May 2025, Malaysia’s KPJ Healthcare Berhad deployed an AI-powered chatbot across 30 specialist hospitals to improve patient experience and service delivery. Built using IBM Watsonx.ai and Watson Discovery, the chatbot handles routine inquiries, appointment scheduling, and specialist details 24/7, employing deep learning, machine learning, and NLP to provide accurate and timely information.

India’s conversational AI healthcare market growth is driven by rapid digitalization and smartphone penetration, enabling widespread AI adoption. The government’s support for digital health initiatives and telemedicine expansion enhances access to conversational AI solutions. For instance, the UNICEF DISHA chatbot uses AI-powered digital agents to support comprehensive primary health care in India by providing accessible health information, guidance, and services. Moreover, private sector investments and AI research collaborations further stimulate market innovation.

The conversational AI in healthcare market in Japan is expected to grow significantly over the forecast period. Increasing demand for personalized healthcare solutions and the growing adoption of artificial intelligence in healthcare contribute to market growth. In addition, technological advancements and growing government support and initiatives further fuel market growth.

Latin America Conversational AI in Healthcare Market Trends

The Latin America Conversational AI in healthcare industry is anticipated to grow at a significant CAGR over the forecast period. This is attributed to the growing awareness about AI technologies, increasing government spending, and growing advancements in healthcare infrastructure.

Middle East and Africa Conversational AI in Healthcare Market Trends

The Middle East and Africa Conversational AI in healthcare industry is expected to grow at a significant CAGR over the forecast period. The market is characterized by a dynamic landscape driven by the growing adoption of smart medical devices, increasing healthcare expenditures, and supportive government policies. Significant integration of AI in healthcare technology across the region contributes to market growth further. For instance, in April 2025, Scale AI collaborated with the Qatar government to develop AI agents for healthcare. This deal includes developing AI voice, chat, and email agents for contact centers.

Key Conversational AI In Healthcare Company Insights

Key players operating in the conversational AI in healthcare market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key Conversational AI In Healthcare Companies:

The following are the leading companies in the conversational AI in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

Rasa Technologies Inc.

Corti

Enlitic, Inc.

IBM

UST

Authenticx

LivePerson

Hyro

Notable

Oncora Medical.

NVIDIA Corporation

Mediktor

Nuance (Microsoft)

Fireflies

Abridge Al, Inc.

Babylon Health

Agora

Google

Recent Developments

In June 2025, Wysa launched Wysa Gateway in the U.S., an AI-powered chatbot designed to streamline mental health patient intake by automating clinical screenings.

In May 2025, OpenXcell launched MediMind, an intelligent AI healthcare chatbot designed to enhance medical care. MediMind supports patients by analyzing symptoms, providing personalized health management plans, and connecting users to healthcare providers. It offers 24/7 accessible support through voice, text, or images, emphasizing data privacy with HIPAA and GDPR compliance.

In February 2025, VoiceCare AI launched a pilot program with the Mayo Clinic to automate back-office operations using AI voice agents’ technology.

“With voice AI, the technology has leapfrogged so much that they are very conversational in nature and can handle conversations that are simple and medium complexity. When you’re making a transactional call, it has clear inputs and clear outputs. When you call an insurance company, you are verifying somebody’s insurance verification, or you’re doing prior auth.”

-Parag Jhaveri, founder and CEO of VoiceCare AI

In November 2024, Rogers Behavioral Health partnered with Limbic to deploy Limbic Access, an AI-powered virtual assistant that screens prospective mental health patients and navigates them into care pathways. The 24/7 chatbot provides a stigma-free, personalized screening experience and is 93% accurate in identifying presenting issues.

In June 2023, DocPlix launched Pāṇini, an advanced AI-powered medical chatbot developed by doctors for doctors, designed to enhance clinical decision-making.

In July 2021, the Novo Nordisk Education Foundation (NNEF) launched Mishti, a WhatsApp chatbot providing diabetes management education to India’s 77 million diabetes patients.

Conversational AI in Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.10 billion

Revenue forecast in 2033

USD 106.67 billion

Growth rate

CAGR of 25.71% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Rasa Technologies Inc.; Corti; Enlitic, Inc.; IBM; UST; Authenticx; LivePerson; Hyro; Notable; Oncora Medical; NVIDIA Corporation; Mediktor; Nuance (Microsoft); Fireflies; Abridge Al, Inc.; Babylon Health; Agora; Google

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Conversational AI In Healthcare Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global conversational AI in healthcare market report based on component, technology, application, end use, and region:

Component Outlook (Revenue, USD Million, 2021 – 2033)

Technology Outlook (Revenue, USD Million, 2021 – 2033)

Speech Recognition & Generation

Natural Language Processing (NLP) & Understanding (NLU)

Machine Learning & Deep Learning Models

Large Language Models (LLMs) & Generative AI

Dialogue Management & Orchestration

Others

Application Outlook (Revenue, USD Million, 2021 – 2033)

Patient Engagement & Support

Mental Health Support & Therapy Bots

Medical Diagnosis & Clinical Decision Support

Remote Patient Monitoring

Telemedicine & Virtual Consultations

Administrative & Workflow Automation

Pharmaceutical & Drug Information Assistance

Medical Training & Education

Others

End Use Outlook (Revenue, USD Million, 2021 – 2033)

Regional Outlook (Revenue, USD Million, 2021 – 2033)

North America

Europe

Germany

UK

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

China

Japan

India

South Korea

Australia

Thailand

Latin America

MEA

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b. The global conversational AI in healthcare market size was estimated at USD 13.68 billion in 2024 and is expected to reach USD 17.10 billion in 2025.

b. The global conversational AI in healthcare market is expected to grow at a compound annual growth rate of 25.71% from 2025 to 2033 to reach USD 106.67 billion by 2033.

b. The chatbot segment held the largest market share of 35.66% in 2024.

b. Some key players operating in the conversational AI in healthcare market include Rasa Technologies Inc.; Corti; Enlitic, Inc.; IBM; UST; Authenticx; LivePerson; Hyro; Notable; Oncora Medical; NVIDIA Corporation; Mediktor; Nuance (Microsoft); Fireflies; Abridge Al, Inc.; Babylon Health; Agora; Google.

b. Key factors that are driving the conversational AI in healthcare market are rising demand for improved patient engagement, increasing adoption of telehealth and remote care, and advancements in natural language processing (NLP) and AI technologies. In addition, cost efficiency & operational optimization and automation of administrative healthcare workflows are some other factors fueling market growth further.