What happens if someone is arrested and charged with a crime?

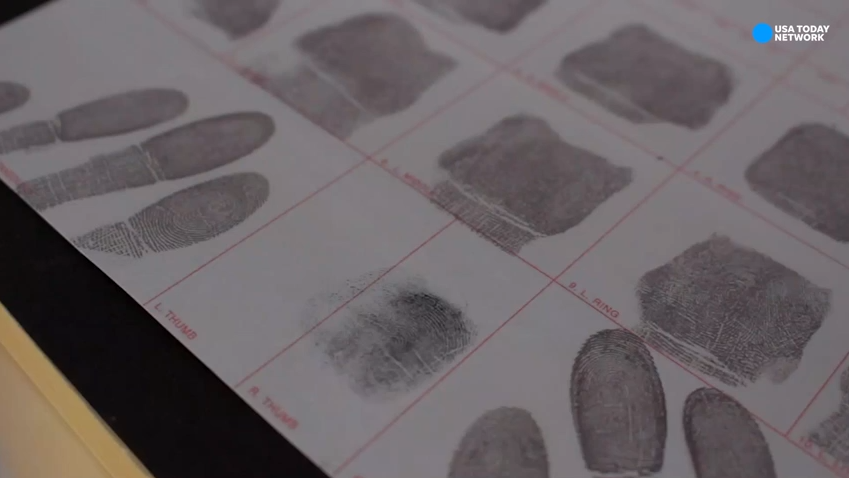

When someone is arrested and charged with a crime, the police department observes protocols that include reading Miranda's rights.

Joseph Schwartz originally owned and operated Skyline Management Group LLC, which was headquartered in Woodridge.

The New York man was sentenced to 36 months in a role in a $38 million employment tax fraud scheme that included nursing homes owned in 11 states, including New Jersey, U.S. lawyer Alina Haba said.

Joseph Schwartz, 65, of Suffern, New York, pleaded guilty before District Judge Susan D. Whitenn of Newark to intentionally failing to submit an annual Form 5500 financial report for the 401(k) plan, due to intentionally failing to pay employment tax withheld from an employee of his company. Schwartz owned and operated Skyline Management Group LLC, originally headquartered in Wood-Ridge, and operated healthcare and rehabilitation facilities nationwide. New Jersey had three nursing homes: North Bergen, East Orange and Voorhees.

Prosecutors said Schwartz withheld employment taxes from employees from October 2017 to May 2018, but failed to transfer more than $38 million to the IRS. Court documents say Schwartz is said to prohibit such lapses, but intentionally ignored his obligation to file a 2018 Form 5500 financial report with the Ministry of Labor.

In the announcement of this ruling, Haba praised the special agent of the IRS-Criminal investigation under the direction of a special agent responsible for Jennifer Piovasan. Investigators from the Ministry of Labor and the Employee Welfare and Security Administration, under the direction of Regional Director Mark Seidel. Under the direction of a special proxy agent in charge of Terence G. Reilly, a special agent of the FBI. and the Generals Bureau of the Ministry of Health and Human Services, under the direction of a special agent responsible for Naomi Gruchatz for the investigation effort.

Newark's Criminal Division Daniel H. Rosenblum and Kendall R. Randolph represented the government in the case along with trial counsel Sean Nord, of the Department of Justice's Taxation Department. Schwartz's lawyer could not immediately comment.