Welcome back to the annual Hospitalogy Soothsayer Special! As is customary practice at this point, Parth Desai and I have been brainstorming over the past several weeks about where healthcare is headed in the new year.

Based on discussions with industry folks, market signals buried in earnings and disclosures, and our often misguided internal dialogues, here are some of our predictions for healthcare in 2025.

Have questions or want to get in touch with Parth? E-mail (email protected). Have any of your own predictions or thoughts for the piece? Shoot ‘em over to me at (email protected).

AI’s Resurgent Debut in Healthcare’s Front Office

Back-office AI was the talk of 2024. With large language model (LLM) advancements powering substantially better product experiences, we saw scribing, revenue cycle management and service operations tools scoop up massive funding rounds and enterprise budgets. In 2025, we think this continues and is followed by a surge in funding for clinical AI solutions.

Of course, we had to use an AI-generated image of AI transforming healthcare

The cost and complexity of processing unstructured clinical data, combined with low risk tolerance, have historically limited the adoption of clinical AI products. Fortunately, LLMs excel at more accurately interpreting unstructured / multi-modal data, and the cost of compute is decreasing. This sets the stage for AI to create more value in clinical workflows. While physician and patient sentiment suggests that we have much to solve before AI meaningfully impacts live clinical workflows, there are a multitude of retrospective or offline clinical workflows that AI can begin to impact today.

Clinical registry abstraction is an arena that is particularly ripe for disruption. LLMs are now saving nurses and clinicians almost 3x more time by converting unstructured medical data into the outcomes data required in registry fields. This is a low-impact, retrospective clinical workflow with rich data insight that can inform a multitude of derivative clinical decisions. In 2024, we also saw meaningful progress in Radiology. Clinical imaging was already a high-value AI target given that 75% of the medical device and software products approved by the FDA since 2014 have been for Radiology. And AI can now combine context from imaging and non-imaging clinical datasets to guide better decisions. Some of us are optimistic that we’ll even start to see the first clinical AI assistants deliver encounters or shape live care experiences in 2025. Just look at RadNet – with their new DeepHealth subsidiary the diagnostic imaging player is shooting for a SaaS multiple!

Capital Markets Thaw…then Superheat

With stable interest rates and a new business-friendly FTC head in place, healthcare’s money and capital markets activity will begin to thaw. Earlier in 2024, I (Blake) dubbed this year the Russian Winter of M&A.

We watched as provider organizations underwent significant portfolio realignment, with health systems restructuring care delivery assets around core markets—Ascension and Tenet leading the charge with portfolio divestitures. Now, as hospitals and health systems enter their most stable post-pandemic operating environment yet, high-performing players are poised to make opportunistic purchases.

These market leaders will acquire both acute care hospitals and complementary services to achieve their transformation goals. In doing so, they’ll widen the performance gap against struggling competitors by building market density and growing their outpatient business. Even HCA—the longtime king of the inpatient model—made notable commentary about the importance of having a dense outpatient network to complement their inpatient facilities. Currently, HCA operates 13 outpatient facilities per hospital, a number they plan to increase to 17-20 by 2030.

On the private equity (PE) side of things, as liquidity re-appears, we should see multiple effects:

PE firms will sell healthcare delivery assets they’ve been stuck with for years, particularly in the practice management space (assuming they can stomach the valuation delta) or we’ll see IPO attempts among this cohort. (US Radiology is ready for an exit, let me tell you guys);

PE firms will look to roll up the maturing digital health ecosystem, and VC will gladly exit to the financial vehicle, resulting in consolidation and fewer point solutions for CIOs to deal with. In general, PE is knocking on the door of many VC backed assets as they architect roll up strategies and get their companies ready to tell a 2026 IPO story.

Relatedly, well-capitalized strategic players will look to roll up digital health assets to similar ends. For instance, Commure completed its merger with ambient player Augmedix in October, then care navigation player Memora today, and can now sell a more comprehensive portfolio of solutions into health systems. Given that AI scribing is a physician recruitment and retention priority for hospitals, and given the fierce competition in that market relative to capital availability, this may be a particularly hot M&A market in 2025.

Finally, some IPOs will happen. More comps! With rumors around an IPO for Omada Health and expectations for drug distributor Medline to go public as well, we will likely see at least a handful of public market entrants. Hopefully, we’ll see some more solid unit economics (and valuations) for those trying their luck in the digital health 2.0 batch. Personally I (Blake) would love to dive into some S-1 breakdowns!

Patients Retake the Pharmacy

Public health data suggests that Americans are getting sicker, sooner, and underutilizing primary and preventative care resources. Maybe this can be attributed to a heightened mistrust in public health. Regardless, when combined with cost growth and uncertainty around the next administration’s insurance coverage policies, it’s clear that the way in which we’re engaging and caring for patients needs to change. In 2025 we believe the healthcare ecosystem will cave to consumer pressure, testing radical new engagement methods out in an effort to regain their trust. The pharmaceutical value chain will be the first target.

Unprecedented medical cost growth has been driven by drug spend. However, the entities that govern how drugs are covered and dispensed haven’t been incentivized to curtail this growth. We know different coverage options (ie, OOP, insurance, discount card) have vastly different costs, but we also haven’t given patients the shoppable experience they need to make a lower cost choice. This is changing as top-down pressure grows to break up PBMs and create a more transparent and affordable experience. Meanwhile, a surge of interest in consumer wellness is creating bottom-up pressure for manufacturers and retailers to engage patients differently.

These convergent tailwinds are already catalyzing disruption. For example, in response to GLP-1 demand, Eli Lilly launched a direct-to-patient initiative in 2024, offering Zepbound directly (and via Ro) for half its list price. Pfizer followed suit, also promising accessibility and savings. Hims & Hers stock has been soaring this year, as patients flock to the platform for cheaper, compounded GLP-1s. And late this year, Amazon Pharmacy began accelerating its efforts to bring lower-cost medications to patients with a geographic and programmatic expansion. Meanwhile, Mark Cuban’s Cost Plus Drug Company has begun manufacturing its own low-cost and generic drugs to give patients more affordable choice. In 2025, we expect even bolder patient-centric initiatives to emerge, including new discount subscription programs and a focus on lower-cost specialty drug access programs beyond GLP-1s.

The Longevity and Wellness Boom Cycle is Here

The Longevity Boom is here.

We saw several longevity startups funded in 2024, and also some interesting partnerships crossing the chasm between wearable technology and traditional medicine. One such wearable company making inroads was Oura – notching a partnership with Essence Healthcare, an MA plan, and also integrating with Dexcom. Full-body MRI players like Prenuvo and Ezra are gaining steam (with Prenuvo facilitating its 100,000th scan in 2024), finding ways to drive more efficiencies in MRI scan time along with possible insights into early development of chronic disease.

Beyond these moves, other factors are at play leading to a boom in longevity medicine slowly working its way into healthcare:

At-home tests and medications (GLP-1s) are more accessible than ever

Rise in consumerism as patients demand user-friendly services

Med spas are quite literally at every corner of every suburban area in the US

A new administration with health, wellness, and a bit of FDA scrutiny involved in the MAHA movement

Coinciding with MAHA and post-pandemic, public mistrust of the healthcare system is high – higher than ever given recent events – and will continue to lead others to pursue alternatives to what they perceive as the medical industrial complex

Basically everyone I know has read Outlive by now

We are in denial about our own mortality (super deep, I know)

As the newest longevity market saturates and matures, questions remain around whether there’s staying power with these direct-to-consumer offerings, or if it’s another fad. Those with staying power will likely hold elements of community building, tie-in to concierge / direct primary care providers, and deeper insight into the roots of chronic disease, which payors are likely to find highly interesting.

Employer Networks Shrink

American employers project that their healthcare costs will grow by 7.7% next year, the highest year-over-year increase in the last 15 years. Simply put, in 2025 employers will be under immense pressure to pursue new cost control strategies. Given that labor markets are still tight, larger employers will want to protect health benefits and may be loathe to pass a lot of these costs on to employees. What this means is that employers are more likely to consolidate vendor relationships, dictate higher accountability standards and look to new plan design and network management strategies to control costs.

One strategy that we believe will grow in popularity is expanded utilization of closed provider networks and Centers of Excellence (CoE). Many employer groups already consider CoEs as their best option to ensure that care is high-value and predictable for a select handful of high-cost interventions. However, CoEs have had their drawbacks, given outcomes can be mixed and some employees resent the restriction of choice. This is why many employers have historically created incentives for CoE utilization, but have stopped short of mandating their utilization. We think this changes in 2025, as employers, with limited options, not only expand the number of procedures they cover with CoEs but increasingly mandate them. Some employers, tired of the status quo, may even be keen to test more creative concepts, like global CoEs.

Big Pharma Prioritizes Durability Over Disruption

Earnings reports from the pharma service provider ecosystem tell a tale of two stories for big pharma priorities in 2025. On one hand it is obvious that R&D budgets remain challenged. Multiple contract research organizations (CROs) have been sounding the alarm on a decrease in preclinical spending over the last 12-24 months. On the other hand, pharma continues to spend aggressively on innovation that boosts sales of existing drug products. Both Doximity and Veeva reported strong quarters and 2025 outlooks, as beneficiaries of this phenomenon.

With a looming patent cliff and multiple blockbuster drugs that are still relatively underpenetrated, we expect pharma to invest more heavily in innovative sales, marketing and education efforts in 2025. This will elevate the importance of medical affairs across the pharma enterprise. In addition to D2C programs designed to get their products in the hands of patients faster, we expect more investment in generative AI to personalize KOL and patient engagement, and even creative advertising on previously untrodden channels.

A New Era of Benefits Administration

Since we came up with this prediction, another 3 tech-enabled benefits platforms were funded. No…not really, but it seems like it. In the past month or so alone, we’ve seen General Catalyst-led Soda Health, Oscar-backed StretchDollar, Bain-backed BizCare Benefits (perhaps the most on-brand name ever) launch into the space, and existing players including Lynx, Take Command, and Venteur grow their collective books of business. Meanwhile, firms like First Dollar were snatched up. The experience of benefits administration is sorely lacking and provides a fragmented experience for consumers and HR professionals.

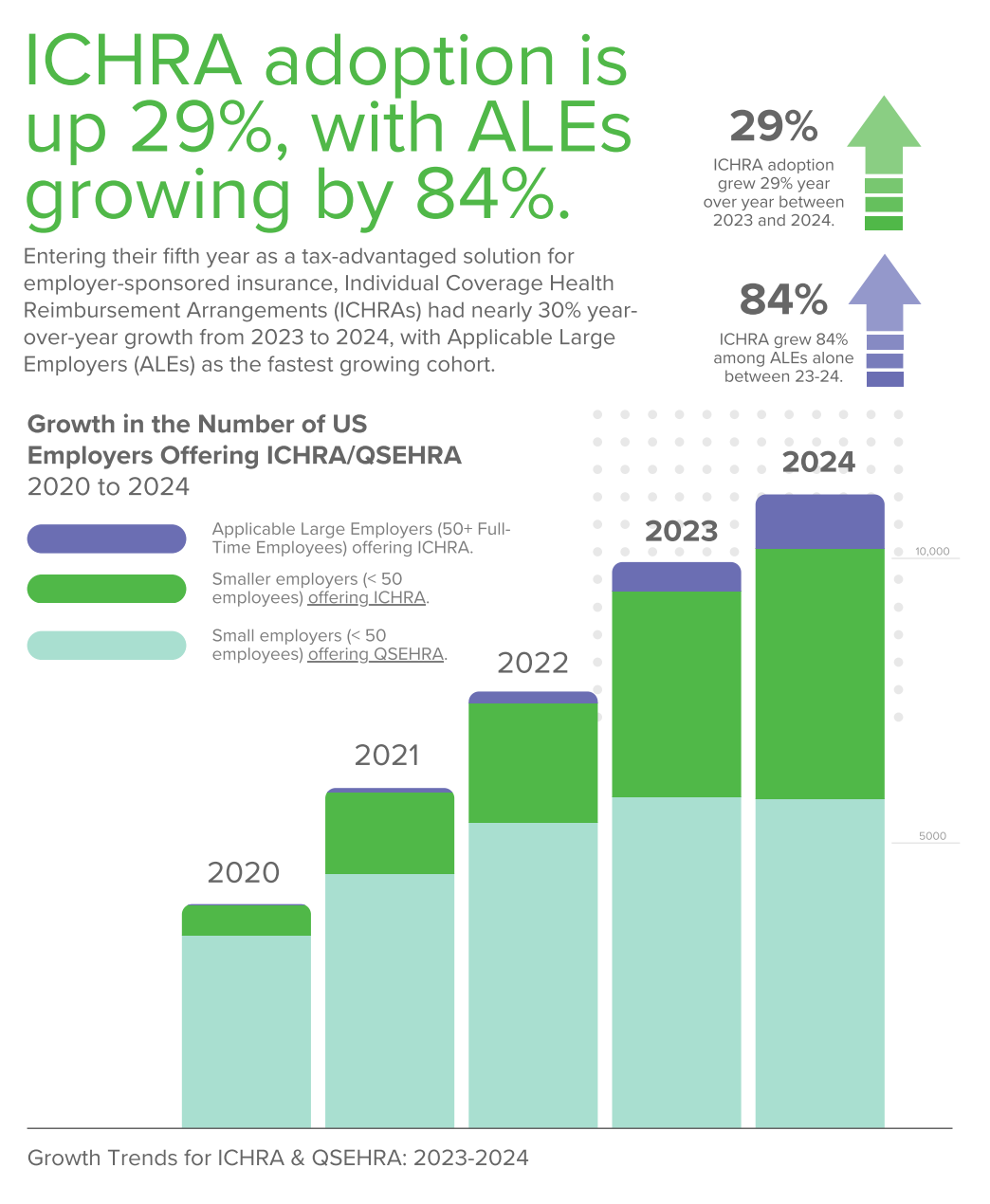

As employers demand more for their dollar and pay closer attention to how those dollars are spent (in light of recent ERISA lawsuits), expect to see more connected platforms and solutions with the ability to deliver more intuitive services. And don’t forget about ICHRA. The hype cycle has now hit critical mass and given ICHRA’s origin with the Trump Administration and its relative disruptive capacity within local health insurance markets, we expect to see continued policy support and uptick of adoption among employers.

The Medicare Advantage Ecosystem Levels off, and Vertical Dis-Integration?

Medicare Advantage, and the associated value-based care ecosystem, will bounce back in 2025.

As mentioned several times throughout the course of 2024 in Hospitalogy, we hit peak bearishness in Medicare Advantage this year, between changes to risk adjustment (and the takedown of players gaming risk scores along with several notable bankruptcies), increased utilization among seniors, and dismal Star ratings. Many of those sentiments remain today, but the level of current negativity in the MA space is unfounded entering 2025.

Health insurance plans have repriced for 2025 and exited unattractive markets or products. The Trump Administration will support Medicare & Medicare Advantage. Star ratings are getting a recalculation after some crackdown and singular calls brought health insurance giants to their knees. Speaking of health insurance giants, the healthcare discourse and public perception of BUCAs is terrible entering 2025. While Congress dropped its PBM reform from the end of year spending bill, sentiment around Big Healthcare won’t go away anytime soon.

The Republican regime will strike a balance between supporting Medicare and competition in healthcare (more power delegated to states, supporting free-market-esque policies like ICHRA, price transparency) while scrutinizing areas of potential abuse, including vertical integration. We’ve already seen remnants of this dynamic play out, with proposed changes to medical loss ratio calculations in the proposed rule. For that reason, we expect to see the BUCAs tuck their tail in between their legs, put their heads down, and focus on core business activity to further avoid the spotlight – so, fewer (if any) large deals.

Finally, without stating the obvious, expect smaller, more focused regional players (Alignment, Essence, SCAN, Devoted) to outperform as their Star ratings provide a nice financial boost, less exposure to risk adjustment changes, and more business model flexibility.

Wrapping Up

While predictions in healthcare are hard simply due to how they play out over multiple years or decades and not a single year, it’s nevertheless exciting to look ahead and see what key stakeholders are prioritizing in the new year. There’s always an extra air of uncertainty and excitement with a new government entering the fold.

What are your thoughts on our predictions for 2025? Hit reply and let us know. Let’s hit the ground running in the new year!

Roundup of other Predictions

Other predictions pieces worth reading:

Bonus: Way-too-specific predictions

My top healthcare stock picks for 2025: Doximity, Alignment, Hims, Evolent (don’t ask for reasoning; it’s pure vibes)

Tenet makes a splash acquisition in the ASC space and/or a large ASC management company gets bought

ACA subsidies get extended one year and are kicked down the road in a Republican attempt at healthcare reform later in 2025

CVS rebounds in 2024 on the back of strong outperformance by Aetna