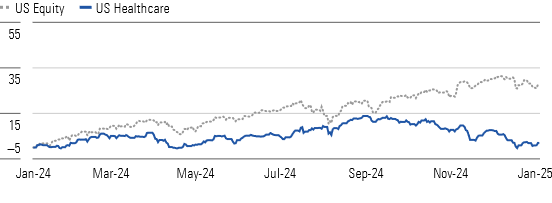

Over the past 12 months, overall U.S. stocks outperformed the Morningstar US Healthcare Index by more than 25 percentage points. The sector's more defensive nature likely led to underperformance at the start of the year and outperformance in the third quarter as recession fears waxed and waned, but the fourth quarter's slowdown was primarily due to the post-election period. It involved uncertainty and disappointing news for large biopharma and biopharmaceutical companies. Healthcare plan (managed care) stocks.

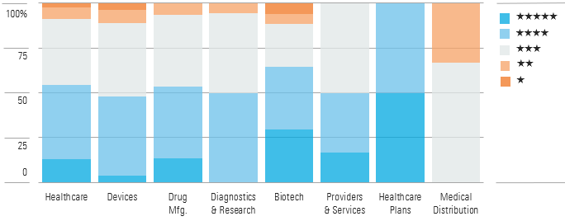

After a challenging fourth quarter, we believe the entire healthcare sector is undervalued, with a median discount to our fair value estimates of more than 10%. Medical distribution stands out as the only overvalued industry, while plans and biopharmaceuticals appear to be the most undervalued.

Despite heightened uncertainty surrounding health care policy under the incoming Republican administration, we expect the more defensive nature of the sector to continue to support it should economic concerns arise. In the biopharmaceutical industry, the market has undervalued innovation beyond obesity leaders Eli Lilly LLY and Novo Nordisk NVO. We believe new government leadership is unlikely to cause significant new approval or pricing headwinds in the biopharmaceutical industry, which is undergoing Medicare reform as part of the Anti-Inflation Act. In the managed care space, we believe stocks appear undervalued even if policy reforms are part of a more bearish scenario under a new Republican-led administration. Device and diagnostic valuations are still stabilizing after falling from an overly optimistic period at the peak of the COVID-19 pandemic.

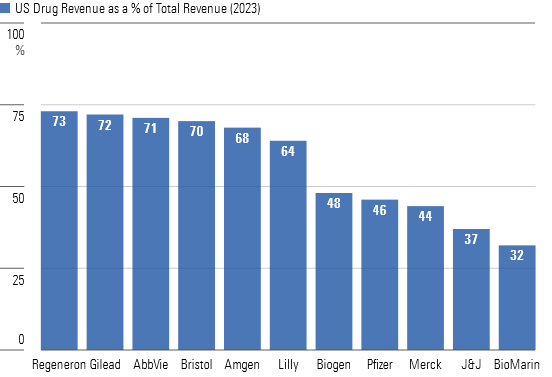

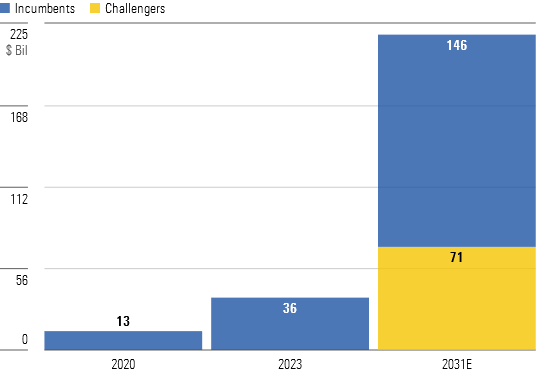

Trump's victory in the US presidential election and Republican control of Congress could put pressure on growth in the US healthcare sector, with most global biopharmaceutical companies having significant exposure in the US. However, it seems unlikely that major reforms will take place. We continue to believe that Novo and Lilly will dominate the potentially $200 billion GLP-1 market by 2031. But near-term growth concerns and mixed data on Novo's next-generation drug, Kaglisema, have dragged down the shares of both companies, leaving the door open for the future. challengers.

Hot stocks in the healthcare field

baxter international

Increased medical usage has improved demand across most of Baxter's BAX medical supply businesses, and new products like the Novum IQ pump platform could drive growth. Baxter also represents improving margins, as most of the inflation problems in the supply chain are easing. Additionally, a major new group purchasing organization agreement is scheduled to go into effect this year, which should help increase product prices. The long-awaited sale of the kidney care division was completed at a low price, and related costs are expected to weigh on margins slightly through 2026, but management's focus on growth and margins in the remaining business should push up the stock price. I expect it to be possible.

CVS Health

CVS CVS stock continues to decline at our fair value estimate due to market concerns surrounding its Medicare Advantage business and the potential for new regulatory headwinds (particularly for its Pharmacy Benefit Management business) with Republicans in power in 2025. It is trading at a steep discount. However, we believe there is room. The company should benefit from the return of star rating-related bonus payments after a disastrous 2024, and we think Medicare Advantage margins should improve starting in 2025. Even some of the most negative regulatory scenarios, where approval seems unlikely, are undervalued. Overall, CVS stock trades at just 8 times its depressed 2024 earnings, and the company's dividend yield is around 6%, so if new management can lead a turnaround, the stock could rebound significantly. I think it is possible.

moderna

Moderna's mRNA investors likely got too excited about the company's mRNA technology's potential during the pandemic and then became too bearish on post-pandemic growth. Although there is some hope for sales of the company's COVID-19 vaccine following massive demand from the pandemic in 2021 and 2022, Moderna's pipeline of mRNA-based vaccines and therapeutics remains We believe that rapid progress is being made in the field of treatment. Despite competition in the RSV vaccine market clouding the near-term outlook, we remain confident in the long-term sales trajectory of the company's diversified pipeline.