If you own Walgreens Boots Alliance stock (Nasdaq: WBA) In the hope of a quick turnaround, I believe now is the time to cut losses on struggling pharmacy chains and allocate capital elsewhere. Here’s why.

The common investment theory for this stock has now disappeared.

One criterion that helps investors decide when to sell a stock is whether the investment thesis they based their purchase on still holds true.

Let’s say you bought Walgreens stock 10 years ago, expecting it to be a safe stock that would generate steady dividend income and moderate stock price appreciation. You might also have expected that its business of providing retail pharmacy services would perform relatively well over time, even as the world changed dramatically.

However, that hypothesis did not materialize as planned.

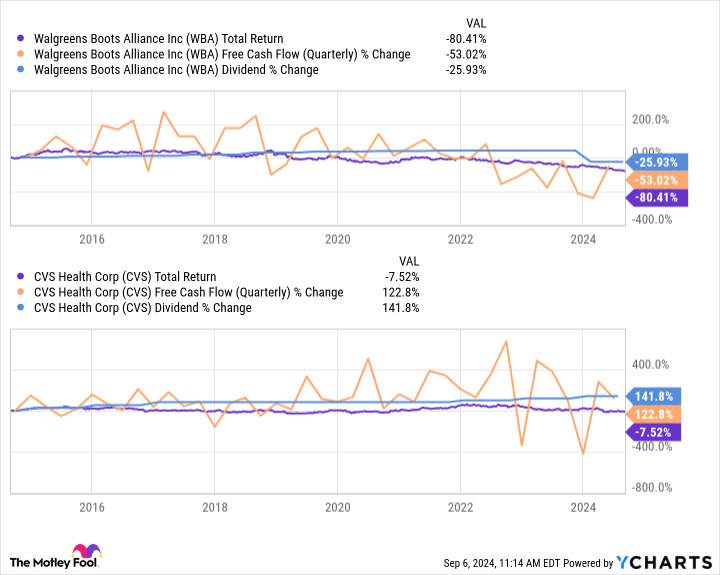

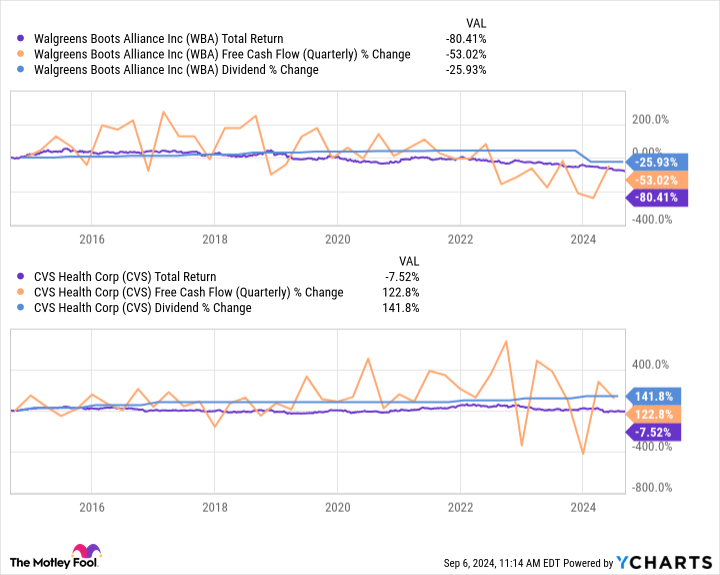

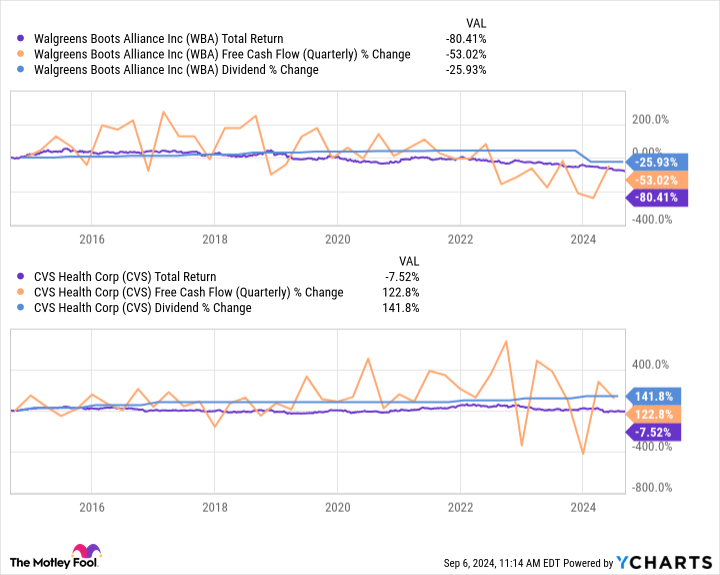

Over the past decade, the stock’s total earnings have fallen by just over 80%. During the same period, quarterly free cash flow (FCF) fell 53% to just $327 million. Earlier this January, Walgreens cut its quarterly dividend by 48% quarter-over-quarter, to $0.25 per share.

And in the last 12 months alone, the company spent roughly $27 billion paying down debt, rather than using that money for growth plans or to return value to shareholders.

In summary, even though it’s not a safe investment, doesn’t provide a steady dividend income, and requires a trip to the pharmacy to fill your prescriptions, these factors don’t seem to have played a role in maintaining the stock price.

Plus, the pharmacy industry as a whole isn’t struggling, so that’s at least some solace in the stock’s slump. Walgreens’ biggest rival, CVS Health, saw its total stock return decline by about 4% over the past decade, while its quarterly FCF and dividends soared. Check out this chart:

So what’s causing Walgreens’ downfall? The company’s core prescription-filling business has held up relatively well, with prescription fills (excluding vaccinations) up 1.7% year-over-year through the third quarter (ended May 31).

But sales of non-prescription health care products have been weak, as have prescription reimbursements from insurers, and the boost the company got as the economy reopened in 2021 has already passed. More importantly, its attempts to diversify into primary care offerings have been costly, and while they’re no longer a waste of money, they’re nowhere near contributing enough to support sales or profits.

