Market Size & Trends

The global activated carbon for pharma & healthcare market size was estimated at USD 450.1 million in 2024 and is expected to expand at a CAGR of 6.3% from 2025 to 2030. Its exceptional purification and adsorption properties propel the rising demand for activated carbon in the pharmaceutical and healthcare sectors. It plays a crucial role in applications such as air and water purification in hospitals and pharmaceutical manufacturing, as it eliminates impurities and decolorants from medications.

The growing demand for activated carbon in the healthcare sector is closely linked to the high incidence of hospital-acquired infections (HAIs) in the U.S. Each year, around 1.7 million inpatients-roughly one in every 20-contract an HAI, with 5%-10% of hospitalized patients affected and nearly 100,000 resulting deaths. These alarming figures surpass the incidence and mortality rates of many other reportable diseases, highlighting the urgent need for advanced air and water purification solutions Activated carbon, known for its effective filtration and adsorption capabilities, is increasingly being adopted to help maintain sterile environments and reduce the risk of infection in medical facilities.

Furthermore, their demand is driven by their essential role in decolorization and purification. Its highly porous structure, enhanced through thermal activation, allows for efficient impurities, pigments, and dyes adsorption. This improves product quality, safety, and appearance . Activated carbon is widely used during production to trap unwanted substances, ensuring cleaner, more effective drugs. The industry’s increasing R&D investments further fuel the need for high-performance purification solutions such as activated carbon. These factors fuel the demand for activated carbon for the pharma & healthcare industry.

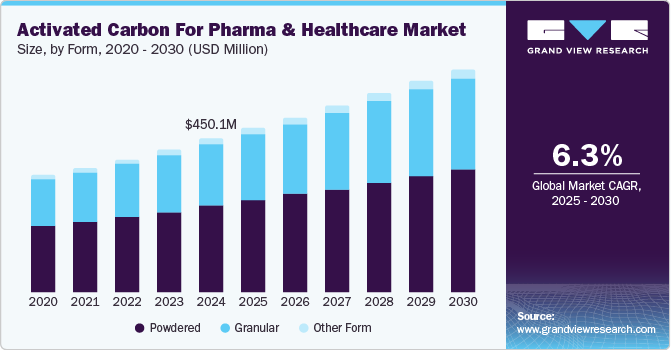

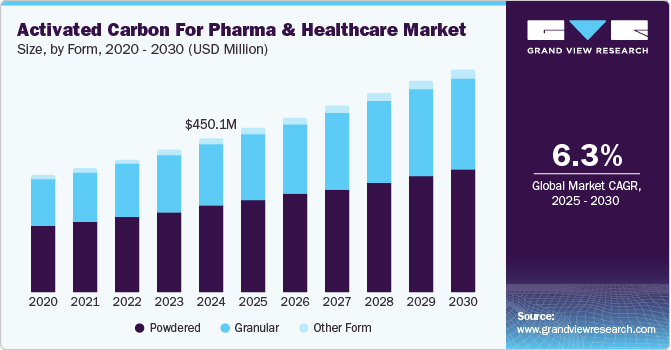

Form Insights

The powdered form dominated the activated carbon for the pharma & healthcare market with the largest revenue share of 56.3% in 2024. Powdered Activated Carbon (PAC) has proven effective in reducing pharmaceutical compounds in wastewater, with a 63-84% reduction in discharged carbamazepine and diclofenac at dosing levels of 10-25 mg/L. PAC is an essential tool for controlling pharmaceutical contaminants in municipal wastewater treatment. It also enhances sludge quality, increasing the dry weight by +1% while limiting the sludge production increase to 7-9%, contributing to more efficient waste management

The granular activated carbon segment is expected to grow at the fastest CAGR of 6.9% over the forecast period. The granular form is increasingly preferred by pharma and healthcare companies owing to its key properties, such as superior absorption, ease of handling and storage, and regeneration capacity. The ability of granular activated carbon to withstand the repeated cycles of filtration primarily drives the growing adoption. Increasing collaborations and supply contracts among market participants also contribute to the growth experience of this segment. In 2024, Arq, Inc., one of the key manufacturers of Granular Activated Carbon (GAC), announced that it secured multiple supply contracts for its GAC product, mainly designed for processes associated with raw material purification.

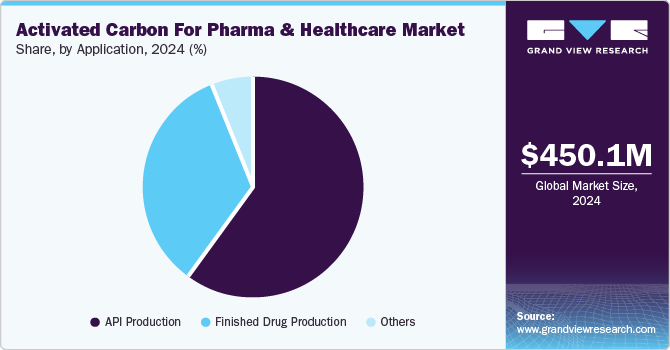

Application Insights

The API production dominated the activated carbon for pharma & healthcare industry with the largest revenue share in 2024. During API production, which is the key component of medicines, responsible for their therapeutic effects, activated carbon helps remove impurities, decolorization, pH adjustment, stability, prevent contamination, and enhance product quality. The pharmaceutical industry is one of the most rapidly evolving sectors worldwide, with active pharmaceutical ingredients playing a central role.

The finished drug production segment is expected to grow significantly over the forecast period. Activated carbon plays a key role in pharmaceutical wastewater treatment, removing residual drugs and contaminants to ensure environmental compliance after drug production.

