Minneapolis (FOX 9) – According to hundreds of complaints reviewed by Fox 9 investigators, Minnesotan, who used long-term care insurance to plan payments for nursing homes and other long-term care, has instead faced patterns of delays, denials and inappropriate communication.

Hundreds of complaints against insurance company Transamerica

Why should you care:

Tens of thousands of Minnesotans purchased long-term care insurance in the 1990s and 2000s. The attractive benefits were provided through several of the state's largest companies, including 3M, Wells Fargo and Mayo Clinic. It was also provided through county and state employees and teachers' unions.

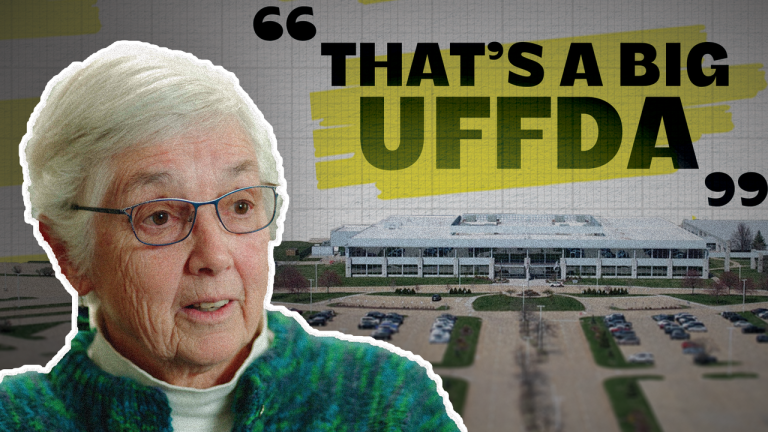

Carol and her husband retired from education in 2002 after purchasing long-term care insurance from TransAmerica.

“We wanted to be relieved,” said Carol, who doesn't want to share her last name because of fear of retaliation from the insurance company.

“We just wanted to make sure it didn't put any strain on others.”

When her husband was diagnosed with Alzheimer's and moved to a living aid facility, Carol believed her insurance would cover the costs of care. Instead, Carol told Fox9 investigators she faced a “terrifying” process that included claims of delays and rejection that continued after her husband's death.

“I think the biggest themes are delays, delays, delays,” said Elizabeth Udell, an attorney who helps policyholders like Carroll navigate the claims process.

Wrobel described the process as “confusing” and “complicated.”

What they are saying:

Hundreds of complaints filed against Transamerica have been reviewed by Fox 9 investigators, detailing patterns of frustration.

“Even when I'm still writing this, I collapse,” one writes about a multi-billion dollar Iowa-based company. “This put me in serious financial difficulties.”

Transamerica was previously fined $600,000 by the state after a surge in complaints.

“It was simply focusing on handling the claims,” said Jacqueline Olson, deputy commissioner of the Minnesota Department of Commerce.

However, despite changes to the mandated order, complaints against the company continued to grow.

One wrote about her experiences with Transamerica on behalf of her parents, complaining, “There's no way for seniors to navigate this bottomless pit… Please help.”

Critics say TransAmerica is “crying” while raising premiums nationwide

The other side:

A TransAmerica spokesman ignored the interview request but provided a statement saying, “The client is our number one priority.”

However, during an investor presentation by parent company Aegon, the company highlighted its efforts to significantly raise costs for these consumers.

“Transamerica is taking several actions to strengthen its capital position, achieving additional long-term care rates,” said Aegon CEO Lard Friese.

Financial records reveal the company's plans to raise premium fees across the US.

Other insurers have also requested significant fee hikes in recent years, leading to claims that they are trying to drive people out of policies they have paid their premiums for years.

“I think businesses are always crying poor and poor, and someone else is expected to pay the price,” Wrobel said.

Dive deeper:

Policy holders can file a complaint against a company like Transmamerica if they feel their claims are wrongly denied or falsely denied. But that's about it.

Minnesota law now prevents people from suing insurance companies if they act maliciously.

Repeated efforts to lift insurance companies' exemptions have been blocked by the Minnesota Legislature's insurance industry.

“I don't think the lawsuit here is the answer,” said Robin Lowen of the Minnesota Insurance and Financial Services Council during a 2024 legislative hearing. “Insurers need to maintain their commitments and the majority need to do so.”

What's next:

Minnesota Rep. Kelly Mueller (DFL -Shoreview) said she continues to hear from constituents about what she calls “predatory” practices and is working on new laws.

“We're looking at putting this in the Consumer Fraud Act instead, and hopefully reduces concerns that this is something like a slippery slope for all insurance companies,” Rep. Mueller said.

“It's not fair to deny this report to them at the most vulnerable period of their lives.”

What you can do:

If you are facing problems with your insurance provider, you can file a complaint with the state Department of Commerce.

File a complaint: https://mn.gov/commerce/consumer/file-a-compraint/

Source: FOX 9 investigators have reviewed hundreds of complaints filed with the Minnesota Department of Commerce. Financial information was obtained from investor presentations by Transamerica's parent organization.

Health CareInvestigatorsminnesota