The story continues

With no concrete hope of relief in sight, Walgreens’ only path forward in the near future is to continue selling investments and other assets to pay down debt, while also cutting operating costs and moving forward with its most profitable segments. These moves could result in some missed revenue. And since total assets will likely continue to shrink, the stock price will fall further.

No matter how patient you are, there will come a time when it’s time to sell

It’s true that Walgreens could reinvent itself over the next decade or more — eventually, its primary care division could become a strong revenue driver, and given enough time, its retail pharmacy division could become efficient again.

But there’s still little evidence that this process has gotten much beyond the starting line, and regardless of the precise reason, shareholders are under no obligation to hang on after an investment thesis becomes invalid.

Therefore, I think the best course of action is to sell the stock now. Even if you are optimistic about a recovery (and I don’t know why at this point), the stock price could fall further. It’s safer to exit now and buy back later if there are signs of recovery.

Should you invest $1,000 in Walgreens Boots Alliance right now?

Before you buy Walgreens Boots Alliance shares, consider the following:

The analyst team at Motley Fool Stock Advisor just identified the 10 best stocks for investors to buy right now, and Walgreens Boots Alliance wasn’t among them — all 10 stocks that could generate big gains over the next few years.

Let’s look back at April 15, 2005, when Nvidia made this list… if you had invested $1,000 at the time of our recommendation, you would have $652,404.!*

Stock Advisor offers investors an easy-to-follow blueprint for success, with portfolio construction guidance, regular updates from analysts and two new stock picks every month. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of September 9, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool recommends CVS Health. The Motley Fool has a disclosure policy.

The 1 Healthcare Stock You Won’t Regret Selling Now was originally published by The Motley Fool.