Regional Insights

The activated carbon for pharma & healthcare market in Asia Pacific dominated the global market with the largest revenue share of 48.6% in 2024. The demand is rising due to rapid industrialization and urbanization. Increased pharmaceutical production in Asian countries further drives the need for efficient purification. Leading companies such as Takeda Pharmaceutical Company Limited, Sun Pharmaceutical Industries Ltd., and Cipla contribute significantly to this demand, using activated carbon in various drug manufacturing and filtration processes.

China Activated Carbon For Pharma & Healthcare Market Trends

The activated carbon for pharma & healthcare market in China dominated the Asia Pacific market with the largest revenue share in 2024. China’s expanding pharmaceutical and healthcare sectors fuel demand for activated carbon, essential for purifying APIs and intermediates in drug production. Since 2021, the industry has grown at an average annual rate of 9.3%, driven by the 14th Five-Year Plan, according to the Ministry of Industry and Information Technology. Strict environmental regulations on pharmaceutical emissions and waste management have increased the use of activated carbon for air and water purification. In addition, activated carbon tablets and capsules are widely used in hospitals and pharmacies to treat poisoning, indigestion, and flatulence.

North America Activated Carbon For Pharma & Healthcare Market Trends

The activated carbon for pharma & healthcare market in North America held a substantial market share in 2024. The growing pharmaceutical manufacturing industries and advancements in cleaner healthcare sectors are driving the market demand. Furthermore, it is used to treat over-the-counter stomach issues, which are continuously increasing according to the American Gastroenterological Association (AGA). In 2022, it was reported that 60-70 million Americans were suffering from gastrointestinal diseases . In addition, North America accounted for 49.1% of global pharmaceutical sales in 2021, indicating the region’s dominant position in the global pharma market, accelerating the demand for activated carbon.

The U.S. activated carbon for pharma & healthcare market led the North American market, accounting for the largest revenue share in 2024. The growing demand is driven by several key factors, such as increasing regulatory pressures from agencies such as the FDA, along with stricter environmental guidelines, which are pushing companies to adopt higher standards of purity and filtration in drug manufacturing. Activated carbon meets these standards by removing impurities from active pharmaceutical ingredients and intermediates. Its medical applications, particularly in treating drug overdoses, have become increasingly vital, highlighted by the 105,007 overdose deaths reported in 2023 . Rising environmental and health awareness also encourages cleaner and more sustainable production practices in the healthcare sector.

Europe Activated Carbon For Pharma & Healthcare Market Trends

The activated carbon for pharma & healthcare market in Europe held a substantial market share in 2024. The increasing demand is largely driven by its expanding use across various industries, including pharmaceuticals. In 2022, the pharmaceutical sector invested over USD 53.5 million in R&D in Europe. Furthermore, the growing digestive disorder in the region is a major driver for activated carbon, as it helps manage certain symptoms. According to a report from United European Gastroenterology (UEG), in 2023, over 332 million people are estimated to be living with a digestive disorder in the region.

Key Activated Carbon For Pharma & Healthcare Company Insights

Some major companies in the activated carbon for pharma & healthcare industry are Osaka Gas Chemicals Co., Ltd., Calgon Carbon Corporation, JACOBI CARBONS GROUP, and Cabot Corporation. These companies focus on innovating purification technologies, ensuring compliance with stringent regulatory standards, and expanding product applications. They focus on high-quality, efficient solutions for pharmaceutical manufacturing, wastewater treatment, and medical uses such as poisoning treatments. Strong R&D investments and strategic partnerships with leading pharma companies also help sustain growth.

Osaka Gas Chemicals Co., Ltd. produces materials such as activated carbon, carbon fiber, fine chemicals, and wood preservatives. The company serves various industries, including pharmaceuticals, electronics, and environmental sectors, and it focuses on innovation and sustainability in its product offerings and operations.

Calgon Carbon Corporation manufactures coal, wood, and coconut-based activated carbon products in granular, powdered, pelletized, and cloth forms.

Key Activated Carbon For Pharma & Healthcare Companies:

The following are the leading companies in the activated carbon for pharma & healthcare market. These companies collectively hold the largest market share and dictate industry trends.

Jacobi Group

Chemviron (a Kuraray Company)

Haycarb PLC

Boyce Carbon

Southern Carbon Pvt. Ltd.

Suneeta Carbons

Calgon Carbon Corporation

Karbonous Inc.

Norit

Donau Carbon GmbH

Recent Developments

In February 2025, JACOBI CARBONS GROUP announced that a 15-20% price increase would be implemented from April 2025 on all coconut shell-based activated carbons. A recent surge in raw material costs necessitated the adjustment.

In December 2024, CPL/Puragen Activated Carbons, ADBA members, won the Energy Innovation award at the MRW National Recycling Awards 2024 for their breakthrough in reactivating high-sulfur spent carbon from the biogas sector-a previously untreatable waste.

Activated Carbon For Pharma & Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 479.7 million

Revenue forecast in 2030

USD 652.1 million

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 – 2023

Forecast period

2025 – 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Jacobi Group; Chemviron (a Kuraray Company); Haycarb PLC; Boyce Carbon; Southern Carbon Pvt. Ltd.; Suneeta Carbons; Calgon Carbon Corporation; Karbonous Inc.; Norit; Donau Carbon GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Activated Carbon For Pharma & Healthcare Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global activated carbon for pharma & healthcare market report based on form, application, and region:

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2030)

Powdered

Granular

Other Form

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2030)

API Production

Finished Drug Production

Others

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2